When it comes to mobile payments, how much do you really trust a credit card attached to your smartphone? Is it secure? Are merchants going to sell your personal information or start sending you piles of junk mail? These are some of the concerns that a new report from Javelin Strategy and Research surfaced this fall during a survey of consumers’ fears of mobile payments and online transactions.

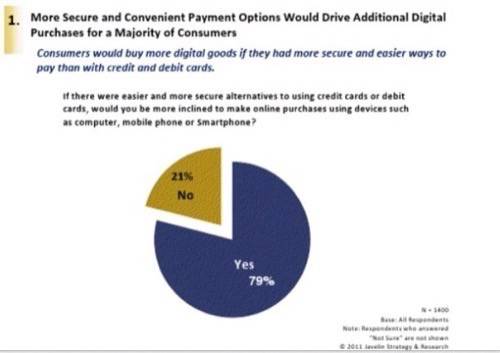

The survey concludes that four out of five consumers would spend more money online if they considered credit cards safer and had payment alternatives. Javelin predicts that an additional $109.8 billion would be spent by offering a “no credit card required” way to pay online and at merchants.

It is important to note that Javelin’s survey was commissioned by PaymentOne, a direct-to-carrier payments company. (PaymentOne would benefit directly from getting consumers’ off credit cards and seeing them start paying through their cellphone or cable bills.) The survey was conducted in the fall of 2011 and polled more than 2,000 U.S. adults concerning payments preferences.

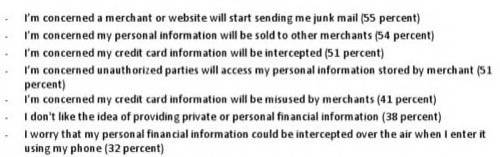

95% of respondents had mobile phones while only 36% had used that phone to pay for an item, be it an app, game, music or media streaming such as Netflix or Spotify. The top concerns around using credit cards online were privacy related concerning personal data falling into the hands of advertisers, marketers or malicious hackers.

There is a tenant in the payments industry that the more clicks that a user has to make, the less likely they are to make a purchase. These are often referred to as “pain point” or “friction.” Think about why Apple or Amazon do so well. Consumers enter their credit card numbers once and after that it is one-click processing with a password. Both companies have done masterful jobs of taking the friction out of payments.

On the other hand, the results of this survey should definitely be viewed through the lenses of a direct-to-carrier billing company trying to drum up support for its business model and get more online and offline merchants to use carrier billing, especially for smaller purchases. “No one is going to buy a fridge through carrier billing,” a PaymentOne executive said at CTIA in San Diego in October.

Users should think long and hard about storing credit card information on their smart devices. A report surfaced this morning that the Google Wallet leaves some information unencrypted if the device it is on is rooted. In the Android ecosystem there are also security concerns with malware-ridden apps that can theoretically gain root access and steal all information on a device. The Google Wallet sandboxes a lot of that data but as the Javelin survey points out, consumers have their fears regardless of the truth behind the technology.

What are your concerns with mobile payments? Is there a reason to fear using your credit card online or is the survey slanting its findings towards the benefit of its client? Let us know in the comments.