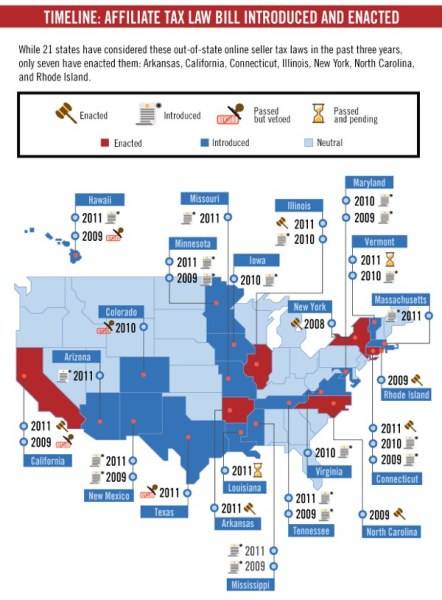

States are going after Amazon for sales taxes, hot and heavy. According an infographic from TurboTax, affiliate taxes have been enacted in Arkansas, California, Connecticut, Illinois, North Carolina, New York and Rhode Island. Another 14 states have introduced, but not passed, affiliate taxes.

Most of this is aimed at online retailers, but what about companies like Rackspace that have affiliate programs and reseller programs for cloud services?

Generally, the concerns I’ve heard about cloud computing outside of technical issues revolve around legal issues relating to privacy, data protection and security. But what about the tax issues?

According to an article in Bloomberg from this August, it’s confusing at best. Tax authorities used to be able to tax off-the-shelf software sales – now they’re dealing with services being hosted in one state (or country) being sold to users in another state. For companies that have affiliates (like Rackspace) the crop of affiliate tax laws may answer the question – or lead those companies to cancel their affiliate programs as Amazon has been doing.

As various forms of cloud computing generate more and more revenue, states are going to be trying to ensure they’re getting their fair share of the revenue. I’d love to hear from providers and users of cloud computing services how they’re dealing with taxes now, and how they’re prepping for the future.