Wallet, the pay-by-name app that payments company Square introduced in 2011 and discontinued earlier this year, is back, according to an email Square sent to users Thursday.

Square is “retiring” Wallet but its putting its key feature—the ability to pay in stores by saying your name, without taking out a wallet or even your phone—inside Square Order. And it is offering the service to merchants for free—a powerful lure as powerful competitors like Apple, Amazon, and PayPal court the same retailers.

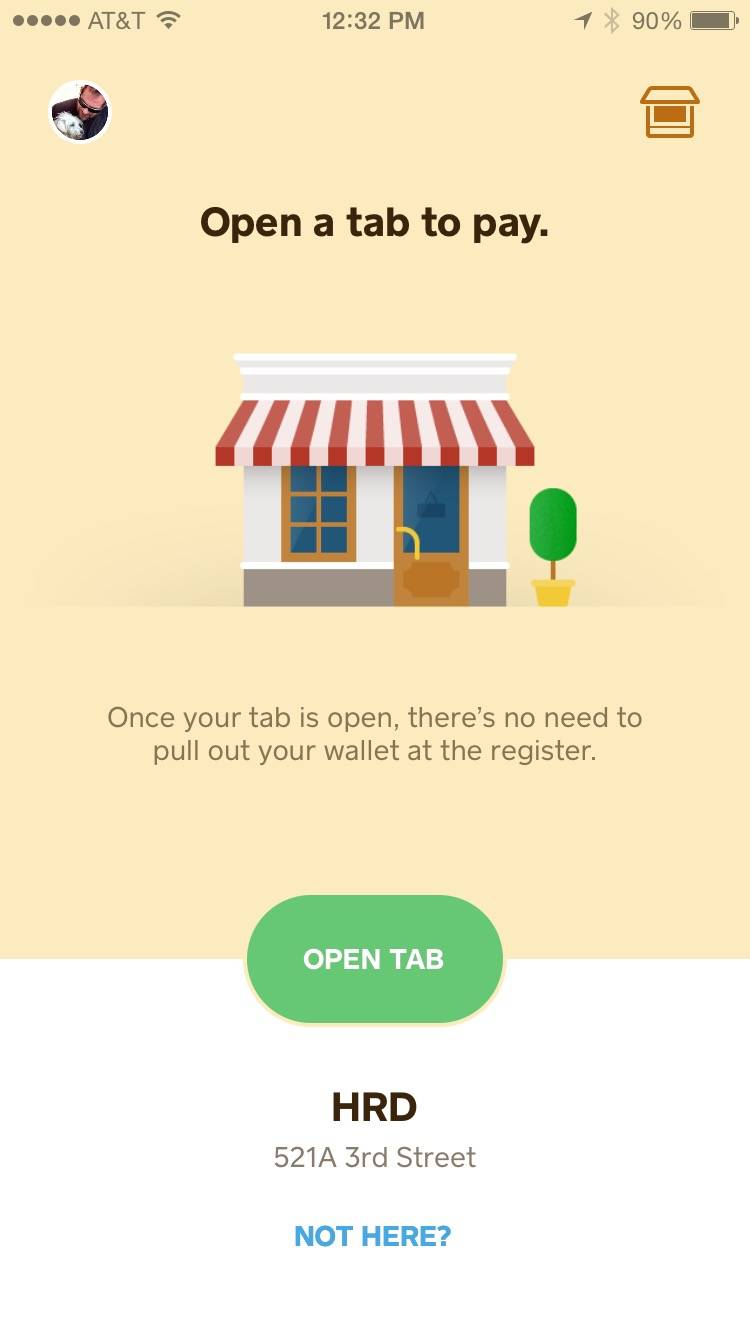

Square Order, an app Square introduced as it discontinued Wallet, allows for customers to place orders ahead of time to pick up in stores. That app is now adding a feature called Tabs, which is picking up where Wallet left off as a way of paying without having to swipe a card.

Johnny Brackett, a Square spokesperson, confirmed the change to ReadWrite, saying that a “subset” of Wallet users had received the email.

“There’s been a lot of talk in the Valley about Wallet failing,” Brackett says. “Wallet didn’t fail, but it did need to evolve.”

