Legal firm Loeb & Loeb is full of thinkers. Its clients and attorneys know that the world is a fluid place and the technology sector dynamic and ever-changing. As part of its “Media MindShare” series, Loeb & Loeb has turned its attention to the digital marketplace to study what the dominant issues will be in 2012.

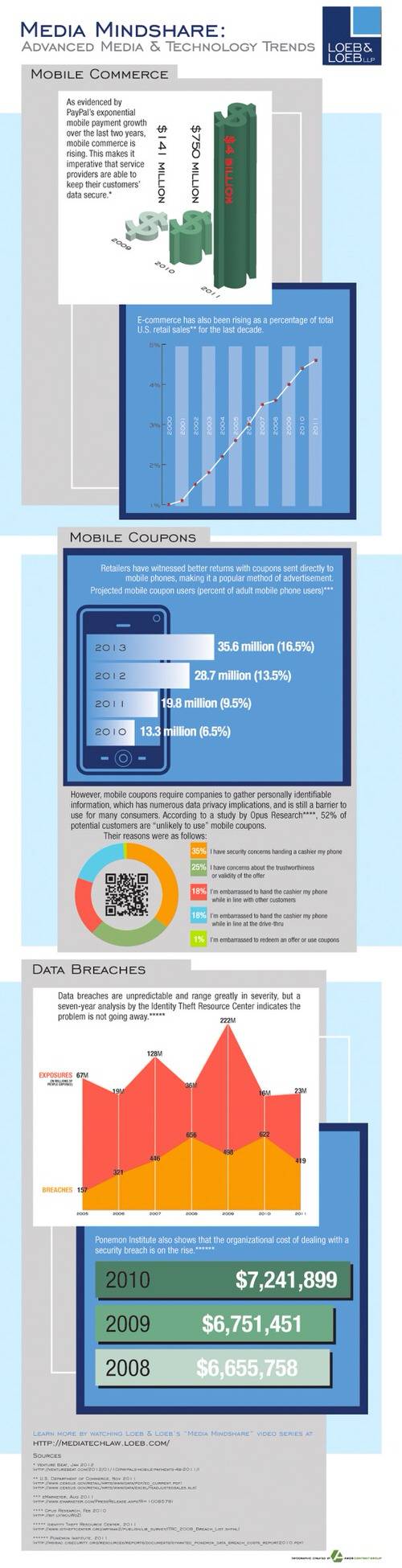

One of those issues is mobile commerce. That includes mobile payments and coupons as well as the security issues that inevitably will accompany the mobile commerce vertical. Are people really prepared to pay with their phones? What is holding them back? Check out the infographic from Loeb & Loeb below.

The infographic points out data reported by eMarketer that 35.6 million mobile phone users will use mobile coupons by 2013. But not all people are comfortable with mobile coupons. Nearly 52% of consumers are “not likely to use” mobile coupons, a study from Opus Research points out. This is due to in part to security worries people have over handing a cashier their phone and in other part due to concerns over the validity of the offers. Some people are outright embarrassed.

Another problem is the notion of data breaches. We have seen it many times with credit cards. Take the restaurant example. A waiter brings you your check. Without thinking, you pop your credit card into the book and the waiter comes back to swipe it at a terminal in back. But maybe that waiter is up to no good and has his own credit card reader in his pocket. He swipes the card through the restaurant’s POS terminal and then again on the reader in his pocket. He then has the card number and can do what he wants with it.

This has been a problem in Europe, though steps have been taken to eliminate the practice. As a former chef, I have seen waiter co-workers of mine get fired and arrested for the same practice. It happens.

Now, think about replacing the credit card with your smartphone. Are you really comfortable handing over a device that can contain very sensitive information over to a stranger, even if that person is standing right in front of you and not taking the device out of sight? To a certain extent, this is an irrational fear. The new era of mobile payments will likely mean that your phone never leaves your hand. POS systems set up with NFC or the ability for a cashier to scan your phone with a QR card reader means that you should never be handing your device over to anybody. Yet, the research says that people have security fears and that is a valid concern.

Check out the infographic below and let us know what your concerns are in the mobile payments space in the comments.