Last week, we looked at one of the latest reports from the investment research firm CB Insights, tracking the top venture capital firms across the U.S. in terms of their deal activity. According to that report, over the past year the top 30 firms participated in 663 unique deals (almost a quarter of all deals) with amounting to almost $9 billion in investment.

CB Insights has broken down these deals further to examine the trends in terms of deal flow by sector, and no surprise, investment in Internet technologies led the pack, comprising 36% of the deals and 26% of the dollars the top VC firms invested. (Healthcare was the number 2 sector for both the deal numbers and deal size.)

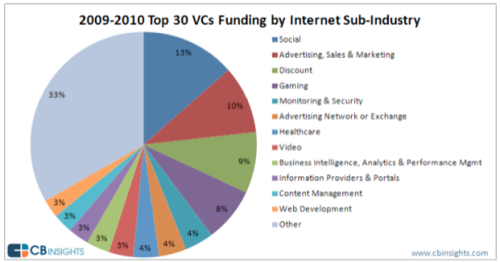

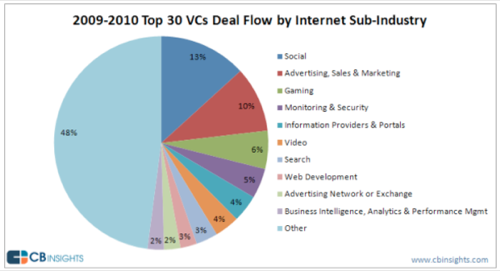

Within the Internet sector, there are numerous sub-industries where VCs invested – monitoring, security, web development, video. But despite this diversity, four of these sub-industries dominated, accounting for 40% of the funding from VC firms: social; advertising, sales and marketing; e-commerce; and gaming. Social, advertising, and gaming were the top three sub-industries in terms of deal flow as well.