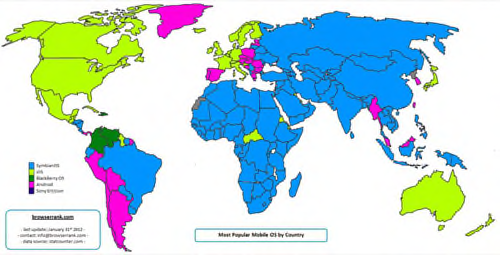

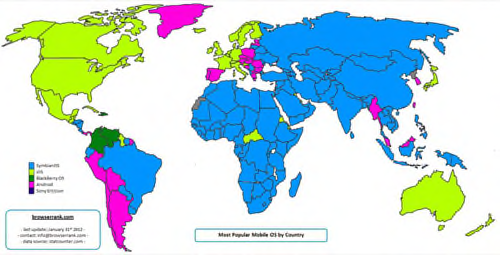

If you think the smartphone you own today makes you more worldly, more cosmopolitan, then take a good look at this five-color geopolitical world map as perceived by BrowserRank.com. Using data compiled from StatCounter’s latest projections of mobile operating system usage country-by-country (the firm detects browser usage, and then backtracks from there to decipher mobile OS), BrowserRank paints most of the world cyan. Cyan, it turns out, is for Symbian.

Wait, wait a moment… Isn’t Symbian dead? Didn’t Nokia reach a deal with Microsoft? Even though Windows Phone is not represented on this chart (it’s not the most popular mobile OS in any single country), if you’re Microsoft, you might not be feeling in too bad shape right now. Nokia’s presence – even its outgoing one – dominates Asia, Africa, the Middle East, and Brazil.

If anyone at Google knows how to play the classic game of Risk, she can look at this map and conclude the game is nowhere near settled. The little rainforest of green in northern South America is now BlackBerry’s only island of respite. But Android has a lock on Chile, Peru, Bolivia, and Argentina, as well as a booming presence in Eastern Europe, as well as Spain and Portugal, South Korea and Taiwan. If Google could amass some ammunition, it could launch a serious attack against Brazil and the Baltic States, and then Russia, India, and China. That sea of blue is up for grabs.

That is, if the game is Risk. These past few weeks, the ammunition that Google has been working to amass is in the form of intellectual property. Its plan to acquire Motorola Mobility (MMI) is closer to settled, with regulators in the European Union and the United States signing off on the plan this week. From an American vantage point, it’s as though the deal is already done, and Google is out to attack Apple.

From a global vantage point… Apple is not the objective. Territory is the objective.

Taiwan

According to StatCounter’s statistics, Android smartphones and tablets enjoy an impressive 58.2% market share, with iOS devices hovering at about 32% after a mild decline in Q1 2011. MMI has a major presence in Taiwan, which is one reason why the Google deal must still clear Taiwanese authorities. But for many in that country, their crown jewel is HTC.

So while American analysts have cast a skeptical eye on whether the many partners in the Open Handset Alliance will continue to be treated equally, Focus Taiwan‘s take is that whatever helps Android helps HTC. At least reporter Jeffrey Wu reached that conclusion after evaluating both U.S. and Taiwan financial analysts’ reports, and citing those which conceded the deal would not hurt HTC all that much.

If things turn negative for HTC in the short term, according to Wu’s read of a Morgan Stanley report, it could always turn its attention to building more Windows Phones. If you combine that logic with Wu’s take on Nomura Securities analyst Aaron Jeng’s report, you could conclude this: As Google amasses MMI’s patents to build up its defense, then the companies that benefit from that protection will include those that are not tied to building Android phones exclusively. So Windows Phone, by way of HTC and others, could feel the benefit of the proverbial rising tide.

Meanwhile, China Post – which, surprisingly, is published in the same country – takes a completely opposite view. Based on Reuters’ talk with Yuanta Securities analyst Bonnie Chang, it spun a completely different theory, which goes like this: Google probably doesn’t want to run a manufacturing operation; it just needs the patents. So if the move ends up benefitting a Taiwanese firm seeking patent protection to get into the Android game, such as Huawei, it could end up selling MMI’s manufacturing arm to Huawei. On the other hand, if HTC starts leaning more toward the Microsoft camp, Google could choose to hang onto MMI and use it to compensate for market share that HTC and others might siphon off. Call it an option play.

