In this latest installment in our series on recommendation engines, we look at MyBuys – a company purely focused on providing recommendations services to retail websites. We’ve noted in previous posts in this series that each recommendations vendor has a different approach. What distinguishes MyBuys is that it takes a services approach and is not based on a single algorithm. We spoke to Paul Rosenblum, VP Products & Strategy at MyBuys, who told us that most companies in the recommendations market have a “pet algorithm”. However MyBuys, according to Rosenblum, uses a variety of algorithms for different contexts and different kinds of retailers. “Fundamentally”, Rosenblum told ReadWriteWeb, “we don’t actually have a product […] we have a service”.

We started by asking Paul Rosenblum how MyBuys compares to some of the other recommendation companies we’ve profiled here on ReadWriteWeb lately. He replied that MyBuys is purely focused on retail recommendations, whereas some of the others don’t have such a narrow focus. For example, he said that half of Baynote’s business is in the corporate space. I pointed out that ATG is also focused on retail, but Rosenblum replied that ATG is more of a platform company – i.e. focused on e-commerce products that goes beyond just recommendations.

MyBuys’ Technology

The services approach means that MyBuys deploys a variety of algorithms and doesn’t favor one approach – unlike, for example, ATG, which uses a method it calls “Statistical Relational Learning” (SRL). This is really the crux of the difference between MyBuys and the other companies we’ve profiled so far. The likes of richrelevance, ATG and Baynote all have a defining technology (usually patented) which for each is the foundation of its recommendations approach.

MyBuys has no specific algorithmic approach. Rather it appears to license technologies from companies such as Blue Martini, BroadVision, MarketLive and Microsoft. However MyBuys does still have a patent on the technology which brings all these disparate algorithms together – it calls it a “patented portfolio of algorithms”.

MyBuys’ recommendations are a javascript include for their clients’ websites – i.e. the heavy lifting is done on MyBuys’ servers. Their clients can see their stats in a MyBuys portal, and also summary stats are emailed to the clients.

Understanding Consumers

MyBuys has a team of people that focuses on site performance for its retail clients. This team – which works across all of MyBuys’ client base – focuses on driving performance using a variety of tools and processes. They also do experiments for clients to find out what works best. Rosenblum noted that MyBuys is almost always paid on performance.

On its website, MyBuys says that it “creates deep consumer profiles based on both explicit information we collect from you and from shoppers when they sign up for alerts and implicit information we collect as shoppers interact with your site.” Rosenblum claims that MyBuys “understands consumers at a deep level”, whereas he said that its competitors don’t necessarily do. He told us that the Baynote approach is “strange” because they don’t focus on the individual, but rather the ‘wisdom of crowds’ (which he said is a ‘lowest common denominator’ approach). Further, Rosenblum claimed that many of MyBuys’ competitors don’t understand the product catalog, that they suffer from the “cold start” problem – i.e. with a new product there is no place to start, unless you know about consumer retail behavior.

Side note: we’re sure that MyBuys’ competitors would disagree with some of the above assertions, so we welcome feedback from them in the comments below. One thing we’ve found in this series is that each company in this space is very willing to talk down their competitors! A sign of a very competitive market.

Examples

On to examples of MyBuys’ approach. One is World Market, a retailer of furniture and other goods from around the world. It has a ‘May we recommend’ section on its homepage, which Rosenblum told us is based on MyBuys’ algorithms and what other people have done on the site. After the user hits the homepage, MyBuys tracks that user – they know where they came from, they pay attention to what the user clicks on next, and so on. On product pages, there are a variety of different recommendations on the right of the page under the heading ‘More great finds’. The categories under this heading can differ (e.g. for some products there may be no ‘featured’ recommendation).

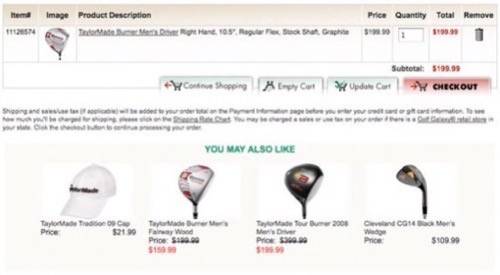

Another example is Golf Galaxy, a web retailer of golf gear. This has recommendations such as “Other great ideas” and “People also bought”. It also serves up recommendations in the shopping cart: “You may also like”.

MyBuys doesn’t just do website recommendations, it uses email a lot. If they know the email address of the customer, they will send follow-up emails (e.g. if a user abandons the shopping cart). Rosenblum told us that this works very well, however he assured us that emails are 100% opt-in. He said that for every dollar MyBuys drives through the site, another dollar comes through the email channel.

Conclusion

So how effective are MyBuys’ recommendations? According to the company, when recommendations engage consumers (i.e. a user clicks on a recommendation), they’re 5 times more likely to convert than when there are no recommendations. Rosenblum told us that its clients see an increase of overall site revenue between 5-20%, which is a similar figure to that which other recommendations vendors have given us. The addition of email usually results in even higher conversions, the company claims.

As to how MyBuys compares to its competitors, as we’ve noted in previous reviews it’s very difficult to make a judgment on that. However we’re interested to note that a recommendations vendor can compete well in this market without having its own unique patented algorithm. MyBuys pushes the ‘services’ approach much more than the other vendors. We’re sure that some of MyBuys’ claims about the competition would be challenged, nevertheless it appears to be a successful business in the retail recommendations market.