Mobile credit card transaction platform Square is coming to the nation’s largest retailer. Square has struck a deal with Wal-Mart that will bring the dongle into retail stores across the country. The move is huge for Square but seems antithetical to align to its core business model, which is to bring mobile credit card readers to the masses.

Bloomberg Business Week first reported the story. Outside of saying that Square will now be located in 9,000 retail stores nationwide, Bloomberg does not say exactly what the use case inside of Wal-Mart stores will be. There are a variety of possibilities.

Update 1:55 EST Oct. 24 —The general premise of this post took the original information from Bloomberg out of context. It appears that Wal-Mart will be selling Square readers, not necessarily using them. In terms of Square’s aim to bring mobile card readers to the masses, getting prominent shelf space at Wal-Mart could be one of the best things to happen for the company. What follows now in more or less a theoretical practice in how Wal-Mart or any other large retail store could use dongle-based payments, which was really the point of the post in the first place.

How Could Large Retail Stores Use Dongle Credit Card Readers?

Ever been in an Apple store and made a purchase directly with the sales rep that you were working with, as opposed to going to pay at a register? Imagine that in the middle of a Wal-Mart store. Say you are shopping for clothes, or shoes or … Wal-Mart sells everything. You just want to make a quick purchase and head out of the store. In theory, Wal-Mart could arm all of the floor representatives with Square dongles and have customers in and out. It may even help alleviate long lines at the checkout.

It is also imaginable that Wal-Mart could set up in-store payment kiosks away from the registers with the Square Register. It could just be a little booth in every department of a Wal-Mart that would be designed to handle payments for a couple of items.

It would be doubtful that Wal-Mart would go to 100% Square, especially at its existing register system. One would think that it would be cost prohibitive to rip out its entire point-of-sale system and replace it with iPads and Square Registers.

Square Card Case Deal?

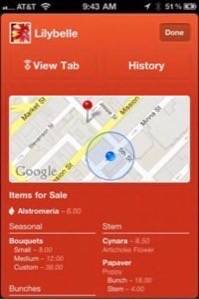

One of the biggest benefits for Square could be to get Wal-Mart to leverage its existing Card Case program that allows for simple payments and transaction information between the customer, the retailer and the payments platform. The Square Card Case was unveiled in May and initially only rolled out to five cities and 50 retail partners.

Square posits the Card Case as an Amazon-style “one-click buying” method, except in the real-world as opposed to digital payments. Users that download the app can set up a “card” from a retailer and see what is happening with the retailer, from new deals to changes in the menu. Wal-Mart could institute the Card Case in a variety of ways, from the national level for what is happening with all Wal-Mart retail stores, to dedicating local managers to updating the card case for each individual store.

The best use case for Square has always been the notion of bringing credit card readers to small and medium business. We often think farmers markets or taxis when we think of Square’s growth potential. Square’s COO Keith Rabois said in the Bloomberg article that will continue to be the case. In terms of that goal, the Wal-Mart adoption may have the affect of a giant marketing campaign. The greatest benefit to Square from Wal-Mart may not be actual transaction revenue, but helping to speed up the awareness and adoption of the platform.