The mobile market is about to get interesting. For years, Apple has dominated both market and profit share, with Google’s Android more recently having severely cut into Apple’s market share while also taking a bite out of profits.

Meanwhile, almost completely forgotten in the mix is Firefox OS, Mozilla’s browser-centric mobile OS, which has been making gains of its own lately. Given Apple’s unwillingness to compete in low-margin markets, we’re about to see a serious scuffle between Firefox and Android for the future of mobile computing.

Apple Locking Itself Out Of The Future Of Mobile?

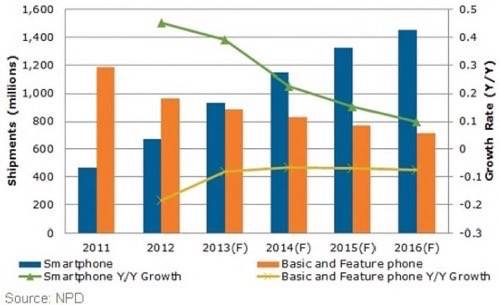

Smartphones have reshaped mobile, but really only in the rich Western world. Throughout much of the planet, old-school feature phones still dominate, though this is changing, as research from NPD illustrates:

The growth in smartphone adoption over the next few years won’t come from North America and Western Europe, however. Not most of it, anyway. That growth will be from emerging markets as they replace feature phones with smartphones.

In these markets, Apple is a non-entity. By choice. As Apple CEO Tim Cook told Businessweek, “There’s always a large junk part of the market. We’re not in the junk business.” Instead Cook believes Apple can dominate the richer half of the market while Android and others scrap it out for supremacy in the low-end smartphone world.

It may not be that simple. And Apple may not have much of a choice, anyway.

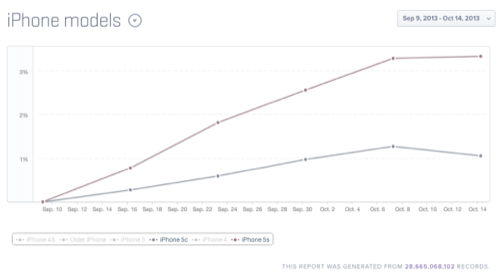

The closest Apple gets to “low end” is its “beautifully, unapologetically plastic” iPhone 5C. Emerging market consumers can’t afford it and more affluent Western consumers don’t want it, as recent data from Mixpanel suggests:

In other words, the iPhone 5S may be outselling the iPhone 5C 3-to-1. That doesn’t bode well for Apple to be able to compete anywhere except in the premium tier of the market. Very profitable, but ultimately not very big. And perhaps not sustainable, as low-end devices have already crimped Apple’s profits, forcing it to release lower-margin products to respond to competition from the so-called “junk market.”

Emerging Markets Matter

Dubbing such markets “junk” is not productive. As Fidelity Investments points out, roughly 85% of the world’s population can be found in emerging markets and they contribute almost three quarters of global GDP growth. Starting from a much smaller base, emerging economies are growing much faster than established markets, as the International Monetary Fund captures.

Meanwhile, according to analyst firm Ovum, mobile service revenues are expected to rise from $968 million in 2012 to $1.1 trillion by 2018. However, global service revenues will contract in 2018 for the first time in the history of the mobile industry, declining from 2017 levels by 1% or $7.8 billion. That has mobile telecoms scattering to find ways to drive innovation in services, tariffs, business models, network operations and partnerships.

Nowhere is this more true than in emerging markets. As the telecoms figure out new ways to wring cash out of emerging markets, such innovations will find their way to more established markets where competition for wallets remains fierce.

Will Firefox OS Progress Be Enough?

Android may have the lead in this environment, but Firefox OS is generating significant interest. As IDC analyst John Jackson notes:

Many of the new markets Firefox OS is expanding into offer significant volume potential, and all contribute Web ecosystem benefits. This growth underscores operators’ strategic commitment to the platform and their satisfaction with consumer adoption to date. It is striking that the Firefox OS is entering its second phase of expansion at a time when other aspiring third smartphone platforms continue to struggle for position, scale, and sustainability in the competitive market.

The platform continues to add new features that are appropriate for its target markets, striking a balance between value to consumers and affordability. Perhaps more importantly, Firefox OS continues to attract new apps and content partnerships. These are like lifeblood for a platform and should further help drive consumer adoption and spur innovation in developer communities around the Web.

Or, as ReadWrite’s Brian Proffitt posits, “Firefox OS isn’t making a dent in the global market share numbers yet, but the continued investment by Telefónica and Deutsche Telekom means that there is definitely some success happening with the mobile platform.”

How much success remains to be seen, as Firefox OS is far from assured success no matter how good it may be. But it’s good to see Android get some competition in the markets that may end up mattering most to the future of mobile technology.