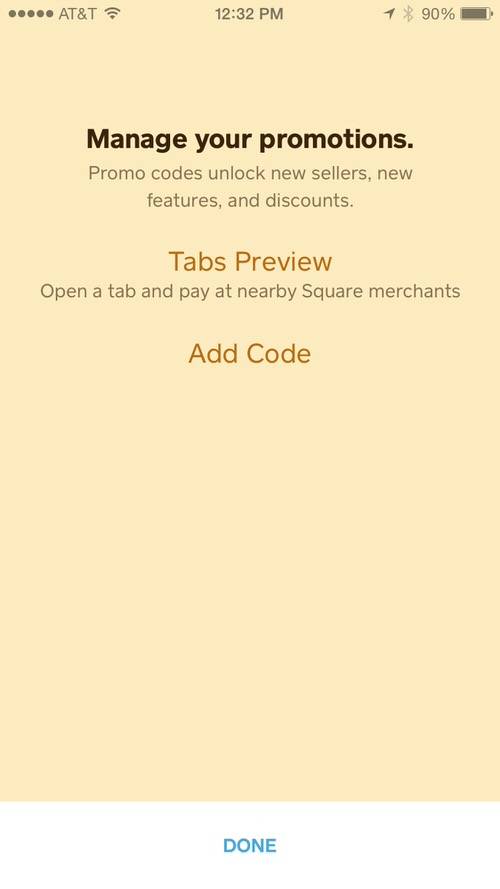

Current Square Wallet users can access the feature by downloading Square Order and logging in with their existing accounts. Other curious users may be able to add the pay-by-name feature by entering a promotional code, TABSPREVIEW, into their apps. In a test, a ReadWrite colleague who had not previously used Wallet was able to add the feature to her Order app using that code.

New Life For An Aging Innovation

At the time Square introduced Wallet, it was seen as a true innovation in payments, fundamentally changing the payment experience. It made for a great demonstration, and won Square a lot of publicity, but it failed to catch on with consumers, who were used to swiping credit cards.

One issue with Wallet may have been its profitability. Square charges most merchants a 2.75% fee on transactions, while it pays varying rates to banks and credit-card processors. On most transactions, it makes a healthy profit, but on smaller purchases, it may lose money.

Rules set by Visa and MasterCard treat transactions like Wallet as similar to online transactions, where a plastic card isn’t swiped. These so-called “card not present” transactions carry higher fees, which means that Square was more likely to lose money on Wallet transactions.

When Square replaced Wallet with Order, it seemed to have an answer: Initially, Order transactions would carry the same 2.75% fee, but that fee was supposed to rise to 8% on July 1, 2014.

According to Brackett, the fee increase for Order never kicked in. And the company quietly cut the charge on Order transactions to 0% in recent months.

Pay-by-name transactions in Order will also cost merchants nothing for the time being.

“We found a way to reduce the cost to zero,” Brackett says. That’s the cost to merchants, not the actual cost of the transactions. Brackett didn’t elaborate on how the company is handling the cost of such transactions, but it is likely that Square is bearing the cost of fees imposed by card processors and banks in the hopes of getting merchants to adopt Order. It’s also possible that Square is getting some assistance from partners; JP Morgan Chase and Visa are investors in the company.

Square is also giving away in-store marketing materials, like posters, coffee sleeves, and vinyl banners.

Courting Consumers, After Taking A Break

The new push to get merchants and consumers to adopt Order is a surprisingly aggressive move for Square on a couple of fronts.

First, Square had largely deemphasized marketing its consumer products in recent months, focusing its website and public-relations efforts almost exclusively on reaching merchants. Second, Square had also emphasized profit-making moves—like the higher rate it initially planned to charge for Order transactions—amid reports that it was aggressively spending the money it had raised from investors.

According to Brackett, Order is being led by Gokul Rajaram, a high-profile product expert Square hired away from Google last year, suggesting it has now become a high priority for the company to reach out to consumers again.

One casualty of the move to eliminate the old Wallet app: Square’s partnership with Starbucks for mobile-app payments. While Square continues to process credit- and debit-card payments for Starbucks, there’s no way to make phone payments with Square Order. (Square Wallet never allowed for pay-by-name payments at Starbucks stores; instead, Wallet displayed a code that baristas scanned.)

The ability to pay with your phone at Starbucks via Square will go away when Square pulls the plug on the old Wallet app, in other words—unless Square gets Starbucks to sign up for Order. That appears unlikely, since Starbucks is introducing order-ahead functions to its own app, which it is currently testing in Portland, Oregon.

“We have nothing to share regarding Starbucks offering Order,” says Brackett. Maggie Jantzen, a spokesperson for Starbucks, did not immediately respond to a request for comment.

Square’s move comes as it faces increasing competition for ways to pay in stores. Apple Pay, a tap-to-pay system currently limited to Apple’s newest smartphones and tablets, is signing up more banks and merchants. And PayPal, which copied Square’s pay-by-name feature in its mobile app, is aggressively marketing the feature in stores and on billboards in San Francisco and other cities. PayPal is also letting merchants add mobile payments features to their own apps; it recently signed up Burger King, for example. Amazon has also introduced a product, Local Register, which is undercutting Square on pricing by charging merchants a slightly lower fee of 2.5% on transactions.

In October, Square raised $150 million in fresh financing. It’s clearly determined to put some of that new money to use getting merchants and consumers to embrace its Order app.

Photo by Adrian Cleave for ReadWrite