Many traders use crypto trading bots and other software to automate their crypto trading ventures. Automated crypto traders can be beneficial as they can analyze a much larger pool of data than a human being, thus locating opportunities and executing trades efficiently and quickly.

This article explores the 10 best automated crypto trading platforms and their benefits for traders. You’ll learn about the best crypto trading and investing bots, how to use them, and whether they are profitable. Let’s begin.

As a result of extensive research, we found platforms that offer some of the most user-friendly and high-quality crypto trading bots on the market. Before we get into the short yet detailed reviews of each one, here’s the list of automated crypto trading platforms that made it to our top 10:Top 10 Automated Crypto Trading Platforms

Reviewing the Top Auto Crypto Trading Software

If the brief descriptions of their key features and benefits are not enough to make a pick, we’ve prepared quick but detailed reviews of each trading bot. Read each one to determine which platform best suits your needs.

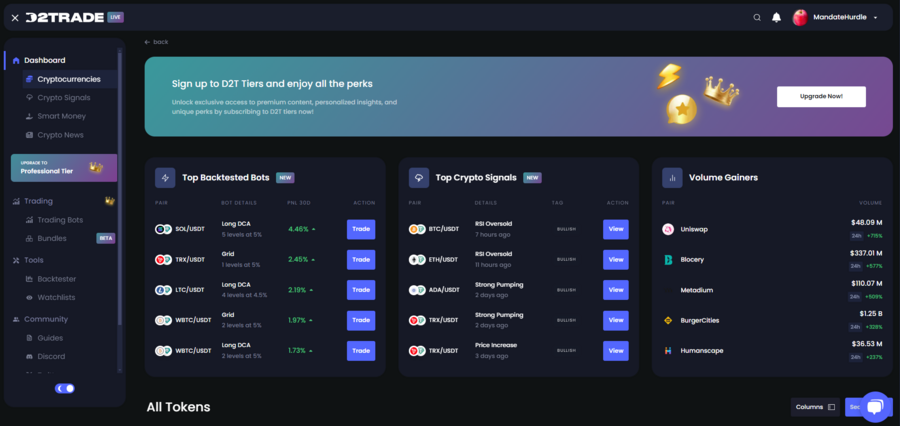

1. Dash 2 Trade — Overall Best Auto Trading Platform Covering Bots, Indicators, and Signals

Dash 2 Trade is a robust platform offering a wide range of crypto trading tools, including two bots, signals, a backtesting feature for evaluating strategies, a bundle feature for acquiring crypto assets in bulk, access to 10,000+ trading strategies, and support for 400+ coin pairs. This support for a wide range of features is what makes it our top choice.

The best part is probably the backtester, which enables you to test custom strategies to find what works best without complex coding. You can use various premade or custom-built indicators and even integrate social metrics into your strategies.

Besides providing you with the latest news straight in the app, Dash 2 Trade also has an interesting Smart Money feature, where its experts share insights into the market and the hottest tokens almost weekly.

The platform also features a native token called D2T, built on the Ethereum blockchain. This utility token allows users to receive additional benefits from the Dash 2 Trade platform.

The only downside is that most of the app’s features are locked behind a paid plan that currently costs $18 per month or $120 per year. If you pay with the D2T token, it’s as little as $102 annually, a discount of nearly 53% compared to the fiat monthly subscription.

Pros:

- Wide range of auto crypto trading features

- Support for 400+ coin pairs

- Option to try out the platform for free

- Native D2T token with added benefits

- Backtester feature for trying out strategies

- Access to DCA and Grid trading bots

Cons:

