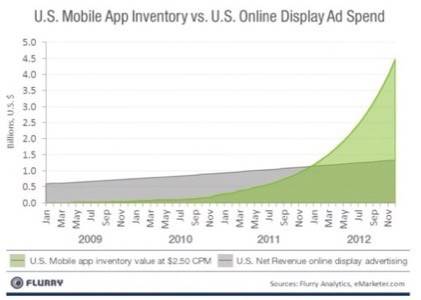

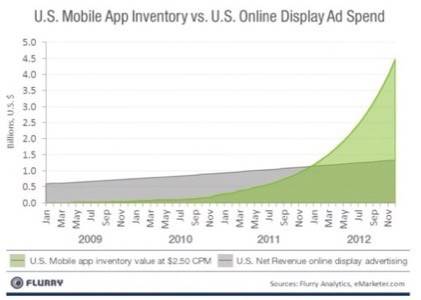

Mobie analytics company Flurry released research today that shows that the available inventory for mobile advertising could absorb all Internet advertising. That means that available display ad spots for iOS and Android could take over just about all revenue for Internet advertising.

Now, while mobile growth has been staggering over the last two years, there are several aspects to keep in mind here that Flurry does not touch on. Foremost, Flurry is taking into account the total amount of inventory available for the more than 600,000 apps available between Android and iOS. That does not necessarily mean that most apps make attractive targets for advertisers.

Flurry sees four reasons why mobile advertising inventory is growing so fast:

- Smartphone growth – More than a million activations across platforms per day.

- Publisher growth – More developers, more apps.

- Session use growth – Users spending more time using their apps.

- Publisher integration of ads – More screen space, more complex apps make for more advertising potential.

Yesterday research firm comScore came out with smartphone user numbers for July that showed nearly 82.2 million Americans, or about a third of all U.S. consumers, are now smartphone users. That number is rapidly approaching the magical inflection point of 50% smartphone market penetration that signals the difference between a mainstream fad and an integral part of the consumer experience.

Flurry paints a pretty picture. On one hand, they are not wrong. Yet, as a market, there is not yet full inundation that will support the entire ecosystem.

Hence, apps and their inventories have grown exponentially as well. Yet, as we have seen from other reports, even though users may download a lot of apps, they do not always use a lot of apps.

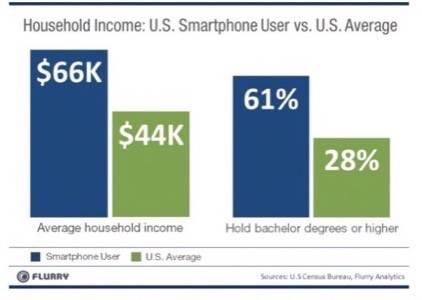

Flurry also notes that smartphone users have a higher average income and tend to hold more bachelor degrees (or higher) than the average American household. With mobile advertising expected to be a $1.1 billion market this year, certainly mobile ads are attractive to advertising firms.

“For mobile apps, less than four years into their growth cycle, a critical mass of highly attractive consumers has been achieved,” Flurry says in its report. “With growing awareness by brands and advertising agencies, we now expect digital advertising on mobile to take off in earnest.”

Yet, recall this report from research firm Nielsen a couple of weeks ago. Of all Android apps that users download, only the top 50 or so make up the vast majority (61%) of use. So, while inventory for all mobile applications has risen exponentially, only the real top-tier of apps are worth it to advertisers. Though we do not have specific numbers for iOS app usage, it is probably comparable to Android use.

Flurry paints a pretty picture. On one hand, they are not wrong. Mobile display ads are definitely an attractive option for advertisers and developers looking to make money on their content. Yet, as a market, there is not yet full inundation that will support the entire ecosystem. It still comes down to making a product that consumers will actually use. Total inventory is interesting, but advertisers go where the eyeballs actually are.