If you are a mobile developer, the findings of a report from framework provider Appcelerator and research firm IDC are fascinating. The Kindle Fire is, well, on fire. So, apparently, is the Barnes & Noble Nook Android tablet. Nokia and Microsoft are making headway with Windows Phone, BlackBerry continues its free fall and HTML5 has superseded everything but iOS and Android in developer interest.

Freemium is becoming the standard mobile business model and with that developers are looking for tools to scale, create loyalty and enhance engagement to increase monetization. You can access the full report here. Check out our commentary and analysis below. Developers: what are your priorities and monetization strategies?

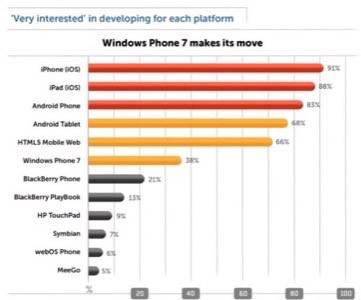

The Mobile Developer Interest Graph

Why does Apple do so well? iOS devices are simple, elegant and powerful and through the past couple of years developers have found them easier to make money from and create beautiful apps. Nothing has changed in Q4 2011. The iPhone (91%) and iPad (88%) lead all mobile platforms in developers that are “very interested” in creating apps. Next comes the Android phone (83%) and tablet (68%) on the interest graph. We have been saying for sometime that HTML5 has eclipsed all the other native platforms and the survey reaffirms that, with the HTML5 mobile Web coming in at a third (66%) of developers.

Windows Phone has made a significant jump in these rankings. In various meetings with Research In Motion officials and product managers from Windows Phone, this comes as no surprise. Windows Phone is benefitting from its Nokia partnership and a lot of that has to do with the capabilities that Nokia brings to bear, such as robust location services and terrific hardware. Nearly 28% of developers said they were interested in developing for the Nokia Lumia. That is almost double the interest that Nokia had in the same timeframe in this survey last year with its MeeGo and Symbian platforms. European developers are particularly interested in Windows Phone, with 42% saying that the Nokia/Microsoft partnership is the reason. The No. 1 reason for interest for the platform in North America was the focus on Windows 8 and tablet potential.

BlackBerry OS and QNX both had a steep drop off with 21% for smartphones and 13% for the PlayBook OS. There is a direct correlation here between hardware and developer interest. Outside of the PlayBook, which has proved to be a bit of a dud in terms of consumer interest, RIM has not released a hyped smartphone since perhaps the BlackBerry Bold 9000. Contrast that with the Nokia Lumia and you see why Windows Phone is on the rise at the expense of BlackBerry. We will see if RIM can make its own splash in Q1 2012 when we get the first glimpses of BBX devices.

Making Money

Appcelerator and IDC identified four objectives in what they call the “mobile relationship lifecycle:” engagement, loyalty, monetization and reach. This is an area of particular interest to ReadWriteMobile as we cover companies and startups in this realm. There are gamification startups, social engagement companies, marketing platforms, focus on push notifications, in-app purchases, advertisements (and the various elements advertising makes up), scale (through platforms-as-a-service), payments, cross-platform development. Appcelerator and IDC found 23 areas of developer interest in those four categories that could essentially serve as the ReadWriteMobile editorial roadmap for the next several years. Take a look at the chart below.

The survey identified the top priorities for each of the four categories of developer focus. For monetization, advertising and easy in-app payments and purchases are the top priorities. This is a departure from the paid app model as developers are learning to open the doors wider and then capture users in a honey pot of advertising and offers.

The top priorities for loyalty are increasing relevance and return visits through notifications, understanding what features in the app are used the most, figuring out the user flow through mobile analytics and the ability to iterate the app quickly. The top priorities in engagement are increasing the ease of use and performance of the native user interface and increasing engagement through media (device APIs like camera etc.).

With the proliferation of mobile platforms and options that are looking like they are worth developers’ time, reach is perhaps the most important of the four categories that developers focus on. It is no longer an “iOS and everything else” type of world. Developers can make money through BlackBerry and Windows Phone and there is the potential of ubiquity developing for HTML5 and Android. Developers priorities for reach are getting their apps to multiple platforms, reducing time-to-market, leveraging existing development skills, scaling through PaaS and improving the integration of PaaS systems.

A note on the survey: IDC and Appcelerator did a survey of 2,160 Appcelerator developers around the world. Appcelerator is one of the biggest framework and tools providers for native mobile apps and is working on HTML5 solutions for developers. The survey represents a good cross-section of developers to the point where ReadWriteMobile feels confident that these results are not skewed towards any particular mobile platform.

Towards the end of 2011 we will revisit most of these categories and look at some companies to watch in each space. Developers – what tools, services and providers are you using to increase reach, loyalty, engagement and monetization? Let us know in the comments.