- Most features are locked behind a paid plan

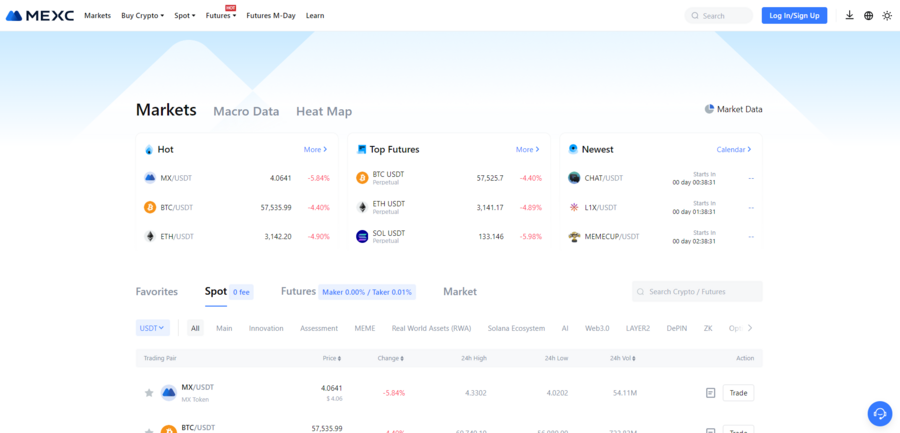

2. MEXC — Feature-Rich Exchange With an Excellent Copy Trading Tool

MEXC is a popular CEX that’s been on the market since 2018 and has over 10 million users. It’s one of the best P2P crypto exchanges, rich in crypto spot and futures trading options, but it also has one of the top crypto copy trading features on the market, earning it such a high spot on our best crypto auto trading platforms list.

Thousands of traders with different experience levels participate daily, covering tens of thousands of strategies. MEXC simplifies copying a specific trader by offering detailed, important info on each trader it locates.

You can filter out traders based on the number of followers, the return on investment (ROI), the win rate, and the profit and loss (PNL) rate. You can also place trades on your watchlist and view more detailed info on any trader by clicking their name. Once you find a trader you like, MEXC can automatically execute their trades for you.

The best part is that anyone can use this for free without meeting a minimum amount threshold.

Pros: Cons:

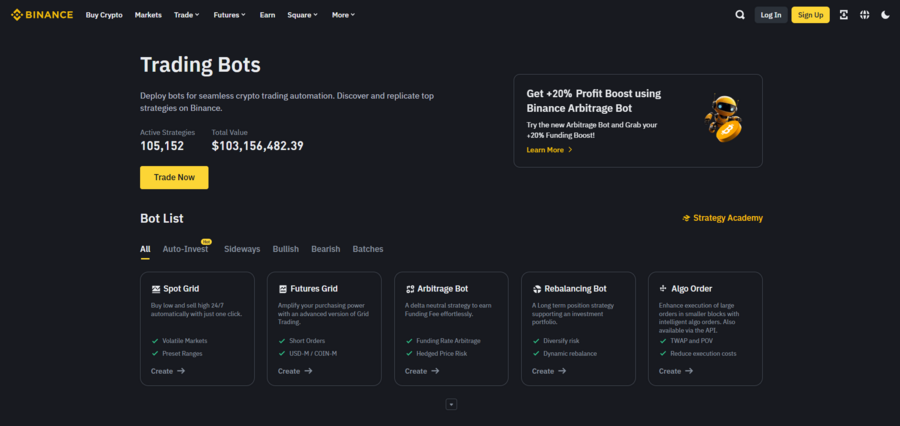

3. Binance Trading Bot — Offers Access to 87,000+ Independent Trading Bots

Not only does Binance, the world’s biggest crypto exchange by volume, offer automated cryptocurrency trading services, but it’s also a sort of aggregate for independent crypto trading bots. There are over 87,000 crypto bots made by independent crypto traders, and you can access all of them on Binance.

This is because most crypto bots, including many of the platforms on our list, already integrate with Binance.

The Binance Bot Marketplace offers many filters to help you find a suitable bot, such as choosing a preferred coin, ROI, and trading direction. You can click a bot to learn more about it or simply click the Copy button to mimic its trades.

Remember that each bot will have its own minimum investment requirement, but it is usually only a few dollars, so it shouldn’t be an issue for anyone.