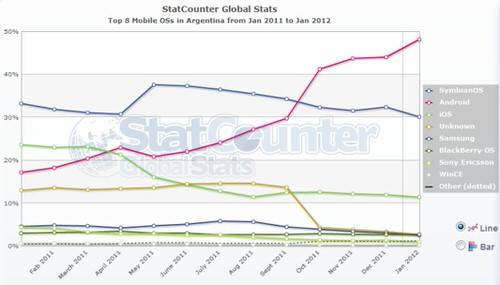

Argentina

Perhaps no country is more emblematic of how ripe the cyan part of the world is (Symbian territory) for takeover, than Argentina. As StatCounter’s numbers confirm, the holiday period saw an extremely sudden rise in Android phone popularity, whose cake was effectively iced in December by the government’s decision there to block sales of foreign-made phones, including Apple iPhones, in a move described as temporary in the midst of that country’s struggling economy. Research In Motion stated in July that it intends to open a factory in Argentina, though progress on that matter has been slow.

In a solid analysis of the situation for Lanacion.com, the Web site for Argentina’s national newspaper (English language translation here), Ariel Torres argues that whether it realizes this or not, Google needs a hardware division. It made its fortune through advertising, certainly, but while that was lucrative for its day, it might not remain so for very long. Android’s future cannot be tied to that of a company whose business isn’t really Android.

Argentina’s sudden ban on foreign smartphones gave Android an artificial window of opportunity – one which might close if the economy picks up. Torres keys in on the possibility that the infusion of Motorola’s knowhow into Google’s philosophy could change the company’s culture. Such a change might not only give MMI an advantage in producing the most desirable Android phones first, but present a challenge for a manufacturer whose phones are mostly imported – thus subject to the government ban. MMI does produce a version of the Droid Pro in Tierra del Fuego.

Colombia

My wife understands that when I have to break some mornings to take a call from Monica Fonseca, it’s all for business, as well as the edification of tens of thousands of South American viewers. On the other hand, when NTN24 viewers tune in every morning to the “C.S.T.” program, I frankly doubt any more than a dozen of them do so looking for Scott Fulton.

The smartphone market in Colombia was locked up by BlackBerry and Symbian as recently as last August, with StatCounter numbers giving the venerable RIM phones a commanding lead. Today it is a jump ball, with the market share graph fluctuating more wildly than an American Republican presidential preference chart. BlackBerry is sinking fast, and may already have been eclipsed by iOS once the February numbers are finally tallied.

On C.S.T. yesterday, Monica’s concerns turned to whether MMI’s massive patent portfolio would make Google too powerful a company, perhaps one warranting extra government scrutiny. I answered that it’s entirely possible that Google will be watched very closely around the world for signs of unfair trade. But its strategy – one which will be difficult for anyone, including a government regulator, to argue against – is to position the move as a great equalizer. The absorption of MMI’s patent portfolio will give Google a more valuable hand at the patent poker table, I said, one which will offset those royalties that Google would otherwise have owed to others had it stayed on its original Nexus course.

What governments will then have to decide is whether these larger companies, by forming non-scalable walls of royalties that offset each other but keep out smaller competitors, constitute a de facto cartel. (I tried finding a synonym, knowing I was speaking to a Colombian audience, but couldn’t find one and punted.) If so, some governments may try to set caps and limits on so-called FRAND royalty rates, and that the European Union would be the first at bat to make such an attempt.

Korea

If HTC is Taiwan’s pride and joy, Samsung and LG are the twin peaks of the modern South Korean skyline. Samsung may have become the leading Android device maker worldwide, and that’s a position Korea’s government is willing to go to some lengths to protect – especially against a company that many still incorrectly perceive not as American, but Japanese.

The iPhone is a novelty in South Korea. StatCounter numbers show Android device usage staying above 90% last month, after what some analysts actually called a decline. Korea’s Fair Trade Commission is continuing its investigation of the proposed buyout – one which is still treats as an “investigation,” with all the bells and whistles. Last month, KFTC announced it had evidence that Google employees in Korea were instructed to delete certain e-mails prior to a raid of its offices in September, just days after the MMI deal was announced. Korea has yet to sign off on the deal, and continues making the case that its approval is still required, no matter what the E.U. or U.S. does.

So it’s… shall we say, curious that the day after KFTC made its allegations, Google announced – as covered by Private Equity Korea – that it is setting up a special $1 million fund for investment in Korean technology startup companies. The fund will be managed, according to the Times of India, not by independent fund managers but by a spinoff of the Korea Communications Commission – making it obvious that Google is making amorous overtures to the government there.

As anyone who plays Risk knows, one of the keys to the game is building up infantry in the right locations, and using them at the right time to overcome the randomness of the dice. As governments and analysts worldwide realize, intellectual property is the infantry of the modern age. Google is preparing to claim a jackpot, and there’s a sea of blue that’s just begging to turn pink. Yes, it’s reason for concern.