It’s a startup truism: Investors fund people, not ideas. But ideas are much easier to assess than people. So how do venture capitalists decide if an entrepreneur is worth millions in funding?

The easy answer is: They look at the founder’s resume.

“The mantra in our business has always been ‘serial entrepreneurs,’” says Bob Ackerman, managing director at Palo Alto-based venture firm Allegis Capital. “These are people who have demonstrated they know how to navigate the minefield that lies in front of every startup. If they get through it successfully once, the bet is they can get through it the next time. In our current fund, two-thirds are serial entrepreneurs. And that shows up in the performance of the fund.”

Going Beyond the Obvious

That’s reasonable. But it’s obvious.

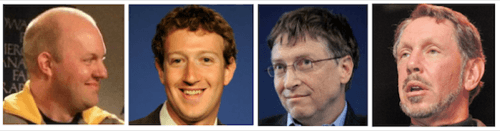

What about finding the next boy genius? The next Larry Ellison or Bill Gates or Marc Andreessen or Mark Zuckerberg? They’re all entrepreneurs who built significant companies (to put it mildly) on their first try. How do VCs and angels identify people like that, who will step up to the plate and hit a grand slam in their first at-bat?

That’s where judgment and experience come in. And that’s why many top VCs are former operating executives themselves. The idea is that experience can help them peer into the soul of first-time entrepreneurs and see if they have what it takes to get through the minefield. Are they coachable? Do they listen? Yes, they need the passion and enthusiasm, but they also need to keep one foot on the ground?

“The history of startup founders making it all the way to exit tells you the deck is pretty much stacked against them,” Ackerman says. “But there are examples of those who do it.”

He recalls a first-time entrepreneur he funded named Scott Weiss, who started a company called IronPort – and sold it to Cisco for $830 million. “When I looked at Scott, there was the confidence and bravado you would expect from an entrepreneur,” Ackerman recalls. “But behind that bravado was a lot of hard work, a lot of solid research and a lot of solid validation. I looked under the hood and found a tremendous amount of substance.”

The first time they sat down, Weiss asked Ackerman who in his network had managed a company that had experienced the sort of growth Weiss was expecting for IronPort. He said up front that IronPort was his first try and that he wanted to connect with veterans who could tell him right away if he started veering off track.

Maturity… and a Map

“To me, that demonstrated a tremendous amount of maturity,” Ackerman says. “Yes, he had that aggressive drive and enthusiasm and confidence, but also the realization that he could step on a mine anytime along the way and lose his whole thing. And he wanted to make sure he didn’t make those mistakes. I loved that.”

There are two ways to navigate a minefield. You can do it by braille. Or you can get a map.

“We look for entrepreneurs who go get the map,” says Ackerman, “who are prepared to do the hard work to develop that map rather than just rush through the minefield, hoping they’ll get through. Venture is all about people. An ‘A’ idea with a ‘C’ team has low probability of success. A ‘B’ idea with an ‘A’ team is a much better bet.”

Lead images courtesy of Netscape, Guillaume Paumier, World Economic Forum and Oracle Corporate Communications.