The meteoric rise of NFTs in 2021 has fueled a spirited debate about the future of non-fungible tokens. But while experts are bickering over the long-term viability of NFTs, digital collectibles maintain their stronghold on the market. According to Chainanalysis (blog), NFT collectors sent over $37 billion to NFT marketplaces as of May 1, 2022. This number topples the total of $40 billion sent in 2021.

However, the current cryptocurrency and blockchain market is a shaking ground with bitcoin tumbling and rampant inflation.

So, will we ever witness the imminent demise of NFTs? And what drives their value? Let’s find out.

What are NFTs, anyway?

Let’s say you are an artist looking to sell your masterpiece. You’ve painted it and you have full ownership over your painting. But instead of paying the agent to sell your painting, you can sell it directly to collectors through a digital auction. To do that, you need to transform your physical item into a digital collectible. And that’s where NFTs come into play.

In simple terms, NFTs are blockchain tokens that represent a unique digital item. Non-fungible tokens allow users to buy and sell ownership of unique digital items with no middlemen.

NFTs are usually bought and sold on specialized marketplaces, and they provide the holder ownership over the data, media, or item with which the token is related.

What does non-fungible mean?

To define the true meaning of ‘non-fungible’, let’s get to grips with what fungible means. Blockchain includes a whole many of the same tokens, which can replace each other. This way, the system can continue to work with no disruptions even after the components of the blockchain have been replaced.

For example, bitcoin and other cryptocurrencies are fungible. If you send somebody a bitcoin or a part of it, you can get one back. Also, it doesn’t have to be the same bitcoin or the same amount you sent. Physical currency is fungible too – you can make a change or convert it into any other fiat.

NFTs, however, cannot be replaced or divided into standalone tokens. Each NFT is unique and exists in a single copy, thus forbidding sharing. All information about its author, buyer, and transactions is securely stored in a blockchain. In other words, an NFT is a digital certificate attached to a unique object.

In this sense, NFT is similar to real art. You cannot replace Monet’s paintings with Mona Lisa – they just cannot be compared.

What makes NFTs valuable?

In a general sense, non-fungible tokens have no physical value behind them. However, they still go up in value because of the community. And there’s some rationale behind this upward dynamic.

Scarcity

Due to the blockchain nature, non-fungible tokens are minted once and forever. No living person can go back in time and manipulate the origin of NFTs. Let’s take the Bored Ape Yacht Club collection. The project launched in 2021 with only 10,000 unique cartoon apes that are generated by algorithms. This paucity has bred in the value of this collection which now translates into $400K. Therefore, scarcity and exclusivity are among the cornerstones of the NFT ecosystem.

Moreover, owning an NFT is now like owning a part of art history. Valuable or not, non-fungible tokens have already gone down in history as an epoch of digital art.

Provenance

Thanks to the blockchain (again), NFT ownership history stays visible and transparent. At the same time, authenticity and source are documented on the platform, which eliminates art forgery and theft.

On the contrary, to prove the authenticity of the Mona Lisa, a collector needs:

-

- A signed certificate of authenticity from a reputable authority.

- A signed statement from the artist ( which is definitely impossible in this case).

Non-fungible tokens have all this information conveniently recorded into the blockchain which stays immutable until the blockchain exists.

Future value

The third and final component behind the value of NFT is its rising value. Once bought, a digital collectible can rise in value steered by the overall demand or deficit of tokens. It means that buyers can sell their NFTs at a higher price than what they paid for them. In this sense, non-fungible tokens act as a long-term investment that can bring a return in some cases.

Will the NFT industry collapse soon?

There is a lot of speculation in the industry about whether or not the NFT industry is sustainable. While there are some concerns, it’s important to remember that the industry is still in its infancy. It’s hard to predict the future of an industry that is still so new.

That being said, some factors could contribute to the collapse of the NFT industry. For example, if the prices of Ethereum and other blockchain-based assets continue to rise, it could become too expensive for people to participate.

Another factor refers to an oversaturated market. We might see more NFTs being created than there are people interested in buying them. This could lead to a decrease in demand and prices, which could cause investors to lose interest.

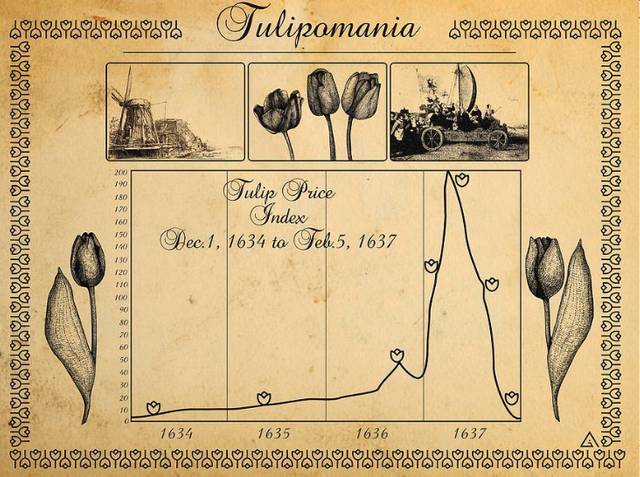

The current NFT craze is often compared with the Dutch tulip mania when tulip bulbs were hyped to the skies and speculated upon. When the exuberance dissipated, the tulip bubble collapsed.

Many experts think that non-fungible tokens will follow the footsteps of Dutch tulips. Finite supply, blockchain vulnerabilities, energy-intensive mining, and the possibility to copy-paste your unique collectible might undermine the bright prospects of NFTs.

What does the future hold for NFTs?

Non-fungible tokens and the blockchain terrain in general present untapped opportunities both for wealthy collectors and enthusiasts. However, the NFT boom gives the impression of a fast-flying frenzy doomed for oblivion.

Nevertheless, non-fungible tokens combine the excitements of art ownership and modern technologies, thus being an attractive investment. Today, the increasing popularity of NFTs is reflected in its numbers – the number of wallets trading in NFTs surged, from around 545,000 in 2020 to over 28 million in 2021.

For the time being, non-fungible tokens are set to ride the wave thanks to their adoption in gaming and unlimited potential in asset ownership.