This post first appeared on the Ferenstein Wire, a syndicated news service; it has been edited. For inquires, please email author and publisher Gregory Ferenstein.

America has the technology to make Tax Day exceedingly simple. The IRS already collects financial information on what citizens earn throughout the year and can precisely estimate how much they owe automatically. All the IRS needs to do is send citizens the estimate, have them add in any optional deductions, and file it away with the click of a button.

In fact, when California piloted this exact idea in 2005 as ReadyReturn, citizens reported finishing their taxes in less than 30 minutes. Fully 97% percent of those who used ReadyReturn said they would happily use it again.

“THIS IS THE BEST SERVICE I HAVE EVER SEEN BY THE GOVERNMENT,” one enthusiastic user wrote on a comment board maintained by California’s state tax agency.

Of Course, It Couldn’t Last

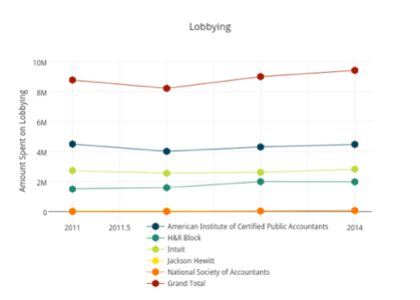

Unfortunately, Intuit, the maker of TurboTax, has banded with other tax-filing corporations to form a multi-million dollar lobbying machine to halt the government from rolling the technology out nation-wide. In 2010, the LA Times reported that Intuit spent $1,250,000 lobbying the state, at least in part to kill the pilot and prevent its spread throughout the country.

ReadyReturn no longer exists, although some of its features have been rolled into CalFile, a new tax service from the State of California. CalFile allows taxpayers to file their returns directly with the state, but does not appear to automatically estimate their tax liability in advance.

“People in other states who had been interested in it started saying, ‘We just don’t want to pick a fight with Intuit’,” Stanford Law School tax Joseph Bankman expert told the New York Times.

Of course, opposition to automatic tax filing is not entirely from the private sector. Tax companies have joined libertarian-leaning conservative think tanks who believe the government should not be involved in the tax-filing process at all. Perhaps it is a legitimate concern, but a few countries in northern Europe, including Sweden and Denmark, have similar systems without any major issues (at least issues that have been reported). For better or worse, the government is already involved in the tax process.

If citizens didn’t want to use an automated estimate produced by the IRS system, they could always choose TurboTax or any other private software company. For now, though, lobbying is taking that choice away from them.

Lead photo by Keith Cooper; graphic by the Ferenstein Wire