Binance offers several bots, including Spot Grid, Futures Grid, Arbitrage Bot, Rebalancing Bot, and Algo Order. There’s also an Auto-Invest option that lets you create a trading plan for earning passive income.

Pros: Cons:

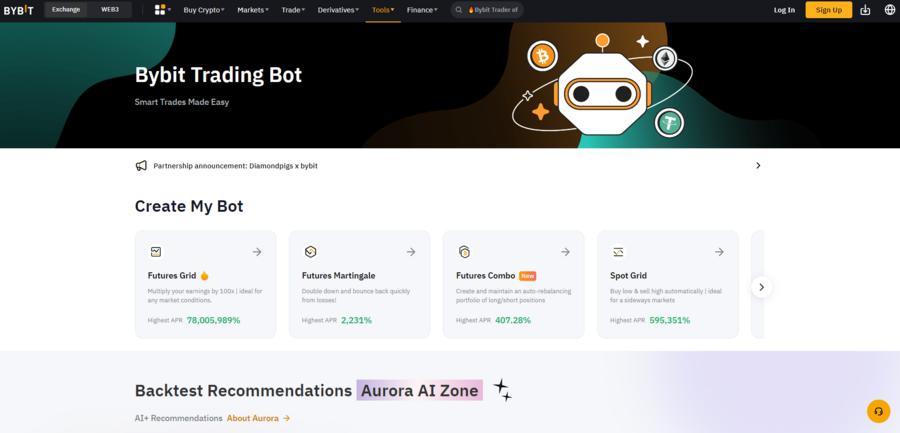

4. Bybit Trading Bot — Great for Automatically Copying Crypto Derivatives Traders

Bybit is another popular exchange on the global crypto market. You can use its massive bot marketplace to search for the parameters you need and locate bots that will do the job.

More importantly, the exchange specializes in crypto derivatives with leverages as high as 125x. It offers inverse, perpetual, and delivery futures and options. This means that you can copy thousands of derivative traders, each with a specific derivative approach.

You have several sorting options to choose from, such as the market, ROI, and running time. The site also has Aurora AI, a feature they launched in late 2023 that offers the best recommendations an AI-powered feature can offer based on the parameters provided.

There are no minimum investment amounts to worry about, and the system runs on profit-sharing fees specific to each trader. The average is around 10%, which is lower than most.

Bybit also has its own preset crypto auto trader bots, including Futures Grid, Futures Martingale, Futures Combo, Spot Grid, and DCA.

As a side note that might interest some traders, Bybit also has one of the best anonymous crypto wallets on the market, where you can earn tokenized rewards and airdrops.

Pros: Cons:

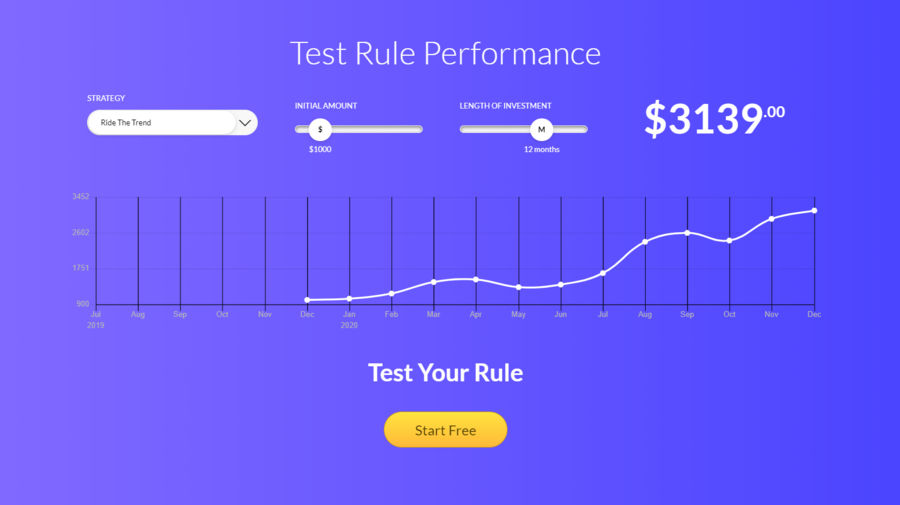

5. Coinrule — An Automated Assistance Platform With Templated Strategies for Beginners

Coinrule is a specialized platform for creating crypto trading bots and following savvy investors. It lets you quickly develop automated trading strategies to use on popular exchanges Coinrule partners with, including Binance, Kucoin, Coinbase, OKX, Uniswap, and Kraken.

