We’ve all been there: You’re making the last purchase of a long day of shopping and the clerk tells you that your card has been declined. Only hours later (and perhaps after embarrassingly arguing with the clerk that you surely have money in your account) do you find out that the bank cut off your account because it suspected fraud.

Situations like this point to the obvious need for a better line of communication between you and the people in charge of handling your money. ClairMail, a mobile banking and payment solutions company, has announced a new mobile fraud management solution that would make this situation obsolete.

The situation described above is just one of many situations where a whole lot of hassle, and hours on the phone with confusing, automated menus, could be avoided if your bank could quickly just say “Hey, we see a suspicious charge – was it you?”

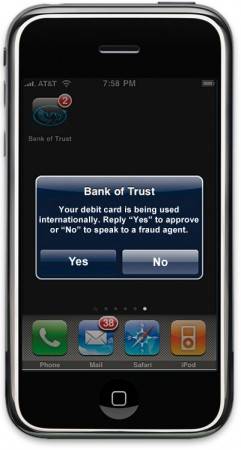

That’s exactly what ClairMail’s “Fraud Solution” does. “Mobile banking has largely been viewed as an extension of online banking,” explains the company in its press release. By using a system like ClairMail’s Fraud Solution, however, banks can “reduce servicing and risk management costs, enhance customer loyalty and acquisition and increase mobile banking adoption.”

A recent study by analyst firm Forrester examined exactly this problem, noting that in order to continue seeing growth in mobile banking, banks would need to “enhance today’s functionality significantly.”

“While more consumers are adopting mobile banking, the full value of the mobile channel has yet to be realized,” said ClairMail CEO Pete Daffern. “Enabling consumers to monitor, respond and resolve fraudulent transactions on their mobile device not only deepens the relational trust between that customer and their bank, it reduces costs for everyone by reducing false positives and minimizing the cost and time of fraud resolution.”