Like RIM before it, this week’s DeathWatch victim is another looming casualty in the smartphone race. But despite its fall from grace, Nokia still has friends in high places. If CEO Stephen Elop can reorganize the company’s business fast enough and catch some lucky breaks from best-buddy Microsoft, it just may be able to stave off the inevitable. But time is running out.

The Basics

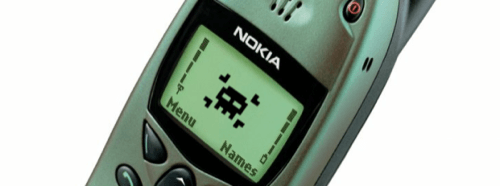

Nokia is a massive telecommunications company, headquartered in Finland. In 1987, it launched the Mobiria Cityman, one of the world’s first mobile phones, and helped launch the GSM standard that led to massive mobile adoption worldwide. By 1998, on the back of iconic models like the 5100 and 6100 series candy bar phones that flooded the U.S., Nokia was the world’s largest cell phone manufacturer, and it’s currently the 143rd largest company in the world, with more than 120,000 employees. In February, 2011, Nokia agreed to an extremely cozy deal with Microsoft in which Nokia would produce flagship Windows smartphones and combine mobile services on the devices. Nokia would offset its licensing costs by reducing its in-house development, and Microsoft incentives could net Nokia several billion dollars.

The Problem

Nokia is massive, but it’s also massively unprofitable. In its Q1 2012 filing, Nokia posted an operating loss of 1.3 billion euros (260 million euros non-IFRS, which ignores certain intangible expenses) created by a 26% drop in net sales from 10.4 billion euros in Q1 2011 to 7.4 billion euros this year, with negative margins in every area of the business. Particularly worrying is a 38% drop in smartphone sales, the highest growth and highest profit sector of the industry. Nokia says it has 4.9 billion euros in cash on hand, but analysts predict that money will be gone in just a year or two.

Nokia blames “greater than expected competitive challenges” for the problem, which translates to “Apple, Samsung and even HTC are eating our lunch.” iOS and especially Android are devouring the smartphone market, and like RIM’s Blackberry, Nokia’s Symbian-based smartphones haven’t kept up with consumer demand. (See Nokia Versus Android: Death by a Thousand Cuts.) For too long, Nokia also ignored the U.S. carriers, with the recently released, Windows-based Lumia devices as their first real push into the American smartphone market. (See The Nokia Lumia 900 Could Be Today’s Best Smartphone, But…)

On the low end, Nokia is struggling against Samsung, which recently stole the #1 overall spot Nokia had held for 14 years. And yesterday Nokia reported that it will cut 10,000 jobs worldwide, while today Moody’s downgraded Nokia stock to junk status.

The Players

When it announced the layoffs, Nokia also indicated that Chief Marketing Officer Jerri DeVard, Executive Vice President of Mobile Phones Mary McDowell and Executive Vice President of Markets Niklas Savander were leaving the company as well. In the wake of their departures, the one man running the show is clearly Stephen Elop.

Elop, whom ReadWriteWeb ranked as one of the five worst CEOs in technology in 2011, is defined by his previous job as the head of Microsoft’s business division. In 2011, we criticized his decision to place Nokia’s future in the hands of Windows Phone, but given how horribly Nokia has handled its own OS, Microsoft might be the only shot Nokia has. But the current Nokia-Microsoft relationship gives all the power to Microsoft, so don’t expect any earth-shaking leadership from Elop over the next year.

The Prognosis

Nokia is running out of money. While the current restructuring is a step in the right direction, the company needs its partnership with Microsoft to score some major wins while Nokia trims more staff and focuses on being a hardware company. Nokia certainly has the technical resources not just to survive, but actually thrive – but the fast-moving and hypercompetitive smartphone may not give the company the time it needs to retool.

Can This Company Be Saved?

Unlike RIM, Nokia has some truly cutting-edge, consumer-friendly hardware (including a 40MP camera in the 808 PureView that can provide lossless digital zoom and incredibly crisp smaller images through oversampling).

In the right hands, with the right operating system, Nokia’s technology could definitely find a market. A buyout would be ideal, both financially and organizationally, giving Nokia the resources needed to make drastic changes and consolidate further.

Unfortunately, the company’s biggest potential suitor has already balked. Microsoft apparently evaluated the company’s financials last year and declined, leaving Nokia to muddle through as a preferred supplier, rather than a full member of the team. If Nokia’s sticker price continues to drop, however, more buyers will emerge. Let’s hope Nokia has more than just patents to offer when they do.

The DeathWatch So Far

Research In Motion: no change in status

HP: No change in status