Over the past 10 years, Corel, Sun, IBM and others have tried to compete with

Microsoft in the office software business, but thus far none of them have been able to take a

significant chunk of Microsoft’s large market share, which generates revenues exceeding $15 billion each year. These companies have tried everything; including Sun open sourcing their StarOffice suite and releasing it as the

free OpenOffice. Yet, even this very compelling move has not

been able to make a serious dent in the market.

However, with web 2.0 and the rise of Rich Internet Applications there are renewed hopes for entrepreneurs to be able to compete with Microsoft’s Office juggernaut. Now these smaller players can leverage the sharing & collaboration capabilities of the Internet, remove installation & maintenance frictions, and provide globally

accessible office software.

Competitive Landscape

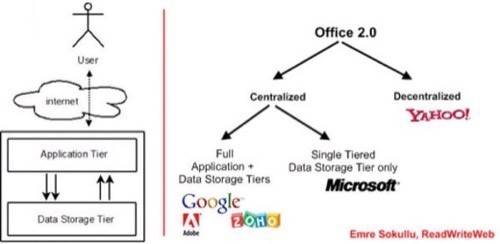

By snapping up Virtual Ubiquity, Adobe has become the latest player in the web

office market, but Google, Yahoo!, Zoho, and even Microsoft, are all established players in the game as well. Let’s take a look at all of the major contenders and their strategies:

Google, whose web office solutions are based on AJAX, probably has the strongest and most clear online office strategy among the big companies. In order to

provide offline capabilities (still a must for many, especially

outside the USA) Google developed Google Gears, which is a set of browser plugins and

Javascript libraries that enable AJAX applications to run offline.

Google built its web office suite via acquisitions. The startups they have acquired are:

Gtalkr (instant messaging), Writely (word processing), iRows (spreadsheets), JotSpot (wiki), Tonic

Systems (presentations), and Zenter (presentations). By acquiring outside talent in the web office space, Google was able to bring together a team of well focused engineers to execute their Google Apps vision.

All of Google’s offerings are freely available thanks to their ad-based

business model. For enterprises, Google offers an ad-free subscription based

model.

Google is betting on centralized servers and thin clients. That’s why they

are spending $600 million to build a new data center in North Carolina – the purpose

is to provide 100% uptime which is a must for enterprise grade acceptability.

Microsoft, the old stalwart of the office software space has a dilemma: they need to find some way to simultaneously compete with the free web based offerings from their rivals, while not hurting their

existing massive revenue stream from their ubiquitous PC-based office suite. For that reason, Microsoft is not in a great position to make bold moves in the web office market.

Perhaps that’s why Microsoft’s vision is evolutionary, rather than revolutionary. Microsoft doesn’t believe in Google’s thin client model and it betting

that people will continue having strong computers at home and in the office. Microsoft

is not trying to centralize software, but instead keep it on the client side. In traditional terms, this means more privacy as

well.

That’s why, with Office Live, Microsoft is centralizing only the data storage tier.

Microsoft’s assumption is that every computer will have Microsoft Office

installed – that’s why they are readying the release of a free, limited and

ad-supported version of their Office suite. Further, like Google, Microsoft recently invested $550 million to build a massive data center in San Antonio, with the purpose of providing full availability for its upcoming enterprise grade services.

Making Office free and universally accessible seems like a good idea, but personally, I’m

skeptical of the user satisfaction level in a world where all

applications are shifting to the web.

Yahoo! made a late entry to the web office market by acquiring Zimbra for $350 million in mid-September.

Zimbra is certainly a great web-based enterprise application provider and will

bring a lot to Yahoo!, but Zimbra focuses mainly on

groupware features and competes directly with Microsoft Exchange – not Microsoft

Office. It is not yet known what Yahoo! will do with Zimbra. They could choose to focus on its office functions (spreadsheets, word processor) and take them out of beta. Or, alternatively, it may use Zimbra to position itself as the leading email

communications company, with both hosted, ad-supported (Y! Mail) and ad-free,

enterprise (Zimbra) offerings, rather than compete directly in the contentious online office market.

In any case, by following

Zimbra’s approach, Yahoo! appears to be betting on a decentralized office

2.0 structure. Maybe that’s because Yahoo! does not want to invest in beefy

server farms like their rivals, which is risky, and possibly is more

concerned about privacy than others.

Yahoo! was not the only major player to enter the web office space in September: Adobe’s

Virtual Ubiquity acquisition seemed to announce that company’s intention to compete for online office market share. Adobe uses its Flash and

Flex

technologies to power its fledgling office suite. However, there are some obvious

concerns here:

- Adobe is inexperienced compared to rivals such as Google, Yahoo!, Microsoft at offering hosted services

- Enterprise-grade acceptability of Flash technology as an office suite backend is

questionable

Alternatively, Adobe may have less ambitious plans and the reason why they

snapped up Virtual Ubiquity may be to showcase the possibilities that the Flex

platform can bring.

Zoho is not as big or as well funded as the aforementioned players, but offers

perhaps the most complete office suite on the Internet. Similar to Google, Zoho has a

fully centralized approach and its solutions are based on Javascript technologies. Zoho’s suite includes a word processor, presentation app, spreadsheets, wiki, CRM, web conferencing, project management, and much more. However, one problem that Zoho

faces is that their applications are loosely connected. There is no single sign-on

and sharing capabilities are weak or nonexistent between most of its parts. Trust among enterprise users may also be an issue – large corporations may feel more comfortable keeping their data with a public company. These factors put Zoho in a good position for potential acquisition.

Others

Smaller players, such as ThinkFree, suffer from being based on deprecated technologies like Java Applets. There is also gOffice, which seriously lacks usability.

Surprise Player, meebo?

meebo is one of the most successful online instant messaging clients,

but with this week’s annoncement of a platform there now exists the potential for a lot of development to occur around their user base. By allowing third-parties to tap into meebo’s communication platform and users, the company’s new development platform could actually be used to create intriguing web office applications. Below is a mockup of what a meebo platform app might look like:

The picture above imagines Google Presentations embedded into meebo.

Conclusion

Finally, we may see new web office attempts from Sun (JavaFX) and Laszlo (OpenLaszlo) –

because, like Adobe, they are working hard to prove the readiness of their

RIA platforms for the enterprise.

In any case, the future is online and all software makers will need to make their

applications available through the web. For me, the big question is whether

Google’s thin client model will work or not. This model would lead us to

live with dumb machines that hook into Google’s server farms to do any real computation.

What do you think the future of Rich Internet Applications and specifically the online office will look like? Leave your thoughts in the comments below.