Philip Elmer-DeWitt of Fortune ran a chilling story last week about Andy Zaky, an “Internet-trained” hedge fund manager who led naive investors over a cliff by investing in Apple. (The Rise and Fall of Andy Zaky.) As Apple’s stock has dropped over the last few months, they all took heavy losses. Forms filed with the SEC reveal that Zaky’s Bullish Cross hedge fund’s entire $10.6 million asset base is now gone. Worse, Zaky had 700 subscribers to his Bullish Cross newsletter, and they seem to have lost even more, as Elmer-DeWitt reports in a follow-up article (Losses of Apple guru’s clients could reach into the billions.)

According to Elmer-DeWitt:

I’ve heard directly from 37 former Bullish Cross members who tell me that they lost anywhere from $15,000 to $50 million apiece.

- Total losses for these 37 investors: $94.5 million

- Average loss: $2.5 million

Given that at its peak Bullish Cross had 700 members, it’s quite likely that Andy Zaky’s followers — many of whom had put their savings and retirement accounts into Apple call spreads — lost hundreds of millions of dollars. If the members I haven’t heard from were large investors, total losses could reach into the billions.

Zaky’s bio on Seeking Alpha lays bare his Apple-centric investment focus (emphasis added):

We only care about the best in breed and nothing less. On the Apple research side of the offering, Bullish Cross will be putting out a mix of public and exclusive Apple content.

Members will also get to participate in an open forum for questions regarding Apple’s short and long-term direction. There will also be a lot of discussion regarding positioning and hedging ahead of major events. The Apple research will give the average Apple investor a distinct advantage over the market as we head into the future. There is a tremendous amount of money to be made on Apple, it’s a matter of how to properly capitalize on it.

What Goes Up…

Apple’s stock was on a tear over the past couple years, and briefly topped $700 a share. During the run-up, Zaky had no shortage of admirers. But as Business Insider pointed out, the people who subscribed to Zaky’s newsletter “were not sophisticated investors who understood the risk of listening to Zaky.”

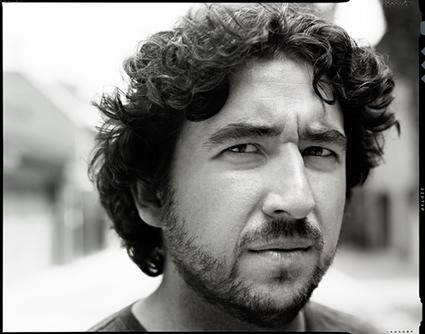

Among the loudest of Zaky’s fans was John Gruber, whose Daring Fireball tech blog has become hugely influential among Apple fans. (That’s Gruber pictured above.) Daring Fireball receives more than 4 million monthly page views and has over 400,000 RSS subscribers.

Business Insider calls Daring Fireball “a must-read blog for Apple shareholders, employees, and the many, many `fans’ of the company.” Readers visit Gruber’s site to learn the latest about Apple products, speculate on the latest Apple rumors and get Gruber’s thoughts on all things Apple.

Gruber, 40, has a BS in computer science from Drexel University. He has spent his career in tech. He makes no claims about giving investment advice. He does, however, claim to have sources close to Apple and frequently addresses rumors about the latest Apple products.

For years, Gruber praised Zaky (pictured at right), holding him up as a wizard who understood Apple better than big-name Wall Street analysts.

A Zaky Fan

In a July 21, 2008, post (Apple Shares Fall in After Hours Trading) Gruber linked to a MarketWatch report noting that Apple shares had fallen short of Wall Street expectations, then added:

Now’s a good time to re-read the piece I linked to over the weekend from Andy Zaky on Wall Street’s misguided obsession with Apple’s conservative guidance numbers.

On Oct. 28, 2008, Gruber again linked to Zaky and his Bullish Cross newsletter, and included this quote from Zaky (emphasis again added):

Right away, one ought to notice the staggering growth rate in both revenue and earnings that Apple displayed in 2008. Apple’s real revenue grew 54.5% from $24.637 billion in FYE 2007 to $38.041 billion in FYE 2008 — a full $13.4 billion growth in revenues. Even more impressive is Apple’s 81.2% growth rate in adjusted net income. For a company that is trading at 12 times 2008 earnings, it doesn’t take a genius to conclude that Apple is severely undervalued. Especially since Apple currently trades at about 3.37 times its cash position — which is objectively and significantly lower than every other large cap tech company.

GOOG trades at 7.18 times its cash position, RIMM at 15.51 times cash, AMZN at 9.15 times cash, MSFT at 9.13 times cash, CSCO at 3.62 times cash, IBM at 10.96 times cash, INTC at 6.54 times cash, and HPQ at 5.15 times cash. What is more, only GOOG, AAPL and MSFT have no debt of the companies mentioned above. Apple has the largest net cash position than any of those companies and Apple has more net cash than RIMM, GOOG, AMZN and IBM combined.

On Jan. 20, 2009, Gruber wrote the post Andy M. Zaky on Apple and Subscription-Based Accounting, in which he stated: “Zaky argues that Apple’s use of subscription-based accounting for iPhone revenue has significantly hurt its share price — casual investors who are only looking at Apple’s GAAP results don’t realize how much revenue they’ve deferred.”

On April 19, 2011, Gruber posted Andy Zaky: ‘Why Apple Shares Are Dirt Cheap‘ and wrote, “Sharp piece by Andy Zaky on Apple’s finances and stock price. He expects a big move.”

In a Nov. 30, 2011 piece titled Apple: The most undervalued large-cap stock in America, Gruber wrote that “Zaky makes a compelling, data-backed case that Apple’s stock price is severely undervalued.”

On that same day, in a different post, Gruber wrote that, “A few readers have asked whether I personally own Apple stock. Good question. I do not. I don’t own stock in any companies that I cover regularly here on DF. I do own shares of an S&P 500 mutual fund.”

A few weeks later, Gruber posted How to Properly Use Apple’s Guidance to Accurately Forecast Earnings, and linked to an article where Zaky “explains in painstaking detail how to do what almost no professional Wall Street analysts actually do: accurately predict Apple’s finances.” Gruber said Zaky’s piece was a “tremendously detailed article,” and that “Zaky continues to impress.”

This was followed up three days later, on Dec. 16, 2011, with Zaky on Apple’s Next Quarter: The Biggest Earnings Blowout in History, which contained nothing more than a short Zaky quote: “The largest company in America is about to grow its earnings by a whopping 84% this quarter, and Wall Street is asleep at the wheel.”

On May 17, 2012, when Apple shares were trading at $530.12, Gruber wrote Bullish Cross initiates rare buy rating on Apple. He linked directly to the Bullish Cross newsletter, and also quoted Zaky:

Now here are the reasons why we believe it’s time to buy Apple and why we feel the valuation is incredibly attractive today. At $533.52 a share, Apple trades at 13x last year’s earnings and at only 10.56x our expect October earnings. Those are incredibly low valuations even for Apple. At the November 25, 2011 lows, Apple traded at a 13.13 P/E ratio. So today, Apple is trading at a lower valuation than it was at the November lows. At the June 2011 lows, Apple was trading near a 15 P/E trailing P/E ratio.

Gruber closed with: “This is only the fifth time Zaky has issued a buy on Apple. He’s four-for-four.”

Zaky was right. By Sept. 17, Apple’s stock had climbed to $699.78.

The Tide Turns

But then Apple shares started to slide. By Oct. 17 the stock had fallen to $644.61. Instead of urging caution, Zaky issued a call to arms, declaring that Apple had hit bottom, and that “History has taught us that the best time to buy Apple is when the bearish sentiment in the stock has reached the pinnacle of extreme pessimism.”

Gruber linked to that Zaky post and quoted that line about this being the time to buy. Gruber titled his post: Bullish Cross: ‘Apple $1000: Why It’s Time to Buy,’ and wrote:

I don’t offer investment advice, but Andy Zaky does — and those who listen to him have done pretty well.

But this time Zaky was wrong. Instead of rebounding, Apple stock went into a free fall. Shares are now at $432.

Gruber’s Role

Did some of those Zaky fans find him through Gruber? Probably. Gruber himself proudly showcases those sites that have been “fireballed” — that is, sites that have been overwhelmed with traffic after Gruber links to them. No doubt each time Gruber linked to Bullish Cross, thousands clicked.

This has happened a lot. In addition to the posts mentioned above, there are numerous others where Gruber directly mentions Andy Zaky and Bullish Cross in a generally positive light, including these:

- 2010: The Year Apple Enters a New Golden Age (July 9, 2010)

- Zaky: Apple to Surpass Microsoft in Revenue This Quarter (July 22, 2010)

- Andy Zaky: Why Apple Shares are Dirt Cheap (April 19, 2011)

- Zaky: Apple’s Cash to Exceed $300 Billion by 2015 (May 31, 2011)

- A Brief Look at Apple’s Stock Seasonality (July 5, 2011)

If Gruber touted Zaky, should he share some of the blame for the losses when Zaky led investors astray? That’s hard to say. But it seems that Gruber’s knowledge of Apple products didn’t give him special insight into Apple’s stock price.

The real lesson? Be careful where you get your advice.

Note: Gruber requested questions by email, but had not responded more than 72 hours later. Zaky did not respond to our requests for an interview.

Top image of John Gruber from the Daring Fireball website. Image of Andy Zaky from his Seeking Alpha profile.