The tech IPO is back in fashion, with the likes of Facebook, LinkedIn and GroupOn dominating the headlines over the past year. One of the lesser known technology brands to have gone public is Splunk, a company hyped by its CEO Godfrey Sullivan as “the Google of Big Data.” Splunk debuted on the Nasdaq last Thursday, at an opening share price of $17. It’s already more than doubled that and is currently trading at nearly $35, giving it a valuation of over $3 billion.

You may not have heard the name Splunk before, but it’s a company that took a full decade to germinate and then blossom into a successful IPO. Splunk provides technology that indexes and analyzes the increasingly large amounts of customer and transaction data inside enterprise companies. Splunk launched in 2006, after 4 years of research and development, and has since built a customer base of 3,700 customers – including many of the Fortune 500 companies.

It’s not a completely rosy picture. Like Amazon.com in the early days, Splunk is actually losing money at this time. As Thomas J Lavan III pointed out in The Motley Fool, Splunk has a history of losses and has yet to be profitable. For the 2011 fiscal year it had revenue of $66.2 million, but recorded a loss of $3.8 million.

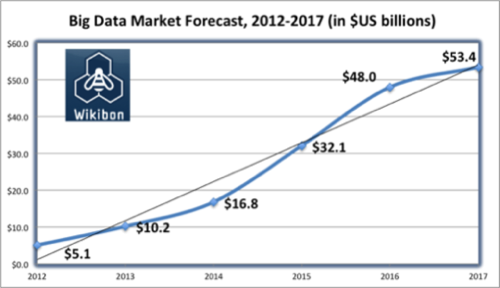

However, the signs for future growth have been promising. Each year Splunk’s revenues have increased and its net loss has decreased. Another positive sign for Splunk is that the Big Data industry is predicted by most to rapidly expand. Lavan quotes tech advisory community Wikibon, which foresees growth in the Big Data Market from $5B this year to more than $53B in 2017.

How Does Splunk Work?

In a nutshell, Splunk is a dashboard for tracking and analyzing any kind of business data. In the demo of version 4.3, Twitter data is used as an example. Using Splunk, you can track hashtags, create alerts and visualize the data.

There are a number of case studies on Splunk’s website, including one from an unnamed financial services organization with “more than 50,000 global customers.” This company has “a large number of distributed applications that generate millions of events per day.” Splunk was deployed to track data across those apps and troubleshoot problems. The machine data that Splunk analyzes for this financial firm includes custom and third-party software, servers, c language code, Java code, operating systems and databases. According to the case study, “Splunk streamlined the company’s ability to search, find, analyze and resolve issues quickly.”

Splunk’s $3 Billion Solution: Troubleshooting Infrastructure

It turns out that troubleshooting large amounts of data was a core value proposition of Splunk right from the start. It even led to Splunk’s name.

Splunk’s affable founders, Rob Das and Erik Swan, have been working with each other since 1993-94, according to a video introduction by the pair (see below). In 2002, when the two began Splunk, they were tackling the problem of how to effectively troubleshoot machine data. Das likened the industry status quo at that time to “digging through caves with headlamps and helmets on, crawling through the muck trying to find these problems; and it took forever.” The term for this kind of exploratory activity in caves is spelunking, which gave the company its name.

What Das and Swan built is technology that trawls through log files of machine data, paired with software for business users to analyze that data and troubleshoot any problems. It’s complex technology and has taken a decade to mature. Co-founder Erik Swan described Splunk as a “mass market IT tool that [works] for just about any use case you could think of.”

Once Das and Swan had figured out the problem (searching and troubleshooting data logs), in mid-2004 they raised capital and began developing the solution. Since then Splunk has slowly but surely built an impressive portfolio of customers, which led to its IPO. That Splunk doubled its share price in its first week shows that this is a solution with a big future.

Let us know if you use Splunk in your company. If so, what have been your impressions?