There is no greater barometer on what people want than allowing them to be free to make a choice. When it comes to smartphones in the enterprise, that choice increasingly belongs to Apple.

The BYOD (“bring your own device”) trend continues to alter the personal computing landscape just as it upends traditional work boundaries and IT controls. The latest mobile security report from Good Technology reveals some striking information:

- Apple’s iOS devices thrive inside the enterprise – when workers bring their own device.

- Microsoft has yet to see any real gains from linking its smartphone and tablet OS with its massive PC install base.

- Despite the steady rise in smartphone and tablet sales, activations inside the enterprise are failing to keep pace. This could mean that larger companies are struggling to manage the complexities presented by BYOD.

According to Good’s Q1 2013 Mobility Index Report [PDF], mobile device activations inside the enterprise were up nearly 30% from the same time last year – a sizable increase, albeit less than the overall increase in smartphone and tablet shipments.

Though the report does not offer any conclusions, the disparity suggests that the many corporate issues associated with BYOD, including security, management, cost controls and support of employee-owned mobile computers, may pose more problems than many employees suspect.

[See also: Is Bring Your Own Device (BYOD) Really Good For Workers?]

Android Rising, iOS Preferred.

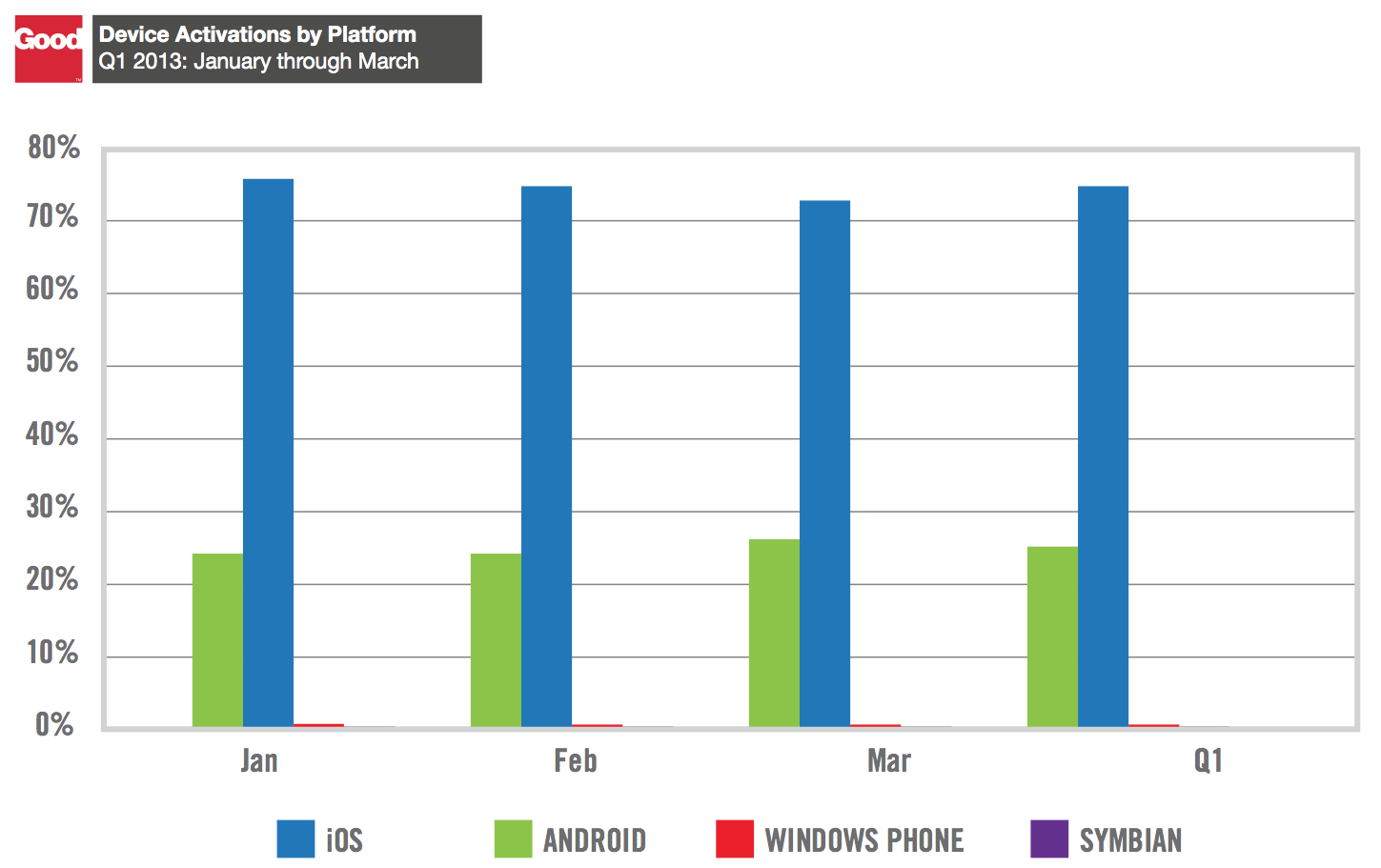

Despite Android’s overall market share dominance, Apple’s iOS remains “the preferred enterprise platform,” according to Good Technology. As the report notes, Android device activations inside the enterprise increased “just five percentage points year over year.” This, despite the explosive growth of Android in 2012.

Apple’s iOS is the enterprise mobile leader with a 75% of total mobile device activations. Android’s gains, while small, came at Apple’s expense.

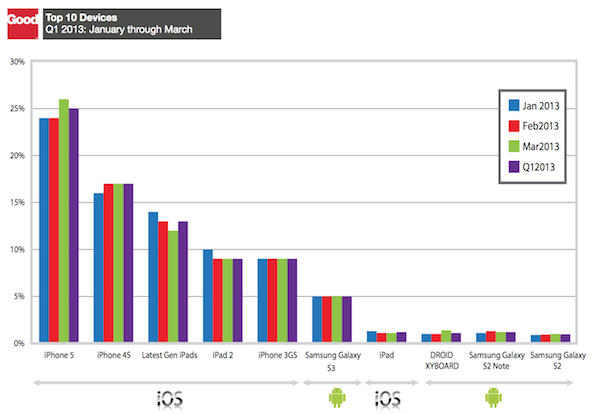

iPhone 5 Most Popular

