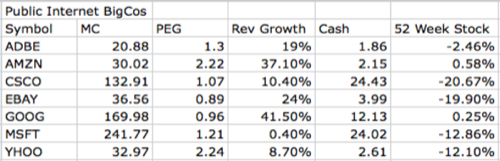

In this post we provide data that shows how public market investors see 7 of the Internet bigcos we listed in our current poll (repeated below). In particular this data provides some background insight into the the “sound and fury” surrounding Yahoo.

We looked at 7 Internet bigcos, chosen from the RWW poll list and with the addition of Cisco (per a suggestion from one commenter). This is a list of publicly traded companies. We have not included AOL – if we did we’d also have to include all of Time Warner, which makes them very far from an Internet company. We also can’t include Facebook, Mozilla or LinkedIn – as none are (currently) public companies.

The data comes from Yahoo Finance, as at July 8th around 10.30am. So results may vary when you check the numbers! Yahoo Finance happens to be what I use, no statement being made there.

Out of many potential parameters, this analysis focuses on 5:

1. Market Cap. This is a simple proxy of “bigness”.

2. PEG. This is Price Earnings Growth. This is a proxy for “value”.

3. Revenue Growth in last 12 months. Growth is the most prized parameter by investors. Revenue growth is less easy to “financially engineer” than profit growth, so it is a good proxy for basic growth.

4. Cash. This just says “staying power” and is prized during recessions.

5. 52 Week change in stock price. This ranks the companies by how happy their shareholders are. That matters, as Yahoo management can tell you (but as you can see, Yahoo is far from the worst on that ranking).

Here are the numbers, ranked alphabetically:

Here is the ranking based on each of the parameters:

A. Market Cap – bigness

- MSFT

- GOOG

- CSCO

- EBAY

- YHOO

- AMZN

- ADBE

B. PEG – value

- EBAY

- GOOG

- CSCO

- MSFT

- ADBE

- AMZN

- YHOO

C. Revenue Growth

- GOOG

- AMZN

- EBAY

- ADBE

- CSCO

- YHOO

- MSFT

D. Cash – staying power

- CSCO

- MSFT

- GOOG

- EBAY

- YHOO

- AMZN

- ADBE

E. Share price change – happy shareholders

- AMZN

- GOOG

- ADBE

- YHOO

- MSFT

- EBAY

- CSCO

Poll: Best Internet Bigco

So, given all of the above data, which do you now see as the most impressive Internet bigcos so far this year? Vote in the poll below (note: Cisco has now been added as an option):