You get to create and test automated strategies with Coinrule’s tester feature, and you can then use them on any of the supported exchanges.

Coinrule offers a fee-based plan ranging from $29.99 to $449.99 per month, but it also provides its services for free to users who trade with smaller amounts. It also has a Business plan for enterprise clients with quote-based costs. The good news is that each plan can be ideal for a particular type of user, and fees will rarely exceed 1% of your trading volume.

The idea behind Coinrule is to give regular traders access to sophisticated trading features typically used by larger corporations and hedge funds. It also uses the “If This Then That” (IFTTT) model, meaning you get to set stringent criteria for the bot to execute trades on. The bots operate 24/7 but stay inactive whenever their criteria aren’t met.

You can create the bots and auto-trade strategies yourself or use one of the 150 pre-set ones Coinrule has made available. These templated strategies are ideal for beginners.

Pros: Cons:

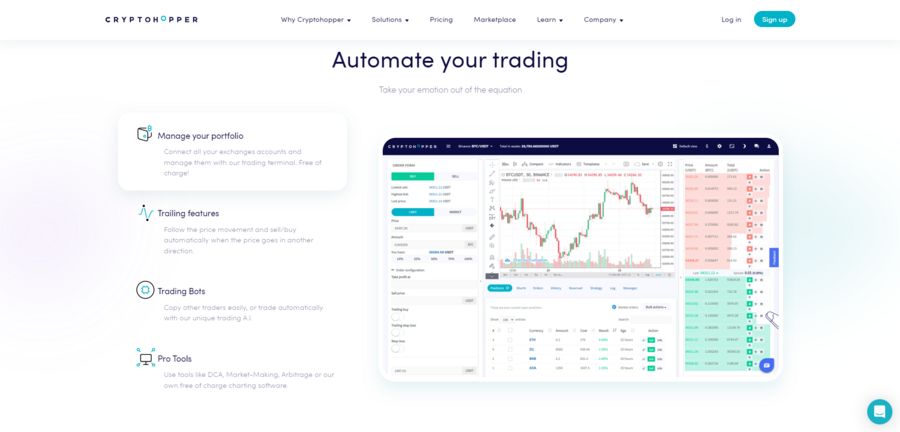

6. Cryptohopper — Ideal for Making Custom Bots With Easy-to-Use Tools

Cryptohopper is a crypto automated trading bot that aims to excel at customization, and we believe it’s definitely there. Its developers have created a simple drag-and-drop system that makes bot creation extremely simple and quick.

However, don’t assume that this simplicity leads to a lack of features for skilled traders. With its 130 indicators, the platform remains an excellent choice for technical traders.

You’ll still find many pre-made adjustable strategies, such as DCA, Bitcoin Devil, Counter Attack, and Arbitrage.

Beginners can also get strategies and templates from skilled traders; those interested in copy trading can find a variety of cop bots, while advanced users can get signals. All these are offered on the platform’s Marketplace, which contains free and paid options.

Cryptohopper’s pricing is subscription-based, but it has a lifetime free plan with unlimited copy bots, 20 open positions, portfolio management, and manual trading. Paid plans are more detailed with more open positions and additional features and start at $29 per month or $24.16 if you pay annually.

