San Franciso-based Kiva.org, a microfinance non-profit organization founded in 2005, is one of the best success stories of the charitable web. We first profiled it back in January. In just 2 years, the site has funded nearly 17,000 loans to entrepreneurs in developing countries, and last week the total amount of those loans crossed the $11 million mark.

In late March, 2005 Elizabeth Omalla, a woman from the town of Tororo in Uganda, received the first Kiva.org loan for $500 to help expand her burgeoning fish selling business. Shortly there after 6 other entrepreneurs in developing nations received loans from the site, in total worth $2,150. By September of that year, all seven initial microloan recipients had repaid their loans and Kiva.org was launched to the public. The company incorporated as a 501(c)(3) non-profit organization in November, 2005.

Within a few weeks of the site opening, founder Matt Flannery left his job at TiVo to work on the project full-time; later he would be joined by Permal Shah, who was the principal product manager at PayPal. Kiva.org reached the $1 million funded mark in just over a year after launching the site. The next million would be a bit easier coming a single month later.

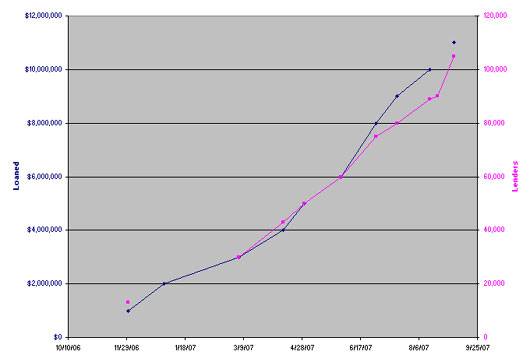

Kiva.org growth chart from Kivapedia.

Kiva.org has now funded almost 17,000 loans by over 110,000 lenders. The average size of each loan is $649.63 and the repayment rate is a very impressive 99.59%.

The site works with 64 different microfinance organizations (field partners) in 37 countries around the world. The field partners locate entrepreneurs in developing nations who are in need of small business loans (usually under $1000) and then upload the loan information to the Kiva.org site where users group together to fund the loans as a crowd. Lenders can lend as little as $25 and all transactions are handled by PayPal. PayPal provides Kiva.org with payment processing free of its usual charges — Kiva.org is the only site that PayPal does this for.

When a loan is funded, the managing microfinance field partner is wired the money and handles doling out the cash and reporting back on the progress of the entrepreneur who received it. After the loan is repaid, lenders have the option of reloaning their money or withdrawing it back to their accounts.

Unlike other person-to-person lending startups, such as Prosper or Zopa, Kiva.org does not charge interest on their loans and lenders do not stand to make any money. But unlike giving to charity, there is a good chance you’ll get your money back. Participating in Kiva.org’s microloan program lets lenders help people in the developing world with the expectation of getting their money back, and given their minuscule default rate, Kiva.org loans are very low-risk. This is an appealing alternative to straight donations for many people.

Kiva.org has already had a very big year, funding about $9 million worth of loans so far, and having been featured in the Wall Street Journal, on ABC News, CNN, the New York Times, and Oprah Winfrey’s television show. Last June, after being featured in a piece on ABC World News Tonight, Kiva.org received 1,000 new members and $100,000 in new loans overnight. Their history is littered with success stories like that, indicating the idea really resonates with people.