What would you do after building a successful Dot Com business that was acquired by SAP in 2005? Many entrepreneurs would do their earn-out in the bigger company, then repeat the same formula with a new startup in the next Web era. That’s exactly what the founders of a forward-thinking Internet of Things company called ThingWorx are doing.

Earlier this month we reported on the sale of Pachube, a pioneer in the evolving Internet of Things [IoT] landscape. ThingWorx is a similar company, in that it provides a platform for connecting real world objects to the Internet. Where ThingWorx differs is that it has a solutions and services model primarily targeted to the manufacturing sector, whereas Pachube created a community platform. I spoke to Rick Bullotta, Co-Founder and CTO of

ThingWorx, to find out the origins and assess the chances of this next generation Web company.

Bullotta has been there and done that with an industrial focused startup. He and ThingWorx CEO Russell Fadel co-founded a company called Lighthammer Software in 1998. It was a supplier of business tools for the manufacturing industry – intelligence, analytics and collaboration software – and was acquired in June 2005 by business software giant, SAP.

As Bullotta put it, they “built a successful business applying Web 1.0 technologies to the industrial sector.” Now he, Fadel and third co-founder John Richardson (another manufacturing software expert) are “busy building a quite groundbreaking platform to hopefully unleash the true potential of the IoT.”

What ThingWorx Does

ThingWorx started out in 2009 with a strictly commercial model that focused on what Bullotta described as “mundane industrial business.”

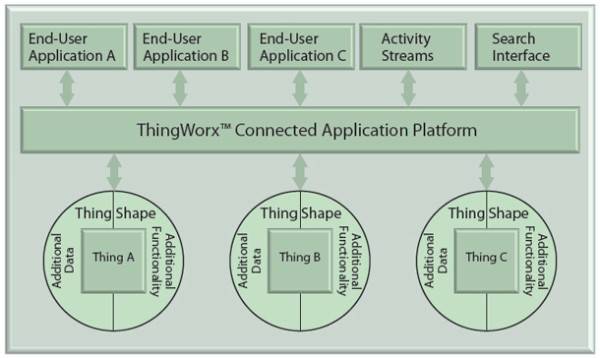

The founders of ThingWorx thought that manufacturing companies building apps in the emerging Internet of Things space were constantly re-inventing the wheel – with features like visualization, search and collaboration. So the idea with ThingWorx was to create a platform with all of those pieces and more, enabling manufacturing companies to build on top of it.

The company is also currently involved in projects related to remote healthcare, building automation, energy optimization, smart grid infrastructure and M2M applications.

Although ThingWorx is tapping into the buzziness of the Internet of Things trend, Bullotta says that the term may not align well with their company. He prefers the term “Intranets of Things” – meaning internal networks of people and applications inside companies. According to Bullotta, ThingWorx is ultimately about “connected applications” in an industrial setting. Whereas Pachube, he noted as a comparison, is “coming at it from a data perspective.”

ThingWorx takes a holistic view of manufacturing systems, aiming to connect people, systems, and the physical world. “When I look at a thing,” Bullotta told me, “it’s much more than data – there are services, people, properties [of things].”

ThingWorx got a second round of funding earlier this year and Bullotta says they have gotten “good traction” among OEM companies [Original Equipment Manufacturer]. These companies, he said, are good at making widgets “but they all tend to suck at software.”

Although he didn’t name customers, one is using ThingWorx to build a “smart grid for infrastructure monitoring.” Another, a beverage company, is using it to develop a sustainability solution.

Playing With The Big Boys

I asked Bullotta what makes ThingWorx different from large technology companies like IBM, HP, Cisco and Verizon Wireless – all of whom offer IoT solutions and services.

“They’re doing all our marketing for free,” offered Bullotta, somewhat tongue-in-cheek. In other words, the likes of IBM’s Smarter Planet campaign is promoting the need for Internet of Things solutions. The Cisco infographic about Internet of Things, which was a very popular post on ReadWriteWeb, is another example.

Looking past marketing, Bullotta said that “a lot of what they [the big tech companies] are doing is very service intensive, custom intensive.” They sell the software they have and services on top – there is no “pattern of repeatability,” according to Bullotta.

The business model for ThingWorx is pretty simple: subscription based license fees per server / user. They’re not interested in the consumer market, they let their OEM partners take care of that. So, ThingWorx is kind of like a niche IBM, in terms of how it makes money.

Successful Formula?

ThingWorx may not have the sexy open data IoT model that Pachube had, but industrial software pays the bills – and historically makes an attractive acquisition target for large IT companies.

One senses that Bullotta and company are using almost exactly the same formula with ThingWorx that Bullotta and Fadel used with Lighthammer Software: build forward-thinking manufacturing software and get acquired by an SAP a few years down the track.

Sounds very smart to me.