The mobile development ecosystem is a large, complicated space. There are innovative startups making tools for native and mobile Web apps along with large enterprise-grade companies that offer solutions from cloud support to frameworks and developer environments. For a mobile developer, it can be confusing to know where to turn and what to use to make the best app possible.

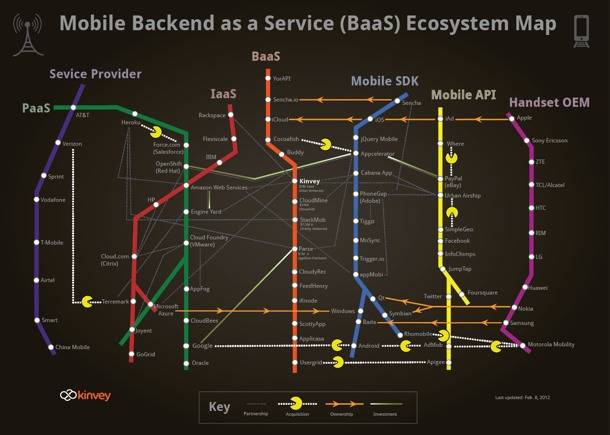

Mobile “backend-as-a-service” startup Kinvey created a map for ReadWriteMobile to help developers understand the ecosystem. Kinvey brackets the mobile ecosystem between two primary pillars: the service providers and the original equipment manufacturers. In between lies the meat of the environment from the “as-a-service” providers (platform, infrastructure and backend) to mobile software developer kit and application programming interface sources. Who has acquired what? What partnerships dominate the ecosystem? Use the map below as a resource when developing your next mobile app.

Mapping the Complicated Ecosystem

The original players in the mobility space were the OEMs and carriers. In 1998, there would have been next to nothing in between those two pillars on the map below. With the rise of the application ecosystem, the service structure for developers has grown rapidly as enterprises and entrepreneurs rush to meet the needs of developers.

“In the mobile world, the service providers and the handset OEMs were the original two players. With the transition to apps and services, all the other new layers have inserted themselves in between the original two players of the ecosystem,” said Kinvey CEO and co-founder Sravish Sridhar.

Kinvey places itself in the middle of the ecosystem. To its right are the PaaS and IaaS companies such as IBM and Rackspace, which are closer to the carriers than the OEMs. To its right are the mobile SDK and API providers, which have more in common with the OEMs.

“Slowly, major players have come into the space, and are now tunneling their way across the ecosystem through acquisitions or by launching new services themselves. For example, Google has been most proficient with an acquisition-led strategy,” Sridhar said. “Companies that are not acquiring are launching new services on their own. For example, Amazon Web Services started with IaaS and now have PaaS, and are growing out other mobile-specific services. Apart from developing Windows Phone, Microsoft is now improving Azure IaaS, and will soon have a robust PaaS platform.”

The goal of the BaaS providers is to bridge these worlds by bringing cloud infrastructure to developers and make it easy to integrate SDKs and APIs. It is not an easy task as it requires a knowledge of robust technical networks as well as the needs of front-end developers.

“As a leading Backend as a Service provider, we tie in IaaS, PaaS and Mobile APIs, and connect them right down to the Mobile SDK, so that millions of dynamic and rich apps can be easily built on any platform, bringing value to billions of users all over the world,” Sridhar said.

There is a lot of movement n the ecosystem, as the map shows. Appcelerator’s acquisition of Cocoafish is the latest example of one pillar moving to another. Kinvey has partnered with Urban Airship and talks with a variety of companies in other pillars, including appMobi. The company’s platform ties into a variety of cloud providers including Amazon Web Services, Rackspace and Microsoft Azure.

Click here for a larger map, hosted by Kinvey.

Kinvey, Competition and Consolidation

Boston-based Kinvey (a recent TechStars alum) is a unique startup in the mobile development world. Sridhar is very supportive of the ecosystem at large, including his primary competitors like Parse and StackMob. The idea is to see every company grow to the fullest of potential.

Sridhar often writes about startup and entrepreneur relationships. Kinvey does not attack its competitors or make edgy comments about how Kinvey may or may not be better than its rivals.

The first startup that Sridhar worked at was Austin-based United Devices, a company that focused on grid computing to manage high performance computing (HPC) infrastructures. From 2000 to 2005, grid computing was a hot vertical in the technology community with a variety of large and small companies entering the space. Sridhar noticed the ill affects of how sniping and holding negative opinions of the competition had on the ecosystem at large.

“A lot of this perspective came from my last startup. I was part of the founding team at United Devices and we were building grid computing software and a very similar thing happened at that company that is happening right now at Kinvey is that we thought we were doing something cool and unique and lo and behold, within about six to eight months, there were about 20 competitors,” Sridhar said.

“We got really paranoid about them and started talking about each other in the press in a negative fashion and started talking negatively about each other with customers and what happened is that I found that was doing more harm than good and the space took a while to develop. One of the reasons that grid computing, which was all the buzz between about 2001 and 2005, didn’t take off is that the whole ecosystem didn’t push it forward. We were waiting for the bigger companies to adopt it. My theory about creating this ecosystem called backend-as-a-service is that we should all work to collectively define it and make it successful.”

We wrote about the consolidation in the mobile services last summer when Urban Airship bought SimpleGeo, much to the surprise of the mobile developer community. When it comes to the BaaS players, some of the first startups are starting to get acquired, like Cocoafish by Appcelerator. When it comes to Kinvey, StackMob and Parse, each has a tie to a major company that may be interested in acquiring it within the next few years. Of those three, each has created a niche for itself to the point where it could grow to be fairly large and stave off acquisition as well. It behooves the companies in the space to help each other grow at this point.

That is in stark contrast to another emerging segment of the developer ecosystem that has emerged with the app economy. Mobile analytics is a high-growth area with companies large and small growing rapidly and looking for developer and media attention. Whereas there is very little bad blood between Kinvey, Parse and StackMob, mobile analytics startups like Kontagent, Apasalar, Flurry, Localytics and others hate to see one company mentioned and not their own (this plays out in my inbox on a daily basis).

Developers: What services are you using to create a backend infrastructure for your app? What do you think about the startup competition in the space vis-a-vis larger cloud providers or in juxtaposition with the mobile analytics space? Let us know in the comments.

Top Image Courtesy Shutterstock