This post is sponsored by IBM’s A Smarter Planet blog, where it has also been cross-posted.

In recent posts we’ve looked at three of the world’s leading RFID-powered Smart Cards: Japan’s cutting edge Suica Card, London’s Oyster Card and Hong Kong’s long-running Octopus Card. The most conservative of those three, the Oyster card, can only be used on London’s public transport system. However that alone is a huge mainstream market for RFID chips. What’s more interesting though is how Smart Cards are being used in Japan and Hong Kong.

In both countries the cards (and other devices, such as phones and watches) may be used to purchase goods from selected shops. It’s more pervasive in Hong Kong, where the Octopus can be used at more than 1,000 merchants. Furthermore, in Hong Kong the card can be used as an access device for places like apartment buildings and schools.

Hong Kong is leading the way in the use of smart cards, but how is the overall RFID smart card market tracking?

A report released last month by VDC Research Group looked at the global demand for RFID Smartcards.

Despite the economy and difficulties in implementing RFID products, VDC believes that “the future remains bright for the RFID Smartcards market.”

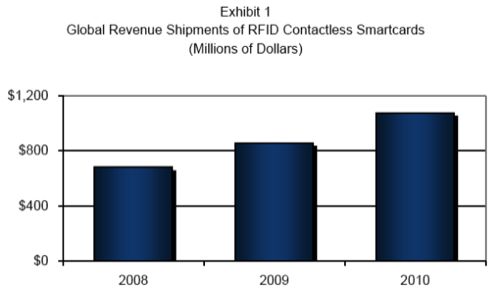

According to VDC Research Group, RFID smartcards revenues were nearly US$700M in 2008 and are predicted to grow at more than 26% per annum through 2013.

Image: VDC Research Group

Most interestingly, VDC stated that “several emerging applications are quickly approaching their tipping points.” VDC mentions contactless payment and ticketing as examples. Both are already features of the Octopus Card in Hong Kong.

At ReadWriteWeb we’d argue that RFID smart cards for ticketing on public transport has already tipped. Just look at the number of cities across the world that use smart cards for that purpose.

What hasn’t yet tipped, in our estimation, is using smart cards for a wider range of purposes – shopping, access to buildings, e-commerce, a range of identity purposes. Hong Kong has, over the past decade, developed into a great test case for many of those things. What’s more, the citizens of Hong Kong appear to have few privacy and security concerns. However we suspect those issues would be much more high profile in, say, the United States.

We’ve only seen the beginning of RFID smart card use cases, although Asia is clearly ahead of the curve. What we’re most looking forward to is web applications built off an RFID smart card platform. Japan’s Suica Card has begun to do that, with its Suica-enabled posters. But there’s much more to come.