Last quarter, Apple’s profits were sagging. But Tim Cook still managed to smirk about it—and we’re about to know why. The company that redefined consumer technology altogether now needs some elbow room. Apple’s iPhone dominates in the U.S. and Europe, but markets elsewhere are a different story, a story with plenty of room for a plot twist.

With the announcement of the iPhone 5S and iPhone 5C, a plot twist of epic (or shall we say global?) proportion is in order. Here’s how.

Why Does The iPhone 5C Exist At All?

Apple’s iPhone 5C is a bright, candy-colored version of its popular iPhone that starts at $99. It differs from the premium model (the iPhone 5S) in that it is mostly made of plastic. The iPhone 5S is the new premium model, retailing for Apple’s normal starting price of $199.

Though it’s the first time that Apple will launch a second tier of iPhone (it usually just points budget-minded customers to its last model), the iPhone 5C was widely expected to be priced even lower than its $99 starting price. Still, Apple has high expectations for the colorful device in Asian markets, particularly China and Japan, which will see their first day-one iPhone launch in history. The company has yet to announce pricing in Asia.

Still, the iPhone 5C remains a puzzle. But maybe it’s just as simple a reason as cutting costs and boosting profits? Assuming the iPhone 5C costs less than the iPhone 5 or 5S to produce, Apple’s markup on the phone could rake in more cash than the company nets from its tier of non-plastic iPhones. If Apple were to have kept the iPhone 5 in circulation, it would likely have given it the last-generation treatment and dropped the starting price by $100, down to $99.

With its plastic body, the iPhone 5C’s components would cost considerably less than a metal-and-glass iPhone 5… and yet, the $99 price tag remains. Without a proper teardown, it’s impossible to know what the iPhone 5C costs to build, but Apple’s considerable shift in strategy seems to point to a higher markup.

Why not just keep the iPhone 5 and sell the heck out of it in Asia? Well, no one gets excited over an old phone, even if it’s a nice one. If Apple really wants to push the 5C in Asia, China specifically, hyping it up as a different (and not lesser) tier of iPhone isn’t a bad idea.

Apple’s Asia Opportunity Is Massive

It’s no coincidence that Apple will host an iPhone launch event in China for the first time. Apple is making an aggressive move on the Asian market—and with good reason. For the first time, Apple’s new iPhones (this time it’s a pair) will launch in China, Japan and Singapore on September 20, the same date as its major U.S. launch. Usually Asian customers are left in the lurch while Apple works out the kinks of an Asia launch.

The U.S. likes to think of itself as number one in plenty of respects—but as far as smartphones go, the nation is small potatoes. China is the world’s biggest smartphone market, far and away.

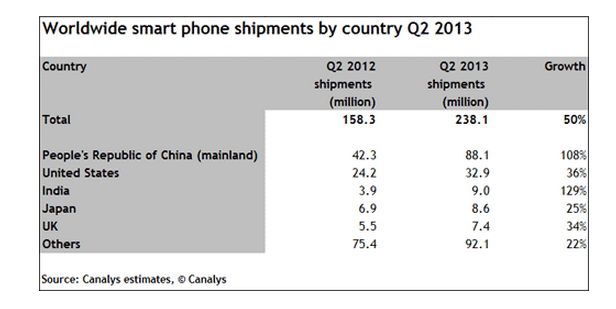

In Q2 2013, 88.1 million smartphones shipped in China compared to 32.9 million in the U.S. India and Japan now trail third and fourth, with 9 million and 8.6 million smartphones shipments during that quarter, respectively. As this chart shows, Apple’s potential for growth is slowing in the U.S. as the country reaches its saturation point. Growth in China and India by comparison shows no signs of stopping whatsoever.

To seal the deal in the world’s biggest mobile market, Apple has been chatting up China Mobile—the world’s largest mobile carrier and coincidentally the only one that doesn’t sell the iPhone. If the rumors—and Tim Cook’s visits to Beijing—pan out, China Mobile could hand Apple 700 million subscribers. That’s seven times more mobile customers than subscribe to Verizon, the largest mobile provider in the U.S. Beyond that, Apple just struck a deal with Japan’s NTT Docomo, Japan’s largest carrier, netting itself another pool of 60 million potential iPhone owners.

Who’s Left To Court In The West?

Here in the U.S., Apple might be able to rouse interest among the teens and tweens who don’t already have an iPhone. From 2009 to 2011, the number of teens with smartphones exploded from 1.7 million to 4.8 million. The number of teens (ages 12 to 17) who owned smartphones grew from 23% in 2012 to 37% in 2013, according to the Pew Research Center. The bright, eye-popping colors of the iPhone 5C definitely appeal to the younger set, a generation weaned on the contract-free iPod touch. Apple needs to keep its momentum with teens in western markets, but that demographic isn’t the real set of keys to the castle.

What happens when you combine the booming Asian smartphone market with booming interest among teens hungry for their first smartphone?

Why, a rainbow’s worth of sales for the $99 iPhone 5C, of course.