Next in our

series on international Web markets is Japan. The information for this post was provided

by Benjamin Joffe (CEO of Plus Eight Star Ltd) and

Masashi Kobayashi (partner of Globis Capital Partners – one of

the largest Venture Capital firms in Japan). We start off with an overview of the market,

then list the main web companies in Japan. There is some extra commentary after that on

why mobile dominates in Japan, the state of online advertising in Japan and its IPO

market. There’s something for everyone here! Thank you Benjamin and Masashi for the

comprehensive and very interesting information about Japan’s Web.

Overview

Benjamin: Japan today enjoys not only the fastest but also the

cheapest broadband infrastructure in the world, with over 20 million households

connected to broadband (out of 46 million). Yahoo! Japan, through its Yahoo! BB service,

is among the largest providers with over 5M users. You can get 8M to 50M ADSL for prices

between $20 to $45 a month, and 100M fiber optics for a $200 set-up fee and $30 monthly

fee. There goes the myth of ‘Japan does not have the Internet’!

Masashi: As a result of the aggressive entry by Softbank BB (aka Yahoo! BB),

Japan today enjoys a very cheap and very high-speed Internet infrastructure. In addition,

on the mobile side there is a very large diffusion of 3G and 3.5G feature-rich handsets

and a solid wireless infrastructure. One thing to point out is that even with the growing

usage of video-based services like Youtube, or movie content, there is not much stress on

the network. In March 2006, more than 2 million Japanese and 5.2% of Internet users used

Youtube! (ref).

Benjamin: Japan is 1.5 years ahead of US in mobile? It is difficult to

come up with an estimate, but the market maturity goes way beyond simply: “do they have

more 3G users?”. Here are some data points:

- Over 50% of the 90+ million Japanese mobile phone users have 3G (W-CDMA, CDMA 1x or

CDMA EV-DO) - 85% have a mobile data connection for mobile email and over half of this number use

mobile services *regularly*

A lot of people in Japan buy not only digital (music, games, videos) but “real” or

“offline” goods on their mobile. They use auction services, blogs and use assisted-GPS

powered navigation services to walk the city. And they have been doing so for already 2-3

years, at least. Market maturity is not only about getting a device in people’s hand, it

is also about the service offering and the actual usage rate. Same for Internet: you can

have a great infra with high-speed and no innovation.

Top Web 2.0 companies

Masashi: Unlike Silicon Valley, there are only a few high-quality services in

Japan. The main reason for this is that there are only a handful of high-quality

entrepreneurs. When magazines publish articles about Web 2.0 in Japan, Mixi, GREE, Hatena

and Drecom appear all the time, but there is little mention of anyone else.

MIXI

Benjamin: Japan’s largest SNS is named MIXI and

has gone last week (Sept 18) onto the Japanese Mothers stock market. Its market cap

reached 109 billion yen (US$930m), which makes the IPO the seventh-largest on the Mothers

market. Its CEO Kenji Kasahara (30 y.o.) set up Mixi in June 1999 when he was a

third-year student at the University of Tokyo. The company initially operated a

recruitment advertising Web site and launched a social networking service in February

2004. In the year ended March, Mixi posted a pretax profit of 900 million yen (US$7.5m)

on sales of 1.8 billion yen (US$15m). A large part of the revenue comes from advertising.

Mixi’s membership totaled 5.7 million as of Thursday. About 70 percent are those in their

20s and younger.

Masashi: The company whose development is the most interesting is probably

Mixi. Mixi is Japan’s leading SNS service. Its number of pageviews is second only to

Yahoo! Japan. In September this year, Mixi IPOed and is valued currently at 200 billion

JPY ($1.7 billion). With its profits rising rapidly, Mixi has become the flagship of Web

2.0 businesses. There is good information about Mixi here (English

PDF).

GREE

Benjamin:GREE is Japan’s second largest social

network (founded in February 2004). Japan’s second largest operator, KDDI, invested $31

million in July 2006 to develop a mobile version – marking its entry in the

“mobile community age”.

YAHOO! DAYS

Benjamin: The third major site is operated by Yahoo! Japan (under control of

the holding company Softbank) and is named Yahoo!

Days, roughly based on Yahoo! 360. More is expected to develop, as Softbank bought

out Vodafone’s operations in Japan and got control of its 15 million mobile phone

subscribers.

Masashi: In Japan, Web 2.0 services introduced by Yahoo! Japan are not doing so

well – many of the key Yahoo engineers have moved to Hatena, GREE and other companies

In addition, Google’s presence in Japan is very weak. Yahoo! Japan controls 20-30% of

the search market – the rest belonging to a variety of local players. Though Adwords and

Adsense are widely used, other Google services have few users and little recognition.

Interestingly, quite a few Japanese startups are hoping to build Web 2.0 businesses like

Google.

HATENA

Benjamin:Hatena is a blog and social

bookmarking service, quite similar to del.icio.us.

Masashi: Hatena Bookmarks has grown to be Japan’s largest Social Bookmarking

service. It has diversified into other services, such as Hatena Diary (Blog service).

