The private investment research firm CB Insights has released Part 1 of its Venture Capital Human Capital Report. Known for its quarterly reports tracking investment deal and dollar trends, today’s report turns from the financial capital invested in companies to the demographics of the entrepreneurs who comprise them.

As the authors of the report write, “when we ask venture capitalists what gets them excited about the young, emerging, and often unproven companies in which they invest, we never hear about deals and dollars. Rather, the first answer is frequently ‘the team’ or ‘the founders.'” This sentiment points to the key role that human capital plays in investors’ decision-making. Noting the dearth of data-driven insight about the entrepreneurs who receive the funding that CB Insights features in its quarterly reports, the firm opted to research “the people dimension behind the deals and dollars we so often read about.”

Part 1 of the report examines race, age, and experience of the founders, along with the number of founders per company. The report looked at the makeup of the 185 companies that received seed VC and Series A investments during the first half of 2010.

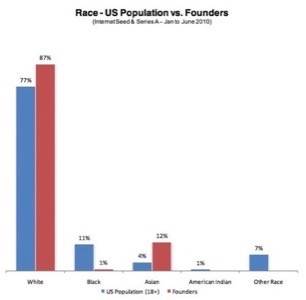

Race

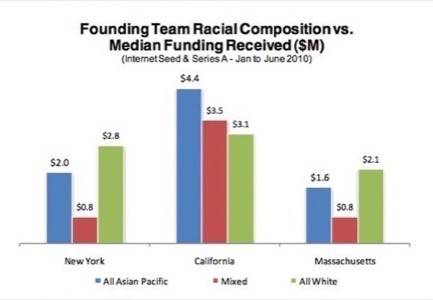

87% of the founders receiving funding in the first half of 2010 were white. Asians were the second-largest group, fairly evenly split between Southeast and South Asians. 89% of founding teams were composed of a single race, and all-Asian founding teams raised the largest rounds.

The report also examines the demographics of founding teams in California, Massachusetts, and New York. Of these three states, New York had the highest percentage of all-white teams.

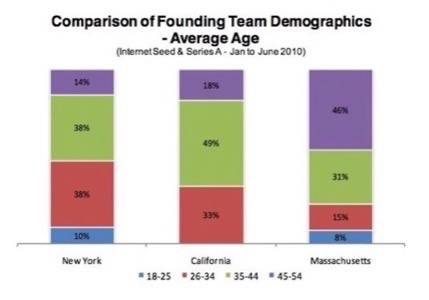

Age

Despite the myth that Internet entrepreneurs tend to be young “wunderkinds,” 48% of the founding teams fell within the 35-44 average age range. Companies with an average age in the range of 26-34 had the highest median funding. Entrepreneurs in Massachusetts tend to be older, and those in New York tend to be younger.

Experience

Not surprisingly, 39% of founders who received funding were formerly CEOs and founders, supporting the idea that VCs back experience. Sales and Marketing and Product Management and Development were listed as common previous roles.

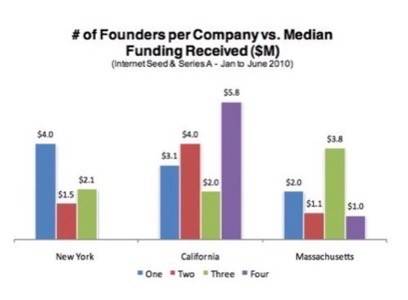

Number of Founders

Overall, the report indicates that the majority of funded companies had two or more founders. Over a third were led by one founder. And having more founders did not necessarily result in larger funding rounds.

More than half the funded companies in California had two founders. Massachusetts had the highest proportion of companies with a single founder, and in that state, companies with three founders raised significantly more funding. The majority of New York companies had either one or two founders, but companies with one founder raised more money than those with two or three founders.

The second part of CB Insights’ report, set to be released in the coming weeks, will examine the gender and educational background of this same group of VC-funded entrepreneurs. Does an MBA really pay? Stay tuned.