Pros: Cons:

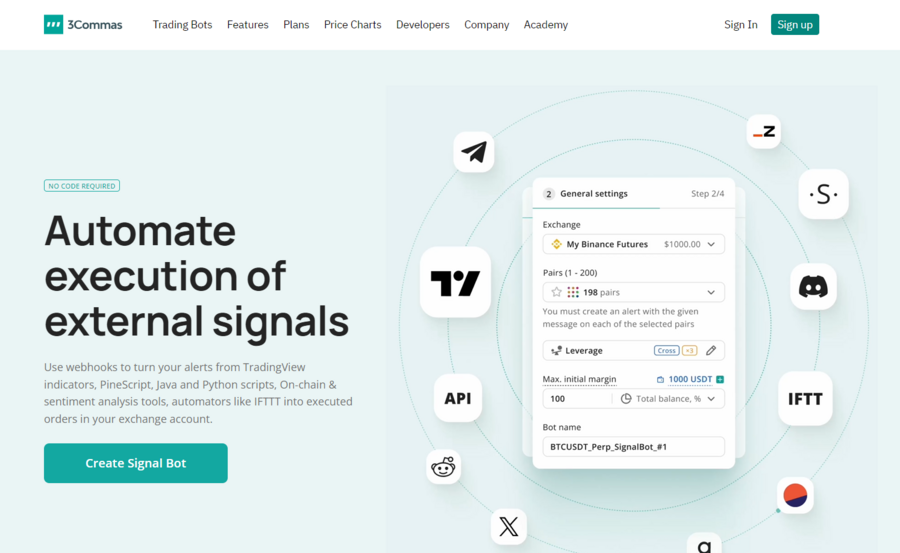

7. 3Commas — Auto Cryptocurrency Trading Bot Made for Pros That Works on the Biggest Exchanges

3Commas was designed for pros, and skilled traders can get started in no time without the hassle of having to learn its technical aspects. The wide range of customization options and trading features makes 3Commas suitable for day traders, large-scale investors, companies, and entrepreneurs.

3Commas is not an exchange but supports a broad range of the world’s biggest exchanges. These include Binance, Bybit, OKX, KuCoin, Bitfinex, Bitstamp, Coinbase, Kraken, and Gemini, among others. You can find the complete list on the site, together with what’s offered for each exchange.

You can use 3Commas for free with only three active SmartTrades and an unlimited terminal, while the paid plans start at $37. The price is steep but reasonable for most advanced traders, especially since the basic plan comes with all 3Commas functionalities. The other plans only have the option of more SmartTrades and bots.

Pros: Cons:

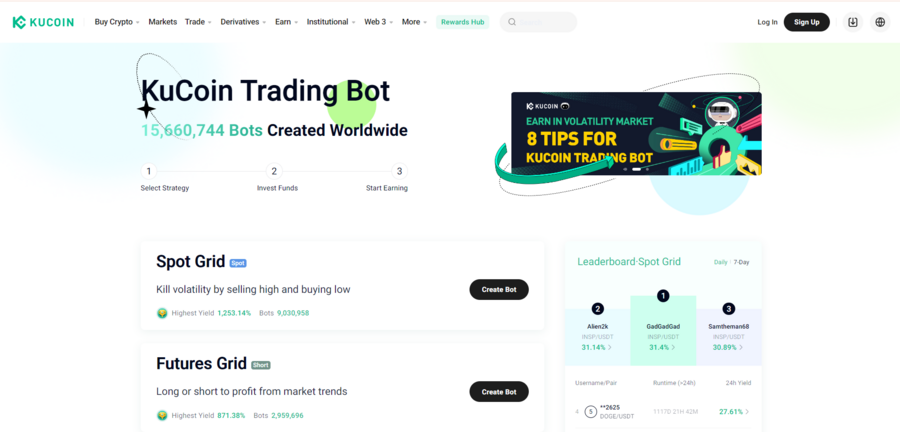

8. KuCoin — Choose Between 15 Million Bots on a Popular Exchange With 700+ Supported Coins

Like Binance, KuCoin offers access to various bots whose strategies you can copy. The site has a live counter showing how many bots were created on this popular exchange, and at the time of writing, there were well over 15.6 million.

