ViVOtech may not be a household name like Google, Visa, MasterCard or even VeriFone, but it is a company at the forefront of the NFC industry. This software-and-systems company connects banks, retail stores and mobile phone providers who are offering NFC products and services to consumers. More recently, ViVOtech has been named by reporters as a partner in building Google’s upcoming mobile wallet service.

This is a post in a series on NFC here on ReadWriteMobile which will serve to get you up to speed on what NFC is, what notable developments are underway and what commercial programs using NFC will arrive this year. You can follow this series by clicking the tag (or bookmarking the tag) “NFC 2011.”

This post assumes you are familiar with the term NFC as well as the technology’s use in mobile payments. If you’re just starting to learn about NFC, you should begin here with the first post in the series to get caught up.

NFC to Revolutionize Shopping

To date, ViVOtech has shipped over 800,000 readers, 600,000 of which were in the U.S.. The company says it has a 70% market share in the NFC space. Its readers are found in locations that range from McDonald’s restaurants to drug stores and even taxi cabs. There’s a good chance that when you use NFC technology to make a payment at the point-of-sale, it will be on a ViVOtech reader. But CEO Mick Mullagh says, there’s more to NFC than simply being a credit card replacement technology.

“There’s a common assumption that NFC is all about payments,” he said, but insists it is much more. “It’s a technology that can influence purchase behavior in-store on near the store, including tapping on shelf tags. It will revolutionize the way people shop.”

Using NFC to shop involves NFC-enabled phones with access to things like payment cards and mobile coupons, plus over-the-air downloading of smart cards, bank cards and transit cards, all of which can be loaded onto a customer’s phone wirelessly. ViVOtech does the over-the-air (OTA) provisioning of branded and retailer cards, a key piece to any mobile payments/mobile wallet’s system’s backend.

An example of this OTA provisioning was demonstrated back in November 2009, when ViVOtech deployed its mobile wallet, its provisioning service and its readers in the Middle East, in partnership with consumer finance company Dubai First and du, a mobile operator in the UAE market. Dubai First MasterCard holders were able to download credit cards over-the-air to their supported handsets, and could then begin conducting transactions at any MasterCard PayPass merchant location.

If a similar solution was made available to U.S. users, in partnership with U.S. banks and mobile carriers, it could provide a way for users to quickly and easily create their personalized mobile wallets on their own NFC-equipped phones. Currently, the list of notable NFC-enabled handsets includes Google’s Nexus S (built with Samsung), Samsung’s Galaxy S II, Nokia’s Astound (aka the C7) and RIM’s forthcoming BlackBerry Bold devices.

Who’s Mobile Wallet Will We Use?

In a few months, you’ll be able to pay using those devices at a variety of locations, Mullagh promised. But who will be the mobile wallet provider? While Mullagh can’t comment specifically on the company’s deals, he said that ViVOtech is “enabling the Googles, the PayPals and the Amazons” of the world, as well as the banks and handset providers.

More accurately, ViVOtech may be enablingGoogle itself, it has been reported. According to Bloomberg, ViVOtech is involved with Google’s mobile wallet initiative, but the specifics surrounding that involvement are sparse at present.

However, ViVOtech’s vision for NFC matches up with Google’s vision for the future of search, as described by then-CEO Eric Schmidt last fall. Google searches will become automatic and autonomous, leading to “serendipitous” discovery of the world around you, Schmidt said.

How does NFC fit in with that vision? As Mullagh explains, your mobile phone knows who you are, where you are, what you’ve purchased in the past and can deliver you targeted real-time messages which are time-based, essentially personalized coupons based on your search or purchase history.

So for example, to recall a scene from the Tom Cruise movie “Minority Report,” instead of a virtual salesperson suggesting items to purchase as you enter a store, your phone will. A mobile coupon will arrive over-the-air to your device after you enter, and at checkout, you simply tap your phone to make your purchase and receive the discount. The merchant may also then send you another offer or add points to a loyalty card, if they so desired.

NFC can even extend itself to signage, posters, billboards and other merchandising and advertising mediums, allowing NFC phone owners to tap their phone to learn more, compare prices, read reviews, receive a coupon and more – much like barcode scanning does today, but with more elegance and simplicity.

Google, of course, would be a provider of such a system, while the software and services that make much of this possible would come from an NFC enabler like ViVOtech.

Does a future of real-time coupons personalized to you based on your shopping history creep you out? If so, not to worry. For those concerned with personal privacy, you’ll be glad to know that these sorts of systems will be opt-in only. At least that’s what Mullagh believes. It’s what needs to happen, he explains. M-commerce needs do a better job than e-commerce, the latter of which was ruined by spam email. The major players in the industry understand this, he said. They won’t spam your phone.

When Will NFC Really Arrive?

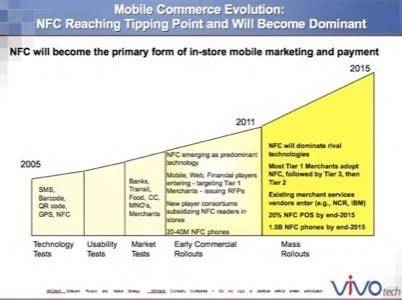

So when will we really have a mobile wallet we can actually use? Sometime in the next 6 months, says Mullagh. But it will be 2 to 3 years before we reach a point of full collaboration between all the players involved, including the banks, handset makers, operators, Web players, etc., he noted. In the short term, there will be some “interesting battles,” says Mullagh, but in the long run, everyone involved will likely move towards more interoperability.

For now, we can expect to see the first big wave of NFC devices making their way to market. NXP, the largest supplier of NFC ships, has projections for shipping 70 million NFC phones from all its suppliers in 2011. 20-40 million of those will wind up in consumers’ hands by year-end. And some subset of those will have mobile wallets, says Mullagh. Maybe as many as 20 million, but probably closer to the low tens of millions, he forecasts.

Will one of those wallet providers be Google? Certainly. Will ViVOtech be involved? No comment from Mullagh here, but it’s a likely yes.