ReadWriteDrive is an ongoing series covering the future of transportation.

It’s looking increasingly likely that we’ve reached peak car, the point at which overall automobile usage tops out. The U.S. and Europe appear to be at that point now; the rest of the world may follow within a decade.

You’d think that would spell trouble for the privately owned car—a future of waning use and perhaps eventual extinction. Think again. Peak car is the result of some major trends that look to marks the biggest change in automobile use since Henry Ford, as the car evolves from a huge piece of standalone hardware in a garage to a computerized network tool for the 21st century.

Auto Use Really Is Down

Peak car represents a major U-turn on thinking from just five years ago. That’s when transportation researchers forecast that the world was headed full-throttle towards global gridlock in the next 20 years, with the number of vehicles on global roads worldwide jumping from 1 billion to 2 billion.

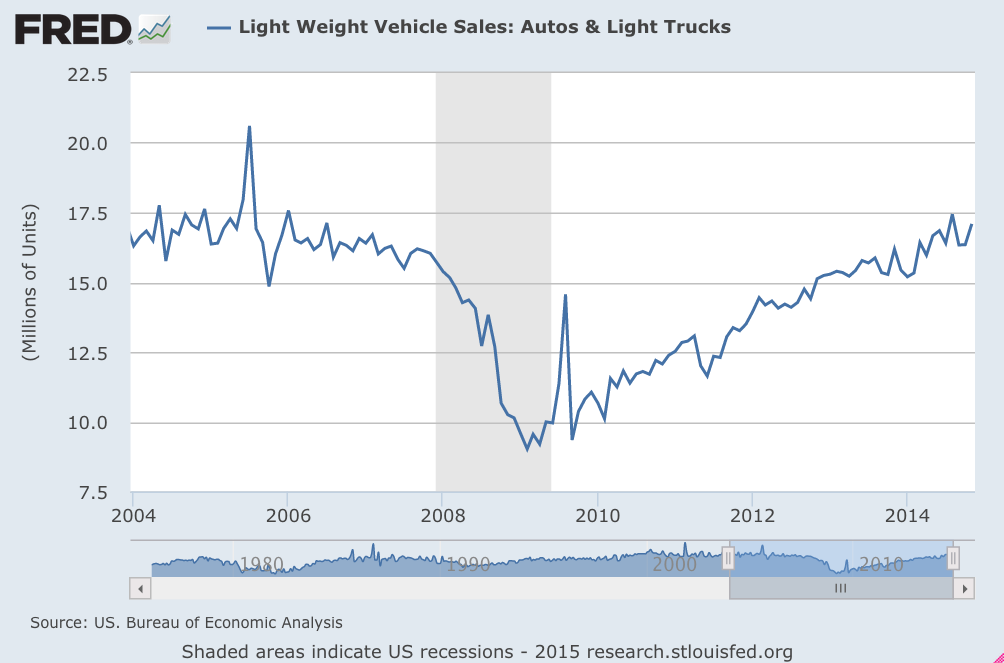

No longer. “We reached peak motorization [in the U.S.] around 2004,” says Michael Sivak, director of the Sustainable Worldwide Transportation group at the University of Michigan. The number of light-duty vehicle registrations in the U.S. stood at 236,448 in 2008; by 2010, it had dipped to 230,444. Total miles driven in the U.S. peaked in 2007. Similar trends hold in Europe.

Of course, other factors have depressed auto sales and use in recent years—most important, high oil prices and the Great Recession of 2007-2009 and the subsequent protracted recovery.

Sivak, however, argues that economic factors alone don’t explain the downturn in car ownership and usage, because U.S. declines in the number of cars owned per person and in households actually predate the Great Recession. As he told me: “Major contributors are increased telecommuting, increased use of public transportation, increased urbanization of the population, and young persons relying on electronic communication to replace some of their need for driving.”

As goes the U.S., this thinking suggests, so eventually goes the world. Though it might still take some time, given still-rising car adoption in Asia—especially China, already the biggest auto market in the world.

Why The Car Is Peaking

While not everyone agrees that Peak Car is here already, there’s a rough consensus among researchers that some major social and technological trends are converging to limit demand for new cars.

Susan Shaheen, a director of innovative mobility at UC Berkeley, suggests that today’s millennials are gravitating toward what she calls “shared mobility”—a term that encompasses cars, bikes and “rides” a la services like Uber or Lyft. Most of these services are only possible because of mobile apps, online vehicle reservations and “smart keys” that let people unlock and use vehicles scattered across a city instead of in often inconvenient central lots.

But she notes that other demographic factors are also at play. Over the past several years, for instance, Americans have started moving back to big cities in droves. That, in turn, increases the difficulty of driving, fueling, insuring and parking cars in increasingly congested urban environments.

Enter The Driverless Car

On top of all that, there’s potentially one more big game-changing technological development on the horizon: The self-driving car.

See also: Why Google’s Driverless Car Is Evil

Here’s how Sheehan sees the advent of cars that no longer require drivers:

Vehicles could eventually self-park and self-charge, provide first- and last-mile connectivity to public transit, and fill other gaps in the transportation network. As a result, the need for private vehicle ownership will likely decrease.

The fully autonomous car is still years away (if not longer) from hitting roads as a commercial vehicle. But automakers are already taking some major steps in that direction.

Many Ford models, for instance, already offer autonomous parallel parking. Later this year, the company will introduce cars that independently maneuver into empty spaces in a parking lot, Erich Merkle, Ford’s U.S. sales analyst, told me.

That’s not to say that big automakers embrace the notion of Peak Car. Far from it.

“The autonomous car changes the dynamics, because it allows you to be more productive while your car is in motion,” said Merkle. “It takes away your need to dedicate attention to the job of navigating your vehicle. You might have people putting more rather than fewer miles on a car.”

Merkle believes that the need for mobility is persistent. He said that in the United States, there are many places, especially in flyover states, where wide-open spaces make owning a car an economic necessity. It’s the means by which people get to work, run errands, and travel just about anywhere.

Even in cities, where millennials can hold off on buying a car while “living in studio apartments and clubbing it for a few years,” as Merkle puts it, the need for personal mobility returns with a vengeance when people settle down and start a family. “Never bet against procreation,” warned Merkle.

“Personal car ownership is not going away,” said Sheryl Connelly, Ford global consumer trend and futuring manager. “But it will be reinterpreted.”

Smart Cars Are Still Cars

As you might expect, automaker officials like Connelly see an ongoing need for mobility. “People need to be in cars,” she said.

At the same time, Ford recognizes that consumers expect to be connected all the time, even while traveling in a car. That’s why Ford was among the first car companies to offer Bluetooth connections for smartphones—at first, mostly to let drivers make and receive hands-free calls in their vehicles—even in economy cars and often as a standard feature.

Under the direction of chairman Bill Ford Jr., the automaker was also among the first to officially re-think its mission. No longer is Ford simply about selling hardware and software in the form an automobile; its mission now is to provide “mobility solutions.” It even just hired a chief data and analytics officer to “speed development of the mobility, connectivity and autonomous driving innovations that will improve people’s lives.”

Nearly every major carmaker is now thinking beyond cars to a range of connected mobility offerings.

Technology will most likely both decrease the need for personal vehicle ownership (see Uber) and make it easier to deal with congested roads. Cars and navigation tools are smart enough to warn you about traffic jams, or help you navigate around them.

“The midterm vision is vehicle-to-vehicle, and vehicle-to-infrastructure communications,” Connelly said. “But it’s still about cars, and how they move people from point A to point B.”

Lead image by Jakob Montrasio; LA freeway interchange photo by Neil Kremer