WorkLight, a startup that offers enterprise 2.0 products, recently did a survey among Facebook users to find out their willingness to use Web 2.0 tools for secure banking. The survey was conducted among 1000 Facebook users between the ages of 18-34. The fact that the survey was conducted among Facebook users gives it a bias towards tech-savvy people. However there are some surprising findings.

The results:

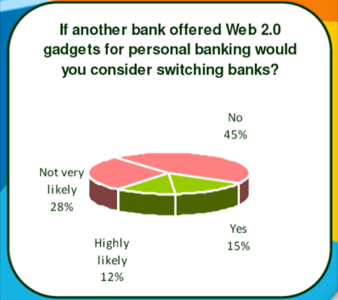

- 27% of respondents said they are willing to switch banks in order to use secure Web 2.0 gadgets to manage personal finances; 73% would not.

- Nearly half of respondents (48%) said they would use secure gadgets for personal banking if their bank offered it

- Men are more open to use these new tools than women (55% to 45% respectively)

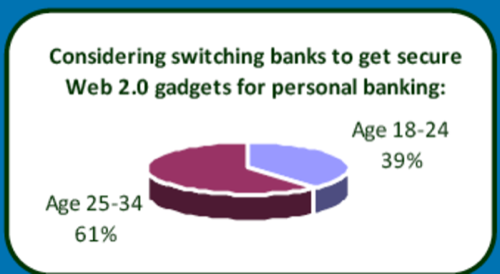

- The older age group – 25-34 – are more open to using Banking 2.0 tools

The fact that the 25-35 age group is more willing to try banking 2.0 than 18-24 years old was a little surprising – although neither group is “old” when you go outside of Facebook. To drill down more into the age group stats: 53% of 25-34 year olds said they would take advantage of a web 2.0 banking service, compared to 45% for the 18-24 year olds. Moreover, 33% of 25-34 year olds would consider switching to another bank that offered Web 2.0 gadgets for online banking — it was just 21% among 18-24 year olds.

The key stat comparison I think is that nearly half would use web 2.0 tools if offered by their current bank, but only 27% would consider switching to another bank because of it. 27% (over 1 in 4) is relatively high, but again I think we need to bear in mind that these are Facebook users. So this tells me that web 2.0 is currently viewed as a ‘nice to have’ feature by banking consumers, but it is by no means an ‘essential’ product worth switching banks over. Still, banks would do well to to take notice of what their users want, especially the tech savvy ones.

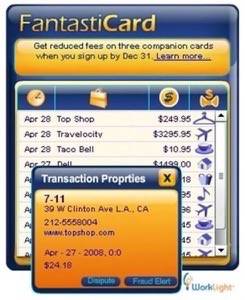

Security is going to be a big part of any potential ‘banking 2.0’ product. Web 2.0 products to date haven’t been known for their security – it’s difficult to focus on that when social networking and sharing is such a major component of web 2.0 products. WorkLight says that it aims to adhere to a bank’s “strictest security requirements”. And let’s be honest, Worklight is going to need 100% validation of security from the banks in order to be taken seriously by consumers. If I’m going to use a web 2.0 product for banking, then I want a guarantee from my bank that it’s secure. A guarantee from Worklight alone won’t cut it.

Having said that, Worklight’s banking solutions look promising and it’s another great example of web 2.0 going mainstream in ‘the real world’ (you know, the land where Twitter and FreindFeed are merely cute toys that geeks play with). Here is an example of a secure Banking gadget, in this case of a credit card company:

WorkLight is a pretty well funded company based in Israel. It recently took in a series B round of funding totaling $12 million led by Pitango Venture Capital, Israel’s largest VC. It previously had taken $5.1m in funding when it was founded in 2006. It’s main focus is consumerizing web 2.0 apps for the enterprise – such as iGoogle, MS Live, Netvibes, and Facebook. With the banking widgets, it appears to be headed into products that bring web 2.0 to the mainstream consumer world; which we think is an area with a lot of promise.