We’ve been taking a look recently into the troubles at online auction and ecommerce giant eBay. Ten days ago we took a look at reasons why many sellers are leaving eBay, and yesterday we covered an Australian ruling that barred the company from forcing sellers to use PayPal as their only online transaction method. Despite the problems the company is facing, their total listing numbers appear to be on the rise. But could they be artificially inflating that number?

Year over year, the number of auction listings at eBay are up according to independent tracking firm MedVed.net. But there is evidence that the listings numbers over the past month or two are being artificially boosted by eBay’s recent partnership with Buy.com.

Buy.com, a traditional fixed-price online retailer in the vein of Amazon, signed a listing deal with eBay in May. The terms of the deal have not been disclosed, but Buy.com is generally listing around 500,000 items on the site at once — or are they? Sellers on eBay’s forums discovered that a number of the company’s listings appear to be empty.

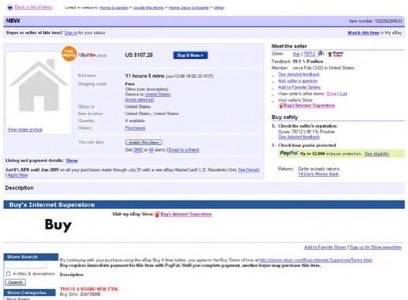

The listings appear in searches labeled as just “NEW.” Clicking through displays listings pages that inform users they are bidding on “a brand new item,” with no indication of what that item actually is.

This is important for two reasons. First, because it means that Buy.com is being given preferential treatment over individual sellers — who would not be allowed to create empty listings to flood category search results with their brand. Sellers in the areas were Buy.com sells are feeling increasing competitive pressure — and this indicates that the playing field is not level. As the auction-watching blog AuctionBytes indicates, that goes against what former eBay CEO Meg Whitman promised sellers.

The second reason this matters is that the number of new listings on the site is a key metric that eBay reports to shareholders in their financial reports. If those numbers are being artificially inflated with empty listings it could indicate that information being fed to investors is not accurate.