As predicted, Google unveiled its own all-you-can-stream music subscription service to compete with Spotify, Rdio, Deezer and MOG. It’s a crowded space with challenging economics, but if anybody is well-positioned to win this game, it’s Google.

Google Play Music All Access will offer on-demand access to millions of songs for $9.99 per month, which is the same as every other music subscription service’s premium tier. Unlike the existing market leaders, though, All Access won’t include a free tier of access, a fact originally reported by the New York Times.

All Access will include “millions” — Google didn’t say how many — of songs within 22 genres, a Google-powered recommendation engine, Pandora-style radio stations, editor-curated playlists and the ability to blend your own library with Google’s.

At first glance, it’s a pretty compelling offering. If you sign up before the end of June, it will cost $7.99 per month. And that’s just the first competitive advantage Google has over the incumbents.

Google Is Already A Streaming Music Giant

Spotify is virtually synonymous with streaming music, but it’s worth noting that Google is already plays a massive role in the discovery and consumption of music. These days, when teenagers want to hear a new song, they don’t turn on the radio or buy a CD. They go to YouTube.

That’s because the Internet’s biggest repository of videos also happens to host millions of songs, which are readily available to stream for free. It’s the world’s biggest accidental music streaming service.

With All Access, Google is making a far more official foray into the streaming music space, having recently signed licensing deals with all three major labels in the U.S. It’s not linked directly to YouTube and its massive repository of free music, but rumor has it that the video giant could get its own paid subscriptions for on-demand music. In the meantime, All Access is another attractive gateway into Google’s content ecosystem, which hosts a hell of a lot of music.

Google’s Biggest Advantage: Being Google

The only reason we’re talking about this new music service is because of who made it. By virtue of being a Google product, All Access has the potential for massive cross-promotion throughout Google’s array of popular Web services.

More important, All Access will be built directly into the world’s most popular mobile operating system. That’s where the magic of streaming music really lies: In our ability to take it with us. It’s why Spotify, Rdio and MOG all wager that the simple ability to access all that music on our phone is enough to convince people to shell out $10 per month. Spotify has done a decent job of proving that thesis by amassing 6 million paid subscribers at an impressive 25% conversion rate.

Of course, Spotify, like Rdio and the rest of its competitors, has to compete for users’ attention via app store rankings, social integrations and plain old marketing. All Access, by contrast will be much more front-and-center within the Android ecosystem. That’s huge.

Who Needs A Business Model?

Another advantage of being a Google product is that All Access won’t have quite as much pressure to make money. Spotify and Rdio will ultimately need to find a way to profitability (or get acquired by a giant), something that isn’t easy under the current economics of the streaming music business.

A company like Spotify will have to find a way to minimize its enormous music licensing costs, which are easily its biggest expense. Google’s entrance into this space might make that harder, since the company can afford to pay out huge sums without investors holding the profitability gun to its head.

Spotify and Rdio’s other biggest challenge is converting paid subscribers. The streaming model, the theory goes, will work much better when there are many millions of people paying for services like this.

So far, Spotify has done the best job of converting those free listeners to paying subscribers. But with a competitively price competing service now shipping on hundreds of millions of handsets, the incumbents may have to get much more creative about courting subscribers.

In a recent interview on WYNC’s On the Media, technology journalist Tim Carmody suggested that this might be how the streaming music business will work:

Probably the most likely thing that will happen is that someone, whether it’s an Apple or a Google or an Amazon or a Sony, comes along and essentially agrees that we’re gonna run music at a loss and we’re going to support it with these other businesses. How do you make money on the music business? Don’t make money on the music business. That’s the answer to that question.

That may well turn out to be true, but it’s probably not quite what Spotify, Rdio and their ilk had in mind.

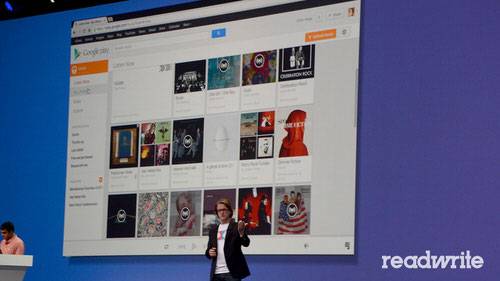

All Access: Merge Your Library With Google’s

Last week, I wrote that as good as Spotify and Rdio both are, neither is perfect. Spotify’s user experience could be better, while Rdio doesn’t let its users upload or merge their own music. What I described as the ultimate streaming service would need to nail both design and music selection, at the very least. From the Google I/O stage, the All Access interface certainly looked nice, although I have yet to get my hands on it to try it out.

The second part of that equation — the ability merge one’s own library with a cloud-based repository of music – appears to be a feature that All Access subscribers will indeed enjoy. By launching alongside the Google Music cyberlocker first unveiled in 2011, All Access effectively allows users to blur the line between Google’s library of licensed music and their own collection of tunes.

One detail that was glossed over at Google I/O was exactly how wide of a selection All Access users will have. Rdio and Spotify both have about 20 million tracks in their libraries, which includes not just the major labels, but a partnership with indie label rights body Merlin and countless smaller labels. How many tracks does All Access have? The Google Music integration makes that question a little less crucial, but more casual listeners without hard drives full of MP3s will want to know when they’re eyeing up $10 music services.

Related Stories

- Why Google’s Rumored Spotify-Killer Makes Perfect Sense

- 6 Million People Pay For Spotify – Is That Good Enough?

- Next Round In The Google-Amazon Death Match: Streaming Music

- The Ultimate Streaming Music Service: Just Merge Rdio and Spotify

Images by Nick Statt for ReadWrite