One in five mergers so far this year has involved technology companies, with the buying led by consortiums intent on acquiring patents.

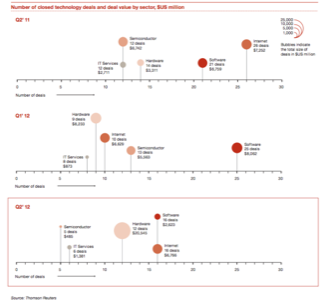

That was a key finding in PricewaterhouseCoopers LLP’s second-quarter U.S. technology M&A Insights Report. The quarterly report covers disclosed deals with values of $15 million or more. Despite accounting for 20% of all mergers so far this year, overall technology transactions were down 15%, to 55 deals in the three months ended June 30.

The push to the cloud seems to be fueling technology-firm acquisitions, which saw their dollar value jump 8%, to $31.8 billion, from a year ago. PwC said some of the deals came as big players tried to shore up previous acquisitions while also shedding non-core assets. Deals involving software, cloud and e-commerce companies combined to make up 58% of the tech deals in the quarter, which included six deals topping $1 billion.

“The line between Internet and software continues to blur as acquirers augment cloud-based offerings and push more services to the Web,” said Rob Fisher, PwC’s U.S. tech industry transaction services leader, in a statement.

In a quarter where Facebook’s initial public offering fizzled, investments in technology carried an air of caution, and the IPO market has all but dried up for tech companies.

Overall, IPO volume was down 39% between the first and second quarters, with the number of tech companies issuing shares for the first time falling to 10 from 13 in a particularly robust first quarter for tech IPOs.

Other trends highlighted in the report:

- Consortiums augmented their patent portfolios through acquisitions.

- Despite the decreases, tech led all other sectors both in the number of deals and the total dollar value of all deals.

- Private equity firms jumped into tech, perhaps seeking to take advantage of the volatility in the market place.

- Minority-stake transactions for tech companies also saw an increase in volume.

“As technology businesses identify non-core assets for spinoff or divestiture, we expect another wave of deal activity to offer abundant opportunities for future transactions, as long as buyers are willing to spend stockpiles of cash accumulated during the last few years of generous growth,” Fisher said in a statement. “The potential impact of a prolonged slowdown in IPO activity may further boost deal activity as former IPO candidates instead consider the M&A route.”