Accounting software for small business and personal use is increasingly moving from the desktop to online. However, compared to other office software, this transition to online has been relatively slow. Partly that’s due to user reticence: writing a document online and sharing it with others (via Google Docs, Office Live, Zoho, or whatever you use) is one thing. Entering sensitive financial information into your browser is harder to adjust to.

There are also technical complications when using online accounting software. Different countries have different tax laws, dealing with multiple currencies is tricky, your software should be compatible with your accountant’s, and so on. We at RWW have had particular issues with multi-currency, as we’ll explain below.

So what is the state of online accounting software? In this post we’ll tell you about our awkward experiences trying out different packages. But we want to hear about your own experiences with online accounting software, because there is still much to learn about this market.

The Big Guns: Slow, Except Intuit

The existing market leaders in accounting software for SMB and personal use are desktop software vendors such as Intuit (with Quicken and QuickBooks) and MYOB. Relatively few of these have made solid moves towards web-based software.

One that has made moves to cover the threat of online software, is Intuit. It’s had QuickBooks online for some time now, for small businesses. In January this year it released Quicken Online, its consumer offering. With Quicken Online Intuit is competing fiercely on price, with a 60-day free trial and then from as little as $2.99 per month. It differentiates itself from startup competitors by either offering lower subscription cost or being advertising-free.

It’s hard to see Intuit not gaining majority market share of online accounting, given its resources and market leverage in traditional accounting software. Allen Stern of CenterNetworks had similar sentiments back in January.

A quick note about Google and Microsoft. We wrote a post end of last year called Online Accounting: The Next Killer App For Google Apps. 9 months later, still no sign of an online accounting app from Mountain View. As for Redmond, it too has seemingly little interest in this market.

Business Accounting: New Kids on the Block

Startups such as Freshbooks, Xero and Zoho are directly competing with the likes of Quicken, on purely accounting features – invoicing, payroll, expense tracking, etc. We have tested out several of these products and they all have impressive ‘web 2.0’ type designs, which make inputting data a pleasure (almost).

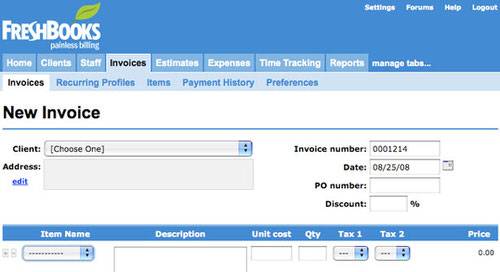

In this post we’ll focus on Freshbooks. It offers online invoicing, time tracking and expense tracking. It has a subscription business model similar to Basecamp (from $14 p/mth onwards) and claims to have over 400,000 users. In our tests it was easy to use and had a lot of nifty features, such as getting a view of your outstanding invoices at a glance. It also has integration with Basecamp (our preferred project management service here at RWW) and offers an API. Freshbooks has an active forum and a browse through its forum showed a very helpful staff.

Another neat feature, which we pointed out in an earlier post today called Four Ad-Free Ways that Mined Data Can Make Money, is that Freshbooks offers benchmark data by industry to its users – e.g. compared to other graphic designers, maybe you’re charging less and getting your invoices filled slower than most.

The only real downside we found was an inability to handle more than one currency per account. This is a major problem, but it’s one that almost every online accounting service shares. Even the desktop accounting software we’ve been testing recently failed when it came to multiple currencies (and/or usability of that feature).

Still, Freshbooks is a breath of fresh air to online accounting, if you’ll pardon the pun. We really want to be able to use it, so let’s hope multi-currency support isn’t too far away. Freshbooks has a number of supporters among friends of RWW, judging by the feedback we got via Twitter. Adam Metz proclaimed: “If you want to get paid on time, stay Fresh(books)”. steaprok quoth: “Freshbooks is great, have used them for sometime, no complaints at all”.

Other similar services

Another service worth mentioning here is Xero, a New Zealand based app that has actually done an IPO – on the local NZ sharemarket. In our tests a few months ago it had many useful features, similar to Freshbooks. However it is currently only available in New Zealand and it too can’t handle multiple currencies. Like Freshbooks, Xero promises support for this feature by end of the year.

Kiwi friends of RWW liked Xero. Sigurd Magnusson of CMS SilverStripe told us that his company uses “Xero, except are forced to use MYOB to deal with U.S. Dollars (e.g.our involvement with demconvention.com)”. Ben Young said that “I use Xero. Simply the best. Streamlines that part of the business for me whilst we are growing. Not location dependent…very handy”.

Also check out Zoho Invoice (which claims to support multiple currencies) and Cashboard, two relatively recent entrants to this space.

Personal Money Management Products

Over the past couple of years we’ve seen a number of impressive new entrants to accounting software – products such as Mint, Wesabe, Expensr (acquired by Strands in April), Geezeo and Rudder. These products are focused on personal financing, such as budgeting and bank accounts.

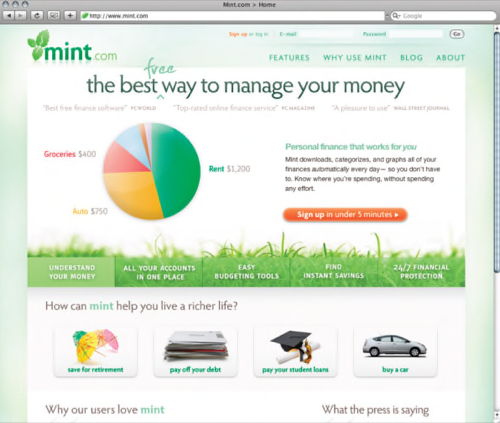

Mint has received a lot of press (some would say hype). Currently Mint.com claims to serve nearly 400,000 users, manages over $12 billion in transactions, and has saved $100 million+ for its users. It recently released a new design, which we reviewed on ReadWriteWeb. The new design focused on the major new features added to Mint since their launch: enhanced budgeting tools, the addition of brokerage and investment accounts, mortgage accounts, student loans, and auto loans. In addition, we wrote, Mint has added six new “how to” guides that can help you with your major financial decisions. These include things like saving for retirement, paying off your student loans, buying a car, creating a personal budget, and more. The guides are the start of a new educational series for the site.

Mint seems like a great solution for US people who want to manage their money online. The downsides are that it’s not international, there is no data import option (an important feature that many other online accounting packages have) and Mint doesn’t cater to people who don’t bank with large, national banking institutions.

This segment of the online accounting market – which is loosely termed ‘money management’ – is arguably the most exciting, because there are new software opportunities being explored. An example is moneyStrands, which we reviewed at the end of April. moneyStrands is employing recommendations technologies, such as enabling users to anonymously compare themselves to others with similar traits – e.g. demographics.

Conclusion

After all our testing, we’re almost ashamed to say that we’re still using custom spreadsheets to manage the accounts here at ReadWriteWeb. That’s because multiple currency support is critical to our business, but sadly lacking in many of the products we tested. We’ll check out Zoho Invoice though, as they claim to have implemented it.

Tell us in the comments if you’re using online accounting software to manage your business or personal finances. What ‘web 2.0’ features have you come across in these products that have particularly impressed you?

top image credit: quickenonline