A year ago, Bill Ready was gunning for PayPal, bragging about how his company, Braintree Payments, was winning customers like TaskRabbit away from the eBay-owned payments giant.

Though Braintree was small, it was popular with mobile-app developers like Uber and HotelTonight—and he was using his edge with them to cook up a plan for a mobile wallet that could squeeze PayPal out of the world of mobile commerce.

Now Ready is working for PayPal, which bought his company last year for $800 million—and he’s putting his PayPal-killer plan to work making PayPal a killer product.

One Touch Payments: The Cure For “Mobile Flu”?

On Wednesday, Braintree announced the arrival of One Touch Payments, a service that lets any Braintree-powered app tap into credit cards a user has already stored with another app in the Braintree family.

Crucially, the family of One Touch-enabled apps include PayPal’s own mobile app, used by millions of users, most of whom have a credit or debit card stored with the service.

It will allow for swift mobile purchases without requiring users to create an account on an e-commerce site and enter credit-card details every time they want to buy something.

That cumbersome process is holding mobile commerce back, Ready believes. As usage shifts from desktop to mobile, e-commerce companies are experiencing what he calls “mobile flu.”

“More than half of the shopping is going on mobile, but it’s shopping not buying,” Ready says. “We think there’s a better authentication model than username and password.”

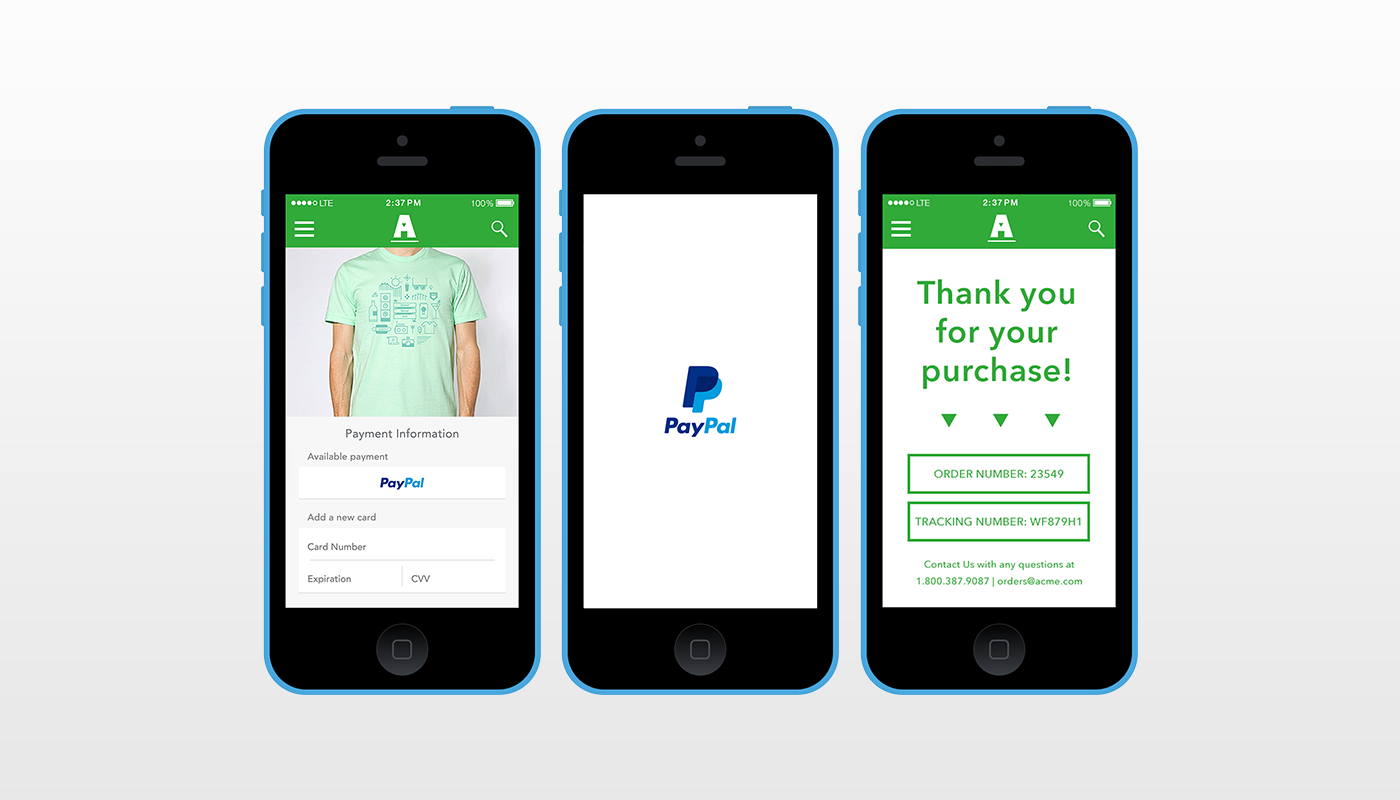

Here are some screenshots that show how One Touch works:

The program is starting out in beta testing now, but will be widely available in a month, Ready says.

Why Braintree Needed PayPal, Too

The inclusion of PayPal’s app will provide the critical mass for One Touch to have a chance for success—a problem which stymied Ready when Braintree was independent.

One Touch Payments began life as Venmo Touch, named after the person-to-person payment service Braintree bought in 2012. At the time, Ready’s strategy was to combine Venmo’s reach with consumers, who used its cash-sending features to split restaurant bills and chip in for gifts, with Braintree’s reach among developers.

Venmo would serve as the wallet that stored payment accounts and shared them from app to app, while Braintree’s software would let merchants tap into that wallet. Or one Braintree-powered app could just share a stored card with another app, with the user’s permission.

