Prospective cloud customers – both consumers and enterprises – throughout Europe are wary of the possibility, however remote, that the contents of their cloud deployments may become open to inspection by government authorities. Not European governments, mind you, but American, by virtue of the Patriot Act. Passed into law before legislators ever pondered the prospects of virtual servers in the cloud, the U.S. law grants federal investigators authority, under court order, to ask service providers for information from and about their customers, for use in anti-terrorist surveillance.

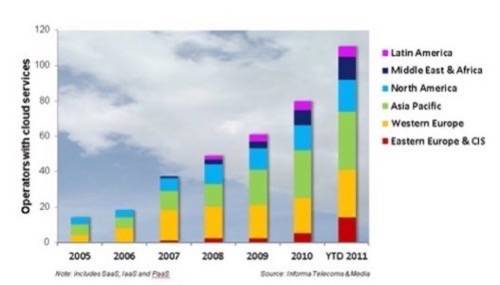

Leading U.K.-based telecom analyst firm Informa has been measuring the extent to which European carriers have been withholding their investments in cloud technology, in U.S. dollars. This morning, Informa released its findings, which indicate an almost crippling setback for the continent as it struggles to stay competitive with North America and Asia/Pacific.

According to Informa’s figures, carriers worldwide invested about $13.5 billion in 2011 in technology and resources for delivering cloud services to their clients. Of that figure, North America and Asia/Pacific combined accounted for $12 billion, or about 90%. European carriers accounted for only 7% of the world’s total carrier cloud investment.

This despite the fact that European carriers and telecom service operators, according to the Informa chart above, account for 24% of the global total number of operators providing service. Over time, that percentage too has been in decline.

Ironically, one of the companies making the most headway last year in designing next-generation carrier-based cloud services has been France-based Alcatel-Lucent. The fear among European customers, including in France, is that once they deploy their services in a hybrid or public cloud, entire virtual machines could travel transparently over countries’ jurisdictions into the U.S., where federal regulators might gain the authority to peek into their contents. In a Bloomberg interview this morning, a security engineer with France Telecom articulated the fear of his own customers: “If all the data of enterprises were going to be under the control of the U.S., it’s not really good for the future of the European people.”

As cloud service providers told me recently, a frequent request of Europe-based customers is that they make express guarantees in their service-level agreements that their data and virtual machines never be migrated to servers under U.S. jurisdiction. And as my friend and colleague Ron Miller reported last September, American companies touting the benefits of the cloud at European customers are met by resistance from would-be customers, some of whom say they would rather do business with Canada than the U.S.

Amid the climate of fear, Informa reports, cloud operators in Latin America, Africa, and the Middle East are growing faster than in Europe, which may be painting a picture of itself as a barricaded fortress in an otherwise burgeoning market.