Yahoo CEO Marissa Mayer has spent close to two and a half years at the helm without articulating any particularly clear strategy for revitalizing the hodgepodge of a Web company. Now, pressured by activist shareholders who want her to cut costs and send its Alibaba-IPO windfall back to investors, Mayer has basically announced that she plans to … do more of what she’s been doing.

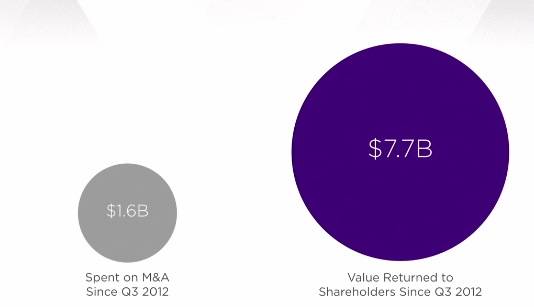

During the company’s quarterly earnings call on Tuesday, Mayer defended her strategy of acquiring startups—the majority of whose apps and services almost immediately vanished without a trace. Since Mayer took the helm in 2012, Yahoo has spent $1.6 billion on acquisitions. Most of that went to snap up social blogging platform Tumblr ($1.1 billion) and mobile analytics company Flurry (presumably somewhere around $300 million).

See also: Yahoo: Destroyer Of Startups

Mayer said her acquisitions have brought in talent, building-block technologies or “strategic” companies that complement or expand Yahoo’s other businesses. Tumblr and Flurry stand out as strategic plays in this scheme. She noted, for instance, that Yahoo and Tumblr now attract a billion “monthly average users,” meaning people who visit the sites at least once a month.

The Yahoo chief added said the infusion of startup employees has bolstered the teams working on Yahoo’s mobile products, while other purchases have brought in key technologies for one of the company’s four “pillars”—search, communications, digital magazines and video.

In recent months, Yahoo has been on a buying spree to bolster its mobile and advertising business; it’s picked up six related startups since March, plus two others in photo and document management. Yahoo competes with Google and Facebook in ads, two companies with growing dominance in online and mobile advertising.

Connecting The Dots

Mayer was quick to draw a connection between her investments and Yahoo’s unexpectedly strong third-quarter financial results. Mobile revenue more than doubled year-over-year, she said. Native advertising was strong, accounting for $65 million in revenue for the company this quarter.

“We achieved this revenue growth through strong growth in our new areas of investment—mobile, social, native and video—despite industry headwinds in some of our large, legacy businesses,” Mayer said in a statement to investors.

Mayer also touched on cost-cutting strategies including closing eight offices, letting go of 2,000 poor-performing employees, and sunsetting more than 65 products.

Wolves At The Door

Mayer’s defensive plans are partly in response to activist investor Starboard LP, which recently sent a letter to Yahoo encouraging it to merge with similarly struggling Internet giant AOL. Yahoo and Mayer are facing pressure to turn the company around as questions about her leadership grow.

“We all came here to return in iconic company to greatness,” Mayer said on the call. “We’ve come really far, very fast.”

Lead photo by Fortune Live Media