Ready faced a chicken-and-egg problem, though: Until enough consumers had Venmo or another Braintree app, developers wouldn’t be interested in playing along with the wallet scheme. And until enough apps worked with Venmo Touch, consumers wouldn’t see the point in allowing Braintree to store and share their cards from app to app. Ready’s one-touch payment dreams was stalled.

Along came PayPal, which was interested in Braintree for a host of reasons, particularly its reach among mobile developers.

After PayPal bought Braintree, Ready had the Venmo Touch retool the software to use either the PayPal or Venmo app as a wallet—and add PayPal itself, with its stored balance and PayPal Credit loans, as payment options.

Braintree also came up with new software for developers, the V.zero SDK, which supports One Touch Payments with minimal work by app builders. (If One Touch Payments is meant to simplify entering payment information for consumers, think of V.zero as doing something similar for developers adding payment features to their apps.)

One feature Ready’s particularly excited about is Braintree’s fraud detection, which he thinks will eliminate a lot of frustration with blocked payments. The current fraud model involves card networks declining a transaction, leaving both customer and merchant frustrated. Braintree’s software, when it detects strange activity, will quiz a user on his or her mobile device before the transaction is finished.

“Stealing Fire From The Mountain”

Even though Ready is part of a big company now, his heart is still with small software developers who wouldn’t be able to build features like fraud detection on their own.

“It wasn’t long ago that we were having conversations with Uber’s first engineer,” says Ready. (The on-demand transportation company is a longtime Braintree customer.) The ease of storing a credit card with Uber, and then being able to walk out of a car and have the ride paid for automatically, is a key part of the service’s success—and that’s part of the “magic” Ready wants to replicate with other mobile apps that sign up with Braintree.

Selling to PayPal was a key part of making his plan happen, he said, because he saw a narrow window of opportunity to seize the mobile market.

“I did look at this as stealing fire from on top the mountain to give it to the masses,” Ready says. “This moment in time is fleeting. Either we’re going to give power to the masses, or people are going to concentrate purchases with a few large retailers.”

There’s an irony there, of course: At eBay, Ready is now working for one of those large retailers.