ReadWriteDrive is an ongoing series covering the future of transportation.

Most cars on the road will soon be smart enough to detect and avoid collisions—with little or no help from drivers who all too easily get tired, drunk, or distracted by incoming texts. And that could radically change a lot of things around the auto industry.

Proven automotive safety technologies—most notably radar-based automated braking—are expected to produce an auto industry shift that is more transformational than the introduction of safety belts and air bags a generation ago. These technologies require a wholesale reconsideration of the overlapping industries that insure and repair cars (and people) damaged in car crashes. These expenses are measured in the hundreds of billions of dollars per year.

Several companies, including Mercedes, Volvo, and Nissan, are already envisioning a “zero fatality” scenario by the end of the decade. Today, more than 30,000 Americans die in car crashes every year.

“The emphasis over the past half-century has been on engineering vehicles so that occupants survive a crash,” said Robert Hartwig, president and economist at the Insurance Information Institute, an industry organization. “The new generation of technology seeks to avoid the crash to begin with. That’s a fundamentally new way of thinking about safety.”

Disruption Ahead

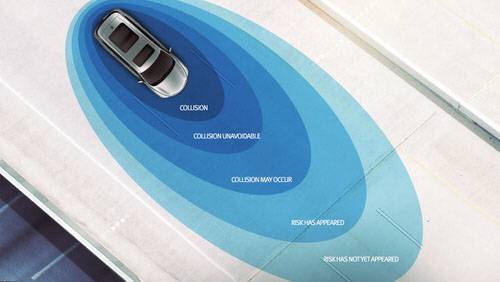

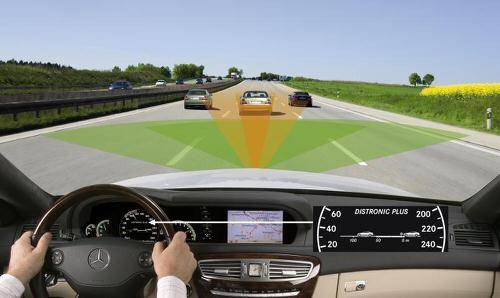

Cars equipped with radars, lasers and lightning-fast processors can detect, with great accuracy, an imminent collision with another vehicle. These systems—already found in luxury vehicles from the likes of Mercedes, BMW and Volvo—issue warnings to drivers to apply brakes. If the driver doesn’t respond, the car will automatically bring the car to a stop or otherwise avoid the collision.

Expect to see crash avoidance systems spread throughout the industry, first as pricey options, then as standard features—and maybe one day as federally mandated technology.

Americans paid approximately $170 billion in auto insurance premiums in 2013. About 77 percent of that was used to pay on claims, with the remainder going roughly half to the insurance company’s operating expenses and half to profit.

Alain Kornhauser, a professor of operations research and financial engineering at Princeton, has absolutely no doubt about the economic benefits of driver-assist technologies. “Money that would otherwise go to body shops, lawyers, ambulance drivers, MRIs, clinics, and hospital emergency rooms will now go to technologists working on safety systems,” he said. “This is disruptive as hell.”

Kornhauser is not exactly sure—and not overly concerned about—how the disruption will play out. “This is fundamental economics,” he said. “The technology to do collision avoidance is so inexpensive that it’s cheaper than the amount of chaos and carnage that it takes out of the system.”

New Business Models

As billions of dollars are liberated from the current system, it’s only a matter of time before enterprising insurance providers begin offering steep discounts to owners of cars using crash-avoidance technology. That represents a consumer subsidy to help car buyers pay for the technology.

In fact, Kornhauser believes the car companies selling much safer vehicles could directly offer insurance—much the way they provide financing today. Besides, with increasing levels of automation, the liability in an accident might very well rest with the carmaker, rather than the driver.

In essence, the broad interconnected markets regarding auto safety market would shift from insuring cars that we all fully expect will experience accidents to development and deployment of technology intended to ensure that accidents rarely happen.

“About 80 percent of what auto insurers take in goes to hospitals, lawyers and body shops. Assume you chop that in half,” said Kornhauser. “I would prefer to see the money in the pockets of the technologists who do the vision systems, the cameras and the radar.”

Lead image by Flickr user Ben Margolin, CC 2.0; others courtesy of Nissan, Volvo and Daimler