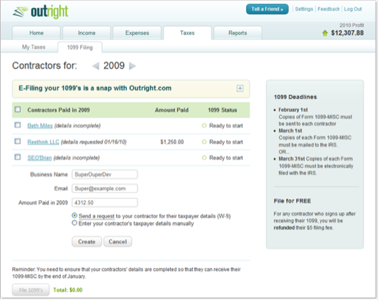

Just in time for tax season, online bookkeeping service Outright.com will begin providing a 1099 tax filing service for entrepreneurs and sole proprietors on top of its current W-9 service. The site is also launching what they say is the first community for the self-employed where startups and entrepreneurs can find bookkeepers.

For most of us, tax day is April 15, but for entrepreneurs required to meet the February 1 deadline for providing 1099 forms to contracted employees, the madness starts now.

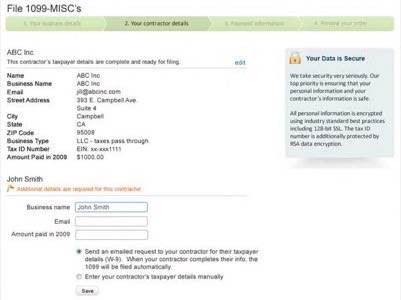

“Startups working with contractors should have collected form W-9 by now,” Outright’s Paul O’Brien told ReadWriteWeb. Using those W-9 forms from users and their contractors, the site does the rest – automatically filling out 1099’s, e-filing them with the IRS and sending copies directly to the contractors.

Starting tomorrow, the new 1099 service will cost users $5 per filing, though for each contractor that joins Outright after their 1099 is filed, the site will refund their $5 fee. The fee for the 1099 can be deducted as a business expense on the user’s personal tax return.

The site will also be rolling out a social directory to help connect entrepreneurs and startups with Outright’s expanding community of bookkeepers. O’Brien says that there are a few thousand bookkeeping professionals using Outright, and this new directory will help them find businesses who need help around tax season.

Outright claims it is tracking over $1.2 billion worth of self employed and startup business, an increase of 21% from just three months ago when it announced tracking $1 billion. Self-employed individuals make up 75% of Outright’s users, and the majority of the remainder employ fewer than 10 people.