The final 2013 numbers are in and Samsung once again reigns supreme over the mobile ecosystem.

According to research firm IDC, Samsung’s shotgun strategy of developing dozens of smartphones across a variety of size and price points led to 313.9 million smartphone shipments, or 31.3% of the global smartphone market share in 2013. Apple was second with less than half of Samsung’s total volume, shipping 153.4 million iPhones for 15.3% of the global market share.

“Apple shipped a record 153.4 million mobile phones worldwide in 2013, up from 135.8 million in 2012,” said strategy analytics senior analyst Ken Hyers in a press release. “However, Apple’s growth rate moderated from 46 percent in 2012 to just 13 percent during 2013. Apple’s lack of presence in the low-end smartphone segment and the big-screen phablet category are costing the firm sizeable volumes.”

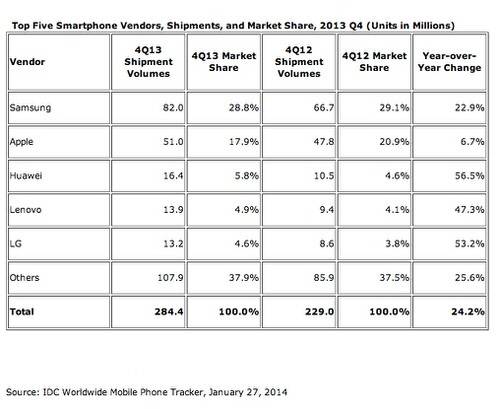

For the final quarter of 2013, Apple shipped 51 million iPhones, a quarterly record for the company. Samsung ruled the roost with 82 million smartphone shipments.

No other smartphone manufacturer came close to Samsung’s numbers last year; none of Samsung’s rivals in Asia could muster even 5% of the overall smartphone market in 2013 (Huawei, LG and Lenovo accounted for 4.9%, 4.8% and 4.5%, respectively). The remainder of the mobile market—39.3% of shipments—was split among companies like Motorola, HTC, Nokia, Panasonic, TCL-Alcatel, Sony and others.

Size & Price The Dominant Factors

Samsung is perhaps the only mobile manufacturer in the world that’s willing and able to play in every segment of the market. It can make big phones and “phablets” like the Galaxy Note 3, top-end smartphones like the Galaxy S4 (and its many variants), but also ship millions of lower-end Android-based smartphones to emerging markets like China and India.

“Among the top trends driving smartphone growth are large screen devices and low cost,” Ryan Reith, program director with IDC’s Worldwide Quarterly Mobile Phone Tracker, said in a press release. “Of the two, I have to say that low cost is the key difference maker. Cheap devices are not the attractive segment that normally grabs headlines, but IDC data shows this is the portion of the market that is driving volume. Markets like China and India are quickly moving toward a point where sub-$150 smartphones are the majority of shipments, bringing a solid computing experience to the hands of many.”

Apple has been unwilling to compete at the lower end of the smartphone market with the likes of Samsung, Huawei, Lenovo, Motorola and LG. Each of these companies is pushing Apple on price, with the LG-made Nexus 5, one of the top smartphones of 2013, coming in at just $349 without a cellular contract. Motorola’s Moto G smartphone was seen as upping the ante for quality smartphones at budget prices, starting at $179 off-contract. Apple’s mid-tier smartphone, the iPhone 5c, starts at $549 while its “entry” or budget devices are older models like the iPhone 4 or iPhone 4S in emerging markets.

Who Can Break Up The Duopoly?

With 2013 in the rear view, the smartphone market for 2014 looks intriguing. About a billion smartphones were shipped in 2013 and the market has shown no signs of slowing down. Over the past three years, the story has been basically the same: Samsung ships the most volume, Apple makes the most profit and everybody else struggles to get a piece of the pie. Is 2014 the year the script changes?

There is no clear-cut answer at this point. Apple’s iPhone growth, while impressive, is smaller than it has been in previous years. Rumors suggest Apple will release two new iPhones this year with 4.5-inch and 5-inch screens, but speculating on what and how Apple will release in the third quarter is just guesswork at this point.

Samsung’s script is looking to shape up the way it did in 2013 with the Galaxy S5 flagship set to arrive sometime in the first half of the year while the company’s next Galaxy Note 4 phablet flagship will ship in time for the holidays. The question becomes if and when any of the competitors can make big dents in the Apple/Samsung duopoly’s established position. Asian manufacturers like Huawei, ZTE and Lenovo hold regional interest but not global appeal; HTC and Motorola hold global appeal but not the same marketing and distribution powers as Apple or Samsung.

If the competition is going to gain any serious ground on Apple and Samsung in the smartphone space, it will be in small percentage points. But if enough of these companies grow by a few percentage points, the overall smartphone market will be much more democratic with excellent options for every region, price point and device size.