According to Good, iPhone 5 is the most popular device for enterprise users, followed by iPhone 4S. The most popular Android device is the Samsung Galaxy S3, though it still trails the iPhone 3GS, which Apple no longer offers. The iPad is the most used tablet inside the enterprise.

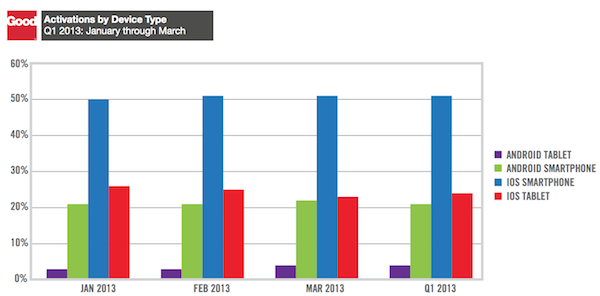

It’s reasonable to expect more iPads – and Android tablets – invading the enterprise. Good’s data shows that while only 1 in 5 shipped smart mobile devices is a tablet. Inside the enterprise, one in four device actiations are tablets.

[See also: ReadWrite Survey Results: What A Typical BYOD Program Really Looks Like]

Microsoft Barely Registers

Despite Microsoft’s tablet push, it was Android-based tablets that saw a significant rise in enterprise activations – nearly doubling the number of activations in Q1 2013 compared to Q4 2012.

The news gets worse for Microsoft: 99% of all mobile device activations in the enterprise over the past year were either iOS or Android devices. In fact, Good’s numbers show that the Windows Phone platform actually dropped during this most recent quarter, falling from 0.5% in Q4 2012 to 0.3% in Q1 2013.

Expect to see more aggressive pricing, marketing and other appeals from Microsoft. It’s clear that iOS and Android are invading Microsoft’s enterprise stronghold.

Note: Good Technology is a long time rival of BlackBerry in the mobile security sector and BlackBerry devices are not included in this report.

Where Good’s Data Comes From

Take Good’s data with a grain of salt if you like. The company has made a significant enterprise push with Apple devices over the last several years while also partnering with Android manufacturers Samsung, HTC, LG as well as Windows Phone maker Nokia.

Good Technology analyzed activations by month among its enterprise and government customers that had at least five activated devices over the quarter. Due to the fact that BlackBerry/RIM devices use only the BlackBerry Enterprise Server for corporate email access, Good is not able to track BlackBerry activations.

Good Technology offers mobile security solutions to over 5,000 organizations in 130 countries. It claims to work with over half the Fortune 100. Good’s report is based on its data.

Image courtesy of Shutterstock.