In many states, you could end up paying a stiff fine if you get caught driving while talking or texting on your mobile phone. But savvy consumers are learning that going car shopping without your mobile phone could cost you much, much more. For me, it saved my family $2,500 and wasted trips to dealerships across town.

U.S. auto dealers say they’ve noticed more new-car buyers on their lots equipped with mobile devices than ever before. And while comparison shopping with smartphone in hand is a frequent sight in grocery stores and malls, the influence of always-connected devices is creating both opportunity and anxiety in the automobile industry.

Sales of U.S. autos, trucks and SUVs reached 12.4 million as of September 2012. That’s up 12.6% form the same month in 2011 (10.8 million)s. Mobile shoppers are contributing to those numbers. Out of all the mobile shoppers in the world, 17% search automotive websites and 53% of those buy a car from a dealership, according to Google/Compete Research. Mobile shoppers are also more likely to use a mobile device throughout the entire process.

A J.D. Power and Associates 2012 Autoshopper Study released this week confirms the influence of the iPhone and iPad on the American car industry. Of the more than 12,000 people surveyed who either purchased or leased 2010 to 2012 model-year new vehicles, 20% used a smartphone to assist in the purchase.

A slightly smaller but still surprisingly large percentage (18%) even brought a tablet computer along to the showroom as a shopping companion.

How Mobile Devices Affect The Sale

While a lot of legwork is done in front of the home PC, nearly 30% of car shoppers use a combination of home computer and mobile device to check out a possible purchase before stepping on a lot, the J.D. survey found. Car buyers used their smartphones and tablets mostly to look up manufacturer information, dealer address and stock availability. Only a small portion (5%) included car information from social media, the survey said.

“This interplay between the dealership experience and digital information has become more intertwined with the availability of shopping content on mobile devices,” said Arianne Walker, senior director at J.D. Power and Associates. “Now that buyers can easily access information right from their pockets, it is essential that the dealer is as well versed as the shoppers in order to provide consistent information both online and in the dealership.”

Indian Car Shoppers Are Truly Mobile

It’s not just Americans who are crazy about shopping online for cars. In India, 65% of people do their initial research about the automobiles on the Internet, according to research from Google India. That figure is 62% for US and Europe. Sandeep Singh, managing director with Toyota Kirloskar Motors told local media his group spends about 10% of his marketing budget on digital media, including mobile.

“Mobile marketing is an important element in our overall digital campaigns,” Singh told marketing publication Pitch. “We regularly include [wireless application protocol’] inventory for all our major campaigns. Spends on this channel depends on the type of campaign and its objectives.”

Mobile Worked For Me

In my case, my family had been in the market for several years to purchase a new vehicle. We had been racing around town kicking tires and asking questions of salespeople.

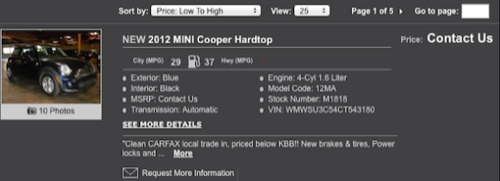

We narrowed down our choices and decided the time was right to sign on the dotted line. Since we knew what make and model we wanted, all we needed was to find the right color at the right price.

We had an appointment set up with one dealership and were heading out the door when my wife suggested we check around one more time. Using our smartphones, we found the car we wanted in the color we wanted at a price $2,500 less at a different dealership.

Feeling empowered with smartphone-delivered knowledge that we were getting the best possible deal, we drove home that day with a new car.

What About The Dealer?

Although mobile apps are still used by a minority of car shoppers, the same types of online tools are being used at home. That has pluses and minuses for dealers,

On the plus side, customers with better information in their pockets tend to know exactly what they want and are confident enough to make decisions. They’re ready to make a deal.

On the other side, dealers are quickly finding that customers can compare prices right up to the last minute. Had my family not checked our prices at the last second, fir example, the first dealership would won the sale – with a fat profit margin.

To stay competitive, manufacturers, dealers and salespeople need to keep up with the same tools that customers use and monitor customer mobile behavior closely. They need to carefully weigh the lowers margins of competitive pricing against losing the entire sale when the potential customer finds a better price on their smartphone.