A lot of things happened in 2007 that seemed to threaten Apple’s stranglehold on the digital music market. Microsoft launched its new Zune MP3 players, which received mostly glowing reviews, and they kept their installed user base happy with major firmware updates for old players. Meanwhile, Amazon launched a major DRM-free MP3 download service at a cut-rate (compared to Apple’s). But generally, the facts still point to Apple dominance for awhile to come.

Why it Looks Like Apple Should Sweat

Yesterday, we heard that Warner Music Group had teamed up with Amazon to offer its entire catalog DRM-free. They joined Universal music and EMI music, as well as 33,000 independent labels in pushing Amazon’s catalog to 2.9 million tracks. That’s still well short of Apple’s 6 million or so tracks offered via iTunes, but Apple’s DRM-free selection comes only from EMI. Warner and Universal have chosen so far to deal just with Amazon.

Amazon is starting to feel like a real threat to Apple’s monopoly on the music download biz. They seem to have the cooperation of the music industry in offering DRM-free tracks, and their lower pricing (generally $.89-.99 per track) already forced Apple to lower its own DRM-free prices earlier this year.

Further, Amazon’s MP3 store soft launched in September and has had little advertising. So far it has gained about a 3% share of the total market (more according to other reports) — measly compared to Apple’s iTunes — but in just over a month, Amazon and Pepsi are planning a large Superbowl promotion to give away 1 billion free songs via the service. According to Billboard, when Pepsi offered 100 million free tracks via iTunes in 2004, just 5 million were ultimately redeemed over the 5 month promotion period. But since then, digital music has grown 416%, so it’s a safe bet tht this promotion will be more successful. Could the Superbowl be a coming out party for Amazon in the music download business?

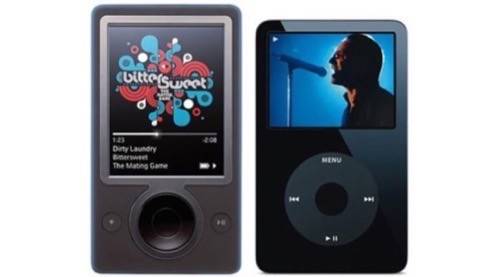

Additionally, Apple faces more competition in the digital media player market. Microsoft’s Zune.net web site reportedly saw a 299% jump in traffic on Christmas day. Granted, Apple’s iTune’s store page still received 6 times the traffic, but the Zune.net numbers might be indicative of a strong holiday season for Microsoft’s player.

Apple’s iPod line still holds about a 70% market share (March), but that is down from over 90% just a couple of years ago. Better offerings from Microsoft, Sandisk, and other competitors are certainly putting a dent in the iPod’s commanding position in the MP3 player market, albeit a small one.

Why Apple Will Continue to Rule the Digital Music Landscape

Even though it looks like a confluence of recent events is finally pointing to a weakening in Apple’s digial music strangehold, the reality is that there still remains a long, long uphill battle for Amazon, Microsoft, and the rest. Further, in order to really take down Apple, both Amazon and Microsoft (or Sandisk, Creative, etc.) need to succeed. Apple has opened two fronts in this battle, iTunes and iPod, and in order to take them down, you have to beat them on both.

Too many people are already ingrained in the iTunes+iPod experience, and for many of them, DRM doesn’t matter. They buy tracks on iTunes and put them on their iPods. As long as iPods control the player market, iTunes will control the download market. And let’s not forget that Apple sells about 2 million DRM-free tracks of its own, so it has hardly sat on the sidelines while competitors have added copy protection-less tracks to their offerings.

Until the music player market shifts dramatically away from iPod dominance, DRM-free tracks will generally matter less to the majority of the MP3-buying public, who just won’t be affected since they are using iPods. Once that happens, though, then all things being equal selection-wise (i.e., assuming the major labels working with Amazon eventually work with Apple as well to sell DRM-free tracks) and price-wise (which it is already), it likely comes down to buying experience.

The most intriguing prospect for that shift? The potential for an Amazon digital media player. Amazon began selling hardware late in 2007 with the release of the Kindle e-book reader, so perhaps an Amazon media player isn’t so far-fetched. It would replicate the vertical integration of the iPod and iTunes store that has been a major part of Apple’s rise to control over the industry.

Then again, as TheStreet.com points out, “with iPod satisfaction rates running at over a staggering 90%, and competitors like Microsoft failing to dent its market share, an Amazon-made device would likely struggle to dislodge Apple.”

Conclusion

Eventually, Apple might lose some of its grip on the music download and media player industry. But while Amazon and Microsoft take baby steps in competing with Apple, the Cupertino, CA-based company is not standing still. Microsoft made positive changes to its Zune, but Apple released the iPod Touch (and updated the rest of the iPod line), plus signed distribution deals with Starbucks to deliver iTunes tracks over wifi in-store. Amazon signed two more major labels onto its MP3 download store, but Apple is already expanding into video rentals (i.e., onto Amazon’s turf to compete with their Unbox service).

It seems likely that Apple’s dominating position over the music download and media player markets will continue for at least a few years. What do you think? Is there and end to the iPod/iTunes monopoly in sight? Does Amazon, Microsoft, or some other company have what it takes to take on Apple? Let us know in the comments.