While games continue to dominate the apps that consumers buy, there are clear signs that the future of mobile may not be what they allow you to play, but what they enable you to buy. According to a new research report, mobile commerce is finally getting real.

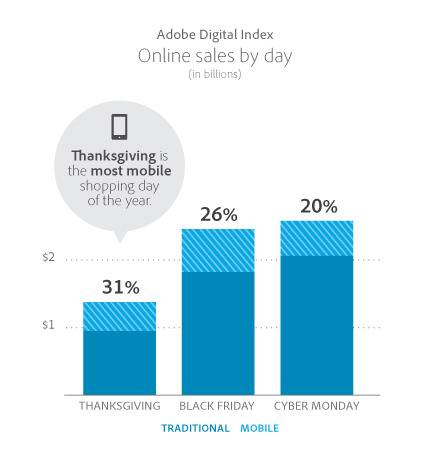

How real? This busy shopping season, as much as 31% of all online purchases will happen on mobile devices. That’s a big change from even a year ago, and portends a healthy future for mobile developers.

Tracking American Purchasing Behaviors

Since 2008 the Adobe Digital Index (ADI) has evaluated the purchasing behaviors of American consumers, tracking more than 1 trillion visits to 4,500 retail websites in that time, and 20 billion visits to ecommerce sites in October 2014 alone. (I recently came across the ADI upon starting work at Adobe last week.) This translates into analysis of 70% of all money spent online with the top 500 retailers, and past-year predictions falling within 1% of actual spend.

In other words, ADI is a pretty good gauge of consumer buying behaviors. (Have a look at it yourself here.)

Some of the findings offer clues as to when to get good deals. For example, ADI holds that the best day to find a deal is Thanksgiving Day, when the average discount hits 24%.

If you can’t wait until Thanksgiving, at least wait until the Monday preceding the U.S. holiday, as ADI predicts a 5% price drop between Sunday, November 23, and Monday, November 24, the largest single-day price drop of the season.

Oh, and if you’re inclined to wait until Cyber Monday to start your shopping engines, be warned: “Out-of-stock messages will increase 5-fold on Cyber Monday due to increased demand and limited supply.”

More Money, More Mobile

But the more interesting data ADI uncovers has to do with mobile buying behavior.

Across the board, ecommerce is booming. As reflected in the Nielsen Global E-Commerce Report, “Online purchase intention rates have doubled in three years for 12 of 22 measured categories,” topping $1.5 trillion on 2014. As noted in the ADI, during the holiday shopping season this growth can reach 28% over last year’s numbers.

But online retail isn’t news. Mobile, however, is.

Last year most mobile ecommerce behavior essentially amounted to showrooming, whereby consumers would visit a Best Buy, for example, to see a dishwasher in person and then would complete the purchase online.

But in 2014 the ADI predicts huge growth in the number of people both initiating and consummating a purchase on their mobile devices and, increasingly, their smartphones.

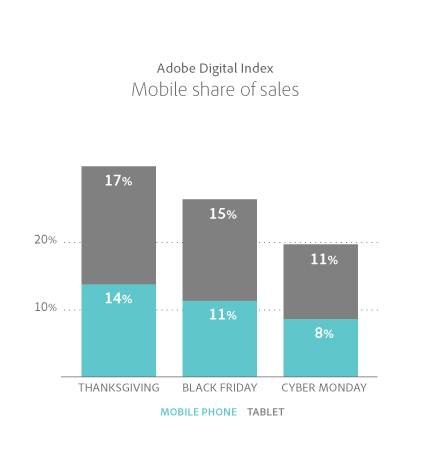

That’s right: tablets, those ugly stepchildren, are getting even uglier, even though you’d think they’re by far the better shopping device given their superior screen real estate. The Wall Street Journal’s Christopher Mims captures the zeitgeist well:

https://twitter.com/mims/status/522704270303719424

Not that the tablet is losing all relevance. While smartphones increasingly take center stage among our mobile distractions, tablets still have a big place in mobile commerce:

But the role of tablets is shrinking fast. In 2013, for instance, tablet use outpaced that of smartphones nearly two-to-one, according to last year’s ADI post-mortem on holiday sales. This year, tablets and smartphones are much closer to parity. Next year, don’t be surprised to see phones jump ahead.

At the heart of this shift away from computer-based buying to mobile-based buying is consumer convenience. A few years ago mobile apps or websites were virtually unusable. Today they’re optimized to make it easy to buy.

As a personal example, I can’t recall ever buying clothes online, and certainly not shoes, which (for me) has always required trying them on to ensure a good fit.

But yesterday I bought a pair of shoes using my Nordstrom app. I was at work, prompting me to think about the need for work shoes. I don’t have time to head over to the nearest Nordstrom, so I downloaded the app and started flicking through options. Ten minutes later, I had a pair of Eccos heading to my house.

What This Means For Developers

All of which is good news for mobile developers and the companies that employ them. In the past there was essentially one business model: build an app that was wildly popular (which almost by necessity meant it had to be free) and sell it to Facebook for $1 billion.

What this meant, as ReadWrite’s Dan Rowinski highlighted, is a non-existent middle class of mobile developers: “The revenue distribution is so heavily skewed towards the top that just 1.6% of developers make multiples of the other 98.4% combined.” Nearly half of all mobile developers make nothing at all.

Part of this derives from the revenue models available to mobile developers. While the desktop web has a healthy advertising-based market, mobile ads have been slow to catch on, and getting someone to notice and then pay for an app is even harder.

Mobile commerce, however, offers another, perhaps better way. And according to a Goldman Sachs report (nicely summarized by Jay Fiore), it’s on a tear:

M-commerce, which accounted for a little more than one quarter of total e-commerce retail sales in 2014, will account for nearly half of all e-commerce sales in 2018. That’s 3x growth for m-commerce while non-mobile e-commerce grows only 31% over the same period.

Given that prospective growth, coupled with the growth already seen in the ADI data, mobile developers really need to be thinking about apps that not only encourage consumers to play games or watch video, but also to buy things. Citibank understands this and is reaching out to app developers to help it build the future of mobile banking, but there’s really no reason to go build someone else’s app when developers can focus on their own.

In short, as consumers become comfortable buying with their mobile devices we’re seeing a “shift in revenue models from pay-to-buy [the app] to pay-as-you-use [the app],” according to VisionMobile’s Developer Economics Q1 2014 report. This changes “the role of developers from innovators to value-adding resellers.”

Given the money at stake, that may be exactly what developers need to be in the mobile app economy.

Lead image courtesy of Shutterstock