Many of these crypto auto bots are known for adopting risky strategies, making the platform ideal for traders who are always on the lookout for high-risk, high-reward cryptos. Of course, there are also plenty of low-risk bots for investors seeking long-term gains.

KuCoin itself offers six free bots, including Spot Grid, Futures Grid, Spot Martingale, Smart Rebalance, Infinity Grid, and DCA. All of them are free, while the independent bots operate on a profit-sharing scheme with small fees.

Interestingly, despite being an exchange itself, KuCoin supports external APIs, so you can connect its bots with other exchanges.

It’s worth noting that KuCoin is a feature-rich trading platform with crypto spot and margin trading options, futures trading, staking, and lending. It even offers promotions, including a newcomer USDT bonus.

Pros: Cons:

9. Pionex — Offers Diversity Through 16 Free Integrated Trading Bots

Pionex, the self-proclaimed leading copy bot platform in the world, is a crypto trading platform offering spot and futures trading and the chance to earn through staking. It has as many as 16 free integrated crypto auto trader bots that can buy and sell 24/7.

This includes the Grid Trading Bot, which buys predetermined percentages of your appointed assets and can regularly place sell-high and buy-low orders. Another good example is the DCA Bot, which can trade multiple assets at the same time, working toward lowering your risks and diversifying your portfolio.

These are just two examples, but the good news is that none are complicated to set up. The bots are user-friendly, and the platform has detailed guides for each one so you can set them up in the best way.

The trading platform also has competitive trading fees (0.05%) and offers up to 100x leverage on futures trading, making it one of the best crypto leverage trading exchanges. According to the latest count, it features 379 assets, users in 100 countries, and over 100 million daily trades.

Pros: Cons:

10. Shrimpy — Full Portfolio Management Platform With a Crypto Auto Trading Bot

Shrimpy is an all-inclusive cryptocurrency portfolio manager that offers auto trading capabilities, which can work together with eight popular crypto exchanges, including Binance, Binance.US, Kraken, Coinbase, Gemini, KuCoin, Huobi, Bittrex Global, and Gate.io.

Even though it’s not a dedicated auto crypto trading platform, it has made it to this list because it has enough features to make it one of the top automated crypto trading services. Shrimpy automates portfolio rebalancing above all else, but also indexing and stop-losses, and offers a wide range of auto trading strategies to benefit traders of different experience levels.

Each crypto asset can be assigned a percentage within your portfolio, and Shrimpy will automate trading to fit these parameters while following your predetermined trade rules.

Interestingly, Shrimpy also offers social or copy trading, ideal for beginner traders who simply want to mimic the pros’ actions.

Bear in mind, though, that many of the advanced features are not free. The standard free plan is limited to only a single exchange, portfolio, and automation. Paid plans are $19 or $45 per month but can be 20% cheaper if you pay annually.

Pros: Cons:

How Do Automated Crypto Trading Platforms Work?

Automated crypto trading platforms host crypto trading bots. These bots either trade cryptocurrencies based on the parameters you set, copy another trader’s parameters, or identify cryptocurrencies with the most potential and execute trades at the most opportune moments. They research the market on your behalf and analyze large amounts of data, such as trading volumes and price movements of various cryptos, to find potentially lucrative trades.

This makes trading bots useful to both beginners and experienced traders. While beginners can rely on them most of the time, they should still research how crypto trading works, limit themselves to high-quality bots, and make sure they can afford to lose any money they invest.

On the other hand, experienced traders can automate their processes and set their own rules and strategies to make the bots complete the trades they want.

These platforms can eliminate the necessity of constantly following and researching the market and allow machine learning algorithms to locate the most opportune trades in real time.

The best part is that many of these bots can perform more complex tasks, such as finding good trading opportunities and executing trades in the right moments, or simply stick to menial tasks, like executing precise trades only when the user’s predefined parameters are met.

Types of Crypto Automated Trading Platforms

There’s no official categorization for automated crypto trading service providers, but many categorize them based on their features or the type of trading they perform. However, this can quickly get out of hand and offer too many types to count, so we’ve simplified things as much as possible by describing three types most platforms can fit into.

Trading Bots

As you’ve likely noticed from our reviews, some automated crypto trading platforms are exchanges with automated trading features, while others offer access to AI-powered bots that can perform more complex tasks. These can:

- Automate most of the trading process

- Scan markets 24/7

- Offer customization options for advanced traders

- Buy or sell automatically based on the trader’s instructions or by relying on their own data

- Estimate potential market risks

- Connect to top trading platforms and execute trades instead of you

Bear in mind that not all automated crypto trading platforms can accomplish all of these things. However, all of them can save you time one way or another.

It’s worth adding that there’s also a subset of trading bots made specifically for DeFi trading. These apps are made to execute strategies for traders and manage their portfolios while the funds remain in the traders’ custody.

Copy Trading

Copy trading platforms, like the one MEXC offers, are automated trading tools that copy the trades of other, more experienced investors. In other words, they mirror their actions without you having to do anything. This is also called social trading.

This type of automated crypto trading is ideal for beginners, as the only thing you’re typically required to do is pick a trader or more to mimic, and the platform will do the rest. It will monitor their actions and perform the same trades.

Signals

The best automated crypto trading platforms offer signals suitable for advanced traders who don’t want to rely entirely on robots to decide what to trade on. This is the case with platforms like Dash 2 Trade, our number one pick.

Signals are automated tips that tell you which positions you should take in crypto investing. In almost all cases, you must pay for this service, usually a monthly subscription fee.

In most cases, the signals are complete orders, so you only need to decide whether or not to use them. When you use them, all you have to do is confirm, and the system will place the order.

Automated Portfolio Managers

Automated portfolio managers go a step further than standard trading bots by striving to maintain a specific crypto portfolio percentage allocation. In other words, they trade cryptos based on price increases and decreases, attempting to maintain a specific percentage share for each cryptocurrency.

This makes them more suitable for investors and long-time-frame traders, while trading bots are more efficient for quick trades.

One of the best examples of this type of automated crypto trading platform is Shrimpy, our 10th pick. Services like it are mostly suited for crypto investors with strict portfolio rules, not casual crypto traders.

How to Pick the Right Auto Crypto Trading Platform for You

If you’re unsure which automated crypto trading app to choose, here are a few criteria to consider.

Type of Automatic Trading Options Offered

Auto trade platforms tend to offer different types of trading options. Take a look at the most common choices, consider what you need, and base your decision on that:

- Copy trading — Platforms like MEXC specialize in copy trading, offering ample opportunities to copy successful traders.

- Auto crypto trader bots — These pre-programmed auto trade algorithms buy and sell coins based on specific parameters and are offered by many platforms, including Dash 2 Trade, Pionex, KuCoin, Bybit, and Binance.

- Custom auto trade bots — Many platforms let you fully customize algorithms, which is ideal for advanced traders who know what they are looking for. This option is available on most platforms that offer auto trade bots, including Dash 2 Trade, Coinrule, Cryptohopper, and others.

- Signals — We’ve already explained how beneficial signals can be for advanced traders who want the most control over automatic trading. You’ll find signals on platforms like Dash 2 Trade, Cryptohopper, and 3Commas.

- Auto portfolio managers — Services like Shrimpy trade cryptocurrencies based on external signals while maintaining a predetermined portfolio allocation. This makes them best suited for investors who want to diversify their portfolio by allocating a certain percentage to each specific cryptocurrency.

Pricing and Fees

As pricing matters to almost every trader, it’s essential to check how much the service costs. However, this might be tough, as auto crypto trading platforms have different pricing systems. Some have subscription models, and some run on profit-sharing fees, with many services incorporating unique additions to their pricing systems.

That being said, most services offering trader bots and copy trading have some form of profit-sharing fee, usually between 10% and 30%, with Bybit’s 10% average being among the lowest. This means you get charged on successful trades, not on losing positions.

However, those with subscription models usually have a limited free plan and one or more paid plans with monthly subscription fees that tend to be lower when paid annually. Dash 2 Trade, with its $18 per month plan, is one of the cheapest options, while others tend to start charging from $20 and more. For instance, Coinrule plans start at $30, while Cryptohopper’s plans begin at $29.

Lastly, it’s worth mentioning that a few platforms that operate as exchanges, like Pionex, offer their bots entirely for free and profit from trading fees.

Available Cryptocurrencies for Trade

Some auto-trade platforms, especially those that are exchanges as well, let you auto trade a large number of cryptos, often several hundred or even over a thousand, like in the case of Bybit.

However, other, more specialized automatic trading platforms and bots are more limited in scope. Most will cover the leading coins, but if you want to trade low-cap tokens, you’ll have to check which cryptos are supported.

There are also different types of crypto trading. There’s traditional spot trading, but also derivatives like futures, swaps, and options.

Minimum Investment Amounts

There’s a minimum investment amount on almost every platform. However, the top options have very low requirements that might as well be zero, while some, like MEXC, don’t have a requirement at all.

Backtesting Availability

You should consider focusing only on crypto auto trading platforms that let you test strategies based on historical data. This makes the service more transparent, as it will help you see how its auto-trading functions would have worked in actual market conditions.

Risk Management Tools

Every platform should have risk management tools because auto trading can be highly risky. There should be an option to set stop-loss limits, preferably highly customizable ones. Other tools, like position sizing, are also good to have.

Are Crypto Auto Trading Bots Safe?

Yes, crypto trading bots are legitimate tools traders use to automate their strategies. There are bad apples, just like in every industry, and you should be wary of those that promise unrealistic returns and assured profits or are not forthcoming with how they operate.

Instead, stick to one of our recommended platforms, which our experts have thoroughly vetted and reviewed.

Is Automated Crypto Trading Really Profitable?

There is no such thing as guaranteed profit, and the same goes for auto crypto trading platforms. However, that doesn’t mean some services aren’t better than others. Choosing a trusted platform is crucial because you’ll be required to leave your money and crypto assets in their hands.

Moreover, you must constantly evaluate the risks and determine how much you’re willing to invest. Know that all of your investments can fall through, no matter how low the potential for that is, which is why it’s best to invest only funds you can afford to lose.

If your risk tolerance is very low, it’s always better to go for platforms that don’t fully automate trading, like auto trader tools that offer signals, where the service only makes suggestions, and you decide whether or not to follow through.

How to Auto Trade Cryptocurrency

If you’re ready to start auto-trading crypto, you should know that the process is not as complicated as it may sound. It’s even more straightforward once you break it down into steps. Here’s how that works for our top pick, Dash 2 Trade:

- Visit the official Dash 2 Trade website using our link.

- Click the Sign Up button to start the registration process.

- Provide your email and desired password, and complete the registration.

- Input the code provided by email.

- Connect your crypto wallet (MetaMask is supported).

- Pick an exchange.

- Choose the crypto pair you wish to trade.

- Define your exposure by setting your risk and trading amount.

- Choose the bot that works best for you and set it up.

Conclusion

We hope this guide has given you enough options and has explained how automated crypto trading platforms work, how to use one, and how to pick the best solution for your needs.

To give you enough options, we’ve tried to cover different types of platforms, from those covering trading bots to those focusing on copy trading. We’ve also included enough options that focus on signals and give a lot of customization features to keep more advanced users happy.

If you’re ready to begin, all that’s left is for you to pick one. Once you have it, click our link, set up an account, learn about the platform’s ins and outs, and start trading.

References

- What Are Crypto Trading Bots and How Do They Work? (Binance)

- Benefits of using an automated crypto trading provider (Coinbase)

- Automated Trading Systems: The Pros and Cons (Investopedia)

- Are Trading Bots Legal? All You Need to Know (InvestingGoal)

- What is automated crypto trading and how does it operate? (ND Labs)

- What is automated crypto trading and how does it work? (Cointelegraph)

- Copy trading: a road to riches or risk? (Financial Times)