As the global demand for semiconductors continues to rise, the European Union (EU) is stepping up its efforts to stay competitive in this crucial industry. The EU has recently approved a groundbreaking plan to invest €43 billion ($47.5 billion) in developing more fabs and increasing semiconductor production within the region. This ambitious move is part of the EU’s strategy to double its global market share from 10 percent to “at least” 20 percent by 2030, as outlined in a press release by the European Council.

How Will the EU Gain More Market Share Growth?

The EU’s investment in semiconductor production aims to achieve more than just market share growth. According to Hector Gomez Hernandez, the Spanish minister for industry, trade, and tourism, this initiative is also expected to contribute to the renaissance of the European sector and reduce the region’s dependency on foreign chips. By enhancing research and attracting more investment, the EU seeks to be better prepared for future semiconductor shortages and reduce its reliance on chips from other countries.

This move comes on the heels of the EU’s earlier commitment to become a leader in developing and fabricating semiconductor chips. Companies like Intel have already recognized the potential of the European market and are investing in new manufacturing facilities on the continent. With the approval of the Chips Act, the EU is now poised to accelerate its progress and strengthen its position in the global semiconductor industry.

The EU’s decision to invest heavily in semiconductor production is not without precedent.

The United States has also recognized the strategic importance of this industry and has taken steps to bolster its domestic capabilities. In 2022, the US passed the CHIPS and Science Act, allocating $52 billion to compete with China in semiconductor production. Furthermore, the Biden administration has introduced incentives worth $39 billion to incentivize companies to establish chip manufacturing plants within the country.

By following the example set by the United States, the EU aims to secure its position as a global leader in semiconductor production. The investment in fabs and increased research within the region will create job opportunities, drive economic growth, foster technological innovation, and reduce the risk of supply chain disruptions.

The Semiconductor Production Will Have Major Benefits

The EU’s investment in semiconductor production is expected to yield numerous benefits for the region and the global technology ecosystem. Here are some key advantages that can be anticipated:

- The semiconductor industry is vital in driving economic growth, and the EU’s investment will create new job opportunities and stimulate innovation. By strengthening its position in this industry, the EU can expect a boost in GDP and increased tax revenues.

- The COVID-19 pandemic exposed the vulnerabilities of global supply chains, including the semiconductor industry. By increasing domestic semiconductor production, the EU can reduce its reliance on external suppliers and mitigate the risk of future disruptions.

- Investing in semiconductor production will enable the EU to maintain its technological leadership and remain at the forefront of emerging technologies such as artificial intelligence, Internet of Things (IoT), and autonomous vehicles. This will have far-reaching implications across industries and contribute to the region’s overall competitiveness.

- The EU’s efforts to boost semiconductor production will also affect national security. By reducing dependence on foreign chips, the region can better protect critical infrastructure and ensure the integrity of its digital systems.

In summary, the EU’s decision to invest €43 billion in semiconductor production demonstrates its commitment to staying competitive in the global market. By doubling its market share and reducing foreign dependencies, the EU aims to secure its position as a leader in the semiconductor industry.

It’s All in the Chips Act

This strategic move will drive economic growth and foster innovation and strengthen the region’s resilience in the face of future supply chain disruptions. As the Chips Act moves closer to implementation, the EU is poised to embark on a new era of semiconductor self-sufficiency and technological leadership.

First reported on The Verge

Frequently Asked Questions

Q. What is the EU’s plan for the semiconductor industry?

The EU has approved a groundbreaking plan to invest €43 billion ($47.5 billion) in developing more fabs and increasing regional semiconductor production. This initiative aims to double the EU’s global market share from 10 percent to “at least” 20 percent by 2030 and reduce the region’s dependency on foreign chips.

Q. How will the EU’s investment in semiconductor production benefit the region?

The investment is expected to create job opportunities, drive economic growth, and foster technological innovation. By increasing domestic semiconductor production, the EU can reduce its reliance on external suppliers and mitigate the risk of future disruptions, as exposed during the COVID-19 pandemic.

Q. What are the key advantages of the EU’s investment in semiconductor production?

Some key advantages include economic growth, increased tax revenues, reduced supply chain vulnerabilities, and the ability to maintain technological leadership in emerging technologies such as AI, IoT, and autonomous vehicles. Additionally, the investment enhances national security by protecting critical infrastructure and digital systems.

Q. How does the EU’s plan compare to the United States’ approach to the semiconductor industry?

The EU follows the example set by the United States, which has also recognized the strategic importance of the semiconductor industry and has taken steps to bolster its domestic capabilities. In 2022, the US passed the CHIPS and Science Act, allocating $52 billion to compete with China in semiconductor production, and introduced incentives worth $39 billion to attract chip manufacturers to establish plants within the country.

Q. What are the next steps for the EU’s Chips Act to take effect?

Before the Chips Act can go into effect, it needs to be approved by the President of the European Parliament and the president of the Council. Once approved, it will be published in the Office Journal of the EU, ensuring its legal validity and enforceability.

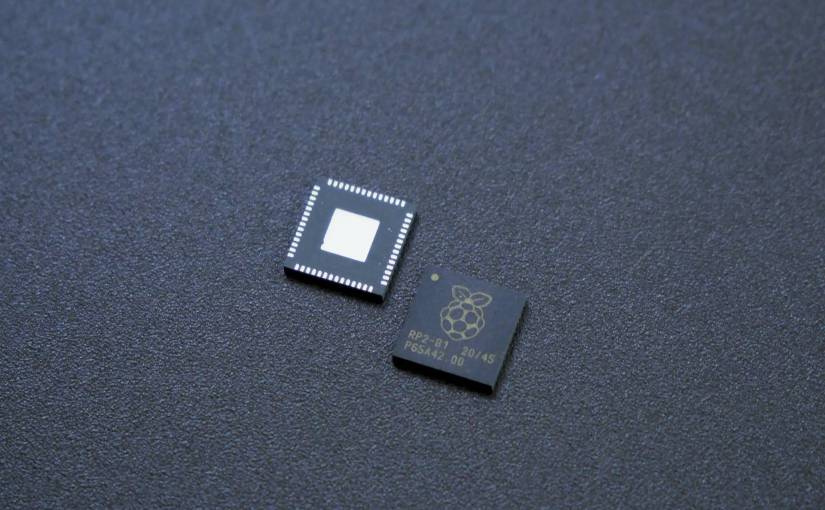

Featured Image Credit: Vishnu Mohanan; Unsplash; Thank you!