Patent Wars

It is impossible to do a year-end review of the mobile ecosystem and not mention the thermonuclear patent wars. Patents are the story of the year in mobile – with billion dollar lawsuits, injunctions, cease-and-desist letters and patent trolls all marching us down the road to chaos.

Samsung and Apple have battled patent lawsuits across the globe to dramatic (and something amusing) results. Apple won a $1.05 billion California jury settlement from Samsung in August based on copying of functional and design patents by many of Samsung’s older products. Samsung is, of course, appealing – and there is a good chance that it might get either a retrial or a significant reduction in how much it has to pay Apple.

The funniest quirk in the global patent battle this year came when a judge in the United Kingdom ruled in favor of Samsung that it did not copy Apple’s iPad design. Since Apple had brought the lawsuit and had allegedly damaged Samsung’s good name, the judge forced a public apology (of sorts) from Apple on its UK website and in major British media.

Apple also brought patent cases against the likes of HTC (getting injunctions against the HTC One X in May) and Motorola. Nokia and Research In Motion have fought their own patent battles and Microsoft does whatever it possibly can to make partnerships with the other players, either to avoid paying licensing fees itself or to garner them from other manufacturers.

The patent wars have spun so far out of control that even the hardcore patent pundits have a hard time tracking of all the cases in the world. A major reason for this are the patent trolls, companies that own and control patents but do not actually produce anything. All they do is sue companies who may or may not violate their portfolio full of patents purchased from other companies. This practice, along with the major lawsuits between major manufacturers, will no doubt continue into 2013 and beyond. Apple already has a lawsuit pending against Samsung for its latest round of products, scheduled for court in 2014.

Mobile Payments Got Stuck In Neutral

2012 was supposed to be the year that mobile payments became mainstream. With services like Google Wallet, Square’s card reader and point-of-sale system, and Near Field Communications platforms like Isis from the mobile carriers, legions of shoppers were supposed to be replacing cash and credit cards at retail stores in favor of paying with their smartphones.

NFC is soon to become synonymous with “technology that does not solve a problem” when it comes to mobile payments. The ability to pay with a tap from your smartphone to a register seems cool, but there are plenty of technologies that seem cool but do not actually eliminate a problem. The standard system of cash and plastic credit/debit cards is so firmly entrenched in the American transactional society that it will extraordinarily difficult to replace. Just saying, “Hey, now you can pay just by tapping your phone,” is unlikely to be enough.

That is if we ever reach the point where NFC terminals become ubiquitous and culturally accepted. For now, the big players in NFC cannot seem to get out of their own ways, with companies like Verizon exiling services like the Google Wallet from the carrier’s Android phones because of dubious claims of hardware security. As ReadWrite mentioned several times this year, the top end of the mobile payments market is chaos because all of the big players want to own as much of it as they can – and are not willing to cede control to another power player. As the transaction companies like MasterCard and Visa know, the companies that control the transactional flow of money create a lot of power for themselves in the American economy.

What traction 2012 did see in mobile payments came from companies building infrastructure at the brick-and-mortar retail level right now, not in some theoretical future. That means that companies like Square, LevelUp, Dwolla and others may be putting themselves in a position to succeed when the market finally matures.

But there’s something big holding them back: The problem of scale.

A small company like LevelUp can do only so much with its limited resources. In the long run, the billion dollar behemoths will likely dominate mobile payments because only they can scale in meaningful ways. They just need to actually start doing it.

Security Concerns Grew

It had to happen, right? You did not think that a new revolution in human computer interaction would take place and the malware authors of the world would just ignore it? Spammers, virus makers, malware enthusiasts and their ilk go where the money and eyeballs are. And in 2012, that meant mobile.

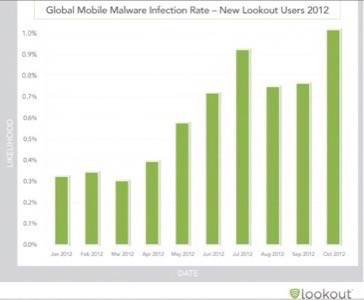

According to mobile security firm Lookout, the global infection rate for mobile malware sat at 1% as of October 2012. That might not seem like a lot, but 2012 saw smartphones reach a billion users. Do the math: If 1% of a billion smartphones have malware, that means 10 million smartphones are infected worldwide. (Note, Lookout’s numbers account only for Android.)

If I was a malware writer, I would call that a pretty good start.

Security firm Kaspersky Labs noted nearly 9,000 new Android malware attacks in the third quarter of 2012. And that was actually down from nearly 14,000 in the second quarter – after three quarters of significant growth. We are now talking about serious volumes of malware that can and will become a dangerous problem for both consumers and enterprises.

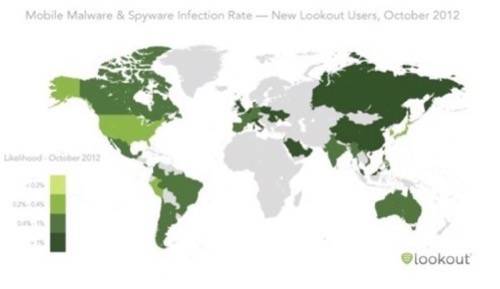

Asia and Eastern Europe – especially Russia and coastal China, long hotbeds for malware makers – see the highest infection rates of mobile malware, at an astonishing 30% rate in some areas. The U.S. does not escape though, with a smartphone malware infection rate of 0.4% For a baseline comparison, if 0.4% of Android smartphones in the U.S are infected with malware, that means that about 362,000 smartphones in America have malware.

Mobile malware arrives in many forms:

- App-based malware comes from giving apps certain permissions to access data in a smartphone

- Mobile-Web-based infections come through URL redirection (an old Web ploy repurposed for the smartphone world)

- Texting-based malware takes hold when an SMS text message signs you up for premium texting services (called “Toll Fraud”)

- Completely inadvertently when an app is not secured by its publisher and a hacker strong arms its way into an unknown vulnerability.

Businesses have to be sure that their data is secured, but this is a problem for consumers as well. Many people keep some of their most sensitive information on their smartphones. And when mobile payments finally do ramp up, mobile security will become even more critical.

Mobile malware reached maturity in 2012, like many other things in the mobile industry. Lookout predicts that 18 million Android smartphones will be infected with malware from the start of 2012 to the end of 2013. The epic battle between security and malware makers will continue to grow more intense in 2013.