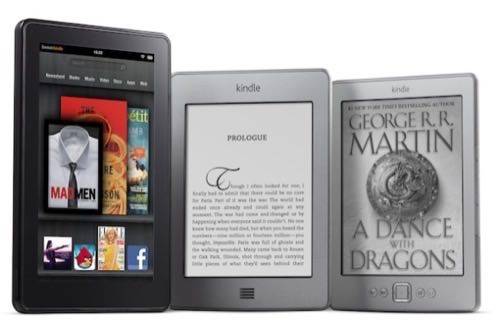

Amazon announced today that the new range of Kindles is coming to over 16,000 U.S. retail stores. The usual big-box and medium-box outlets will carry Amazon’s whole family of media devices.

The basic new Kindle – which sells for $79 with ads and $109 without – has been available in stores since just after launch on September 28. Now the $99/139 Kindle Touch and the $199 Kindle Fire tablet will appear on physical shelves.

Boxing Out The Nook

The announcement was timed for the day after Barnes & Noble revealed its new Nook Tablet, an upgrade and rebranding of its Nook Color with boosted specs and a nice $249 price point ($50 more than the Kindle Fire).

Barnes & Noble has 705 stores of its own and operates 636 more college bookstores. The special stores get their own sales nook for Nooks. With the holidays approaching, Amazon and B&N are jockeying to sell their new readers by putting them directly into consumers’ hands.

Amazon’s Scale Advantage

Barnes & Noble may have more control over its in-person retail experience than Amazon does, but Amazon is bigger in several key ways. Its Android app marketplace is broader, for one thing. But it’s Amazon’s massive cloud computing scale that gives it the real edge. Amazon is able to accelerate its Silk Web browser and stream Amazon Prime video to the Kindle Fire thanks to its scale. It can also offer high-bandwidth, digital-only services like a lending library for the Kindle.

Barnes & Noble’s only response to that is that the cloud is “unreliable.” If B&N turns out to be right about that, the Nook’s bigger internal storage will turn out to be an advantage. But it will be a hard sell to consumers that all Amazon’s on-demand content is actually a disadvantage.

Amazon’s move to bring the Kindles into 16,000 physical stores will give it some brick-and-mortar scale as well. Then the Kindles and the Nooks will only have features left on which to compete.

Remaking Retail

Amazon is doing things the old-fashioned way by putting the Kindles on retail shelves, but it has always been aggressive towards brick-and-mortar stores. Other recent developments at Amazon don’t look kindly on the retail experience.

Last week, it launched Amazon Flow for iPhone, an free, augmented-reality shopping app that scans products and finds them on Amazon.com. When the Amazon price is lower than the in-store price, which are consumers going to choose?

Amazon’s retail interests are best served by temporary partnerships like the ones announced today. To sell a new device in the traditional shopping season, and to compete with the last brick-and-mortar media giants left, Amazon will put Kindles into big-box stores.

But the whole line of new devices is built around digital-only media. Amazon’s push in physical retail is only to sell a device that will keep its ideal customer from buying a CD at Best Buy – or a book at Barnes & Noble – ever again.

Are you buying a new tablet this holiday season? Which one appeals to you and why?