Overall, Hatena is a service more directed to the IT-literate.

EC Navi

Masashi:EC Navi is the second largest price

comparison engine after Kakaku.com (“price.com”). Thanks to its automatic price

collection, it now has Japan’s largest number of registered goods. With the recent

opening of the EC Navi Lab, the site has started to offer Web 2.0 features like social

bookmarking and cooperating with other existing price comparison sites. A majority of its

users are girls and young women.

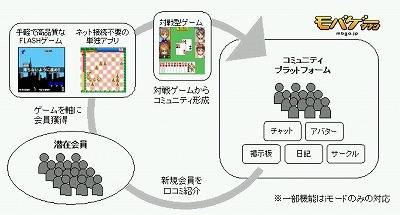

DeNA

Masashi: While DeNA is the third ranking

auction site, its mobile service which opened a few years back has achieved a tremendous

success. Its quick gathering of users had a lot to do with its cooperation with the

mobile affiliation site Pocket Affiliate. Riding on the success of its mobile auction

site, its new site “Mobile Game Town” is growing rapidly. Offering free casual game

including SNS elements, this new type of community site has grasped the interest of young

users. Revenues come from the huge traffic and advertising revenues from affiliate

networks. The “Mobile Game Town” service started in February 2006 and in 156 days (July)

achieved 1 million users. This service targeting students and housewives has three points

of interest:

(1) High quality mobile games with avatar, diary, BBS (forums)

(2) Fast growth as an all-free content site The most distinctive feature of the mobile

community site is the ability to post to the diary and forums, with the same ease as when

sending regular emoticons-rich mobile emails (Japan more or less dropped SMS in favor of

rich mobile email in early 2000). With this ability to post anytime and from anywhere,

users can react and see reactions from others at a much faster pace than when using a

computer. In addition, the use of avatars increases the capacity to show emotions in

messages. Service usage increases through word-of-mouth and its current monthly pageviews

averages 1.5 billion per month (about 52 million daily PV).

(3) The site is today the largest mobile community site in Japan.

Note: Japan’s mobile advertising market is growing at a fast pace through affiliate

marketing.

OTHERS

Benjamin:Startforce is a kind of

“start page” service. Kizasi is a Technorati lookalike,

showing what are the current hot topics in the bloggers community through a keyword

ranking and an original chart – very easy to read. Hyakushiki is a social bookmarking service with a

focus on hobbies and technology.

Why does Mobile dominate in Japan?

Benjamin: Why is there so much mobile action and so little on [PC-based]

Internet in Japan? People do not have Internet in their DNA here and I don’t buy the

cultural explanations.

I think this situation has a lot has to do with:

- Difficulty to get users to pay/monetize Internet services vs. clear payment systems

and good revenue sharing with operators on mobile - Possible lack of exposure to foreign innovative services, due to weak English skills

and self-supporting local market (Japan is the world’s second largest economy, after

all). - Recent financial scandal with Japan’s #2 portal site Livedoor creating a bad karma

around Internet entrepreneurs.

Strong online advertising market

Masashi: Japan has the world’s second largest GDP and its advertising market is

maturing into a very large one. As the Internet is shifting into a primary advertising

market, ad revenues for Internet companies are growing. On contrast to the US – and due

to the limited number of large Internet players in Japan – a large share of online

advertising goes to the dominant player Yahoo! Japan (a JV between Softbank and Yahoo! US

and managed locally). Hence, the rise of advertising revenues of recent SNS services like

Mixi and Gree has more to do with a lack of destinations for online

advertising.

IPO Market is hot

Masashi: IPOs from Internet-related companies are now coming, one after the

other, with a PER often getting over 100. Expectations are huge in the case of such a

famous service as Mixi – and the valuation has gone sky-high. The emerging individual

investors market in Japan is also supporting this economic comeback.

In Japan, shares reach on average twice the price of the offering after the IPO. As a

result, IPOs are a popular bet for private investors.

This second generation of entrepreneurs, who cashed stocks from the first wave of

Internet companies, are very professional. As an example, GREE was created by former

Rakuten executives.

The good shape of the IPO market stimulates in turn the Venture Capital industry, with

large Japanese players like JAFCO investing with high company valuations. JAFCO (largest

Japanese VC) set up last year a 100 billion JPY ($850 million) fund, while NIF SMBC (2nd

largest) created this year a 60 billion JPY ($510 million) fund. Due to the size of those

funds and the scarcity of valuable investment targets, the oversupply leads to pushing to

high valuations.

Summary

My thanks again to Benjamin and Masashi, who have provided us with a great overview of

the Japan Web market and its top apps. As always, there will be apps that we haven’t

covered, so I encourage you to add them to the comments. Also we’d love to hear your

views of the Japanese Web industry, if you’re familiar with it. And feel free to ask

questions in the comments, as perhaps someone from Japan will answer it.

This post is part of Read/WriteWeb’s continuing coverage of international Web markets.

Other countries profiled so far have been Germany, Holland, Poland, Korea, United Kingdom, Russia, Spain, China, Turkey, Italy, Brazil and France.