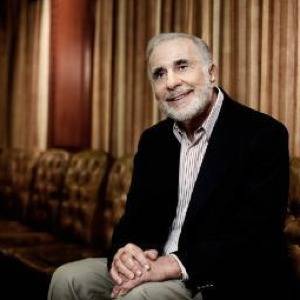

Carl Icahn called Tim Cook.

The reactions to this relatively simple act between an investor and the CEO of Apple were notable, depending on what side of the country you were on. On the East Coast, Wall Street investors perked up their heads, took little bottles of scotch out of their desks and saluted Icahn, the billionaire “activist” investor that was making Apple’s stock soar.

On the West Coast, the denizens of San Francisco and Silicon Valley shook their heads, muttered “not this guy again,” and went off to brewpubs to complain about greedy investors stifling innovation while tweeting from their iPhones.

Icahn has a history of meddling. Ask Michael Dell. Icahn has been battling Dell about the terms of taking the struggling computer maker private. The pitch has been a very public, very turbulent war where Icahn is looking for little more than as big a cut as he can get from the company. Icahn also famously pushed himself onto the board of Yahoo in 2008. That did not really work out for anybody.

Icahn and his cronies (such as fellow activist investor Dan Loeb) like to target high volume, large asset companies, try to pump up their stocks and margins and then cash out, leaving the company worse for wear. Icahn is the wannabe puppet master that will whine and cry until he gets his way and when he finally does, he will pad his wallet and walk away.

See alsoMichael Dell Discovers A New Ring Of Hell: Carl Icahn

How is this guy good for anything other than the sharks on Wall Street that love to watch his slash and burn campaigns and profit in the process?

The Bulls & Bears Love Icahn’s Apple Investment

The other night I shot an on-air segment for New England Cable News (NECN) on the topic of BlackBerry’s potential sale and the forthcoming iPhone 5S. In the lead up to the segment, I was asked if I wanted to comment on Carl Icahn’s $1 billion investment in Apple and subsequent call with Cook and tweets announcing the purchase. I declined. I am generally not interested in the wanderings of Wall Street activists because I know they are interested only in the top 1% of the 1% of the richest people in the United States (namely, themselves).

My fellow guest on the segment, Ned Riley of Riley Asset Management, had no such compunction.

“I love it,” Riley said when asked what he made of Icahn’s Apple investment. “I have never seen such a soap opera in my life. He told Tim Cook that he should probably buy back more of Apple’s stock currently, he should probably raise the dividend as part of this cash hoard of $145 billion. I have really never seen anything like it.”

Apple’s stock went up 25 points after Icahn’s call to Cook became public (via Icahn’s Twitter account).

Of course Icahn’s message to Cook was to return more money to investors. Buy back more stock and give us greater dividends on our quarterly statements, Icahn says. Why? Because he wants to turn his $1 billion in Apple money into much, much more.

To be sure, Icahn probably said nothing to Cook about using Apple’s cash supply to increase efficiency in the company’s supply chain, improve working conditions at factories where Apple products are made, increase research and development spending to create the next big product vertical or to buoy the U.S. technology sector. No, Icahn called Cook and said, “show me the money.”

Icahn’s Potential Impact On Apple

The good news for Apple fans is that Icahn’s investment in the company should not lead to any real material changes in how the company operates. Computers, iPhones and iPads will still come to market on Apple’s own peculiar timeline. Icahn may have bought a big chunk, but even a $1 billion investment in Apple is only a drop in the bucket compared to the company’s quarterly earnings, market capitalization and cash hoard. Icahn likely won’t be able to push himself on to Apple’s Board of Directors (the way he did with Yahoo five years ago) and set up his own puppet system to get his way.

The problem is that we are having this discussion at all. Activist investors like Icahn and Loeb are not activists at all, except for when it comes to cheerleading their own bank accounts. We are not talking about evangelists like Guy Kawasaki (who galvanized the Apple community for years and now does the same for Android at Motorola) or even Robert Scoble who, despite his flaws, at least cares about companies, products and innovation. With Icahn, all we are talking about are merciless Wall Street stooges trying to make even more bang for their already considerable bucks.

Icahn does not and cannot give Apple what it needs: a reason to take a risk and transcend into the type of company that takes moonshots on big ideas instead of big profits. Apple leaves the disruptive, interesting products to the likes of Google, Amazon, Jeff Bezos and Elon Musk all the while content to take its billions in profits and sit on them for a rainy day. Icahn isn’t going to change Apple for the better. Depending on how vocal he becomes, could definitely change it for the worse. Icahn’s interest will be more in making Apple pay Wall Street. That is what he does and that is what he is good at.

And that helps no one except Carl Icahn.