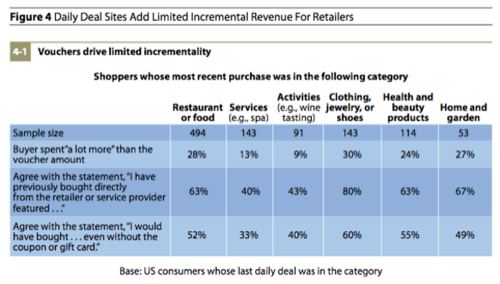

A new Forrester report entitled “Myths and Truths About Daily Deals” lays out the bigger challenge that daily deals sites are facing: More than 50% of consumers say they would have purchased the product without the voucher.

Most consumers who redeemed prepaid vouchers – 80% for clothing or shoe stores – were already customers of the brand. A whopping 51% of prepaid voucher buyers and approximately a quarter of flash sales buyers say they would have purchased the deal without the offers.

Similarly, 63% of respondents in the restaurant or food category said that they already shopped at a particular place, and 52% said they would have bought the product without the voucher. In home and garden, 67% already bought the product, and 49% said they would have done so without the voucher.

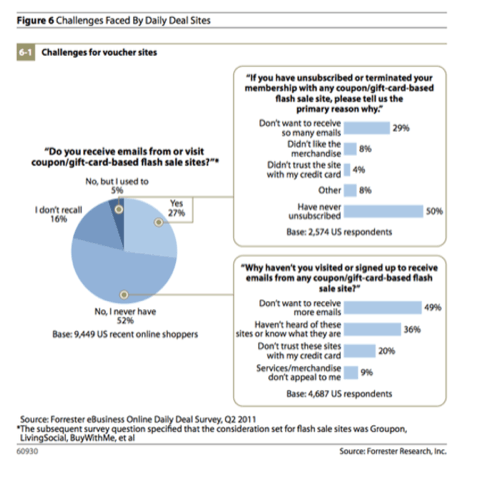

People Don’t Want More Emails

Groupon may brag about the size of its email “subscriber base,” but email is becoming increasingly less important. A sizable portion of subscribers have unsubscribed.

Forrester reports that it has heard “anecdotally that revenues for these sites are increasingly coming from organic traffic.” Is that why Groupon thought it was a good idea to cut its marketing and sales staff before going public? In its S-1 filing, Groupon said:

Our goal is to retain existing and acquire new subscribers by providing more targeted and real-time deals, delivering high quality customer service and expanding the number and categories of deals we offer.

The real challenge comes in converting buyers of daily deal vouchers into regulars.

What’s Really In It For Merchants?

Daily deals can generate short-term bursts of demand, true. This is where faster, on-demand offers like Groupon Now could play a significant role, especially for younger, more technologically inclined consumers.

Still, Groupon may offer a portal into some new consumers.

For merchants, it will be useful to track information about every redeemer of a daily deal. That means who redeems an offer, when and for how much.

Smaller daily deals knock-offs will disappear, but Groupon will stick around if it can prove to brands and merchants that it’s more than just the hot new thing, the shiny bling. That will probably mean less interesting deals, and a much smaller, not